Home loans

Explore our lowest online variable home loan rates, calculators and popular guides.

Win the ultimate State of Origin experience

Ready to talk home loans? Book and attend an appointment with a home lending specialist and you'll be in the running to win one of four State of Origin prize packs valued up to $10k.

Why choose a Westpac home loan?

Simple to get started

You could get conditional approval in 1 business day to bid. Or unconditional same-day approval to refinance to us.

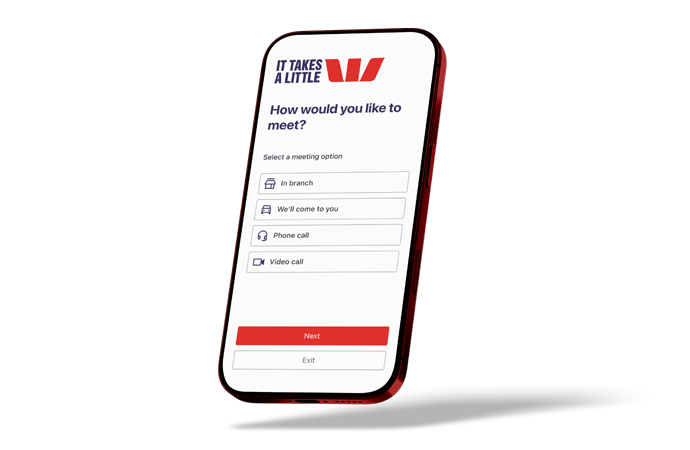

A local lender

Your local home loan specialist will help you from start to settlement. Choose how you connect: phone, video, a visit or in-branch.

Rewards & discounts

Access Westpac Rewards with an eligible debit/credit card and get discounts on the brands you love.

Australia's Best Banking App

Accept and upload documents all in one place1.

What kind of home loan are you looking for?

-

Basic variable rate

Our lowest online variable rate

- Tick - A flexible loan with unlimited extra repayments, minus monthly and establishment fees.

-

1-5 YEAR FIXED RATE

- Tick - Lock in your rate, know exactly what your repayments will be.

-

VARIABLE RATE WITH OFFSET

- Tick - Up to 10 full offset accounts, unlimited extra repayments, option to fix a portion.

-

SUSTAINABLE UPGRADES

- Tick - A 2nd loan designed to help you make energy-efficient or climate-resilient home upgrades.

-

BRIDGING LOAN

- Tick - Helps bridge the gap between buying a home and settling your current one.

State of Origin prize pack

The confidence of a fast pre-approval^^

Choose your next step

Our lowest online variable home loan rate

Check out our online rate discount on our basic variable home loan or investment loan. Apply online, and select a Flexi First Option Owner Occupier or Investment loans with P&I and IO repayments.

Frequently asked questions

What is a mortgage?

A mortgage is a home loan from the bank to help you buy a property. You pay the loan back with interest over time. To get the loan, you usually save some money first, called a deposit. We keep the home ownership papers (known as the title or deed) until you finish repaying. And if you don’t repay, we could sell the property to recover our losses.

Most loans take can 15 to 30 years to repay, with regular repayments that include the borrowed amount (principal) and interest.

How much can I borrow for a home loan?

When we decide how much money you can borrow, we look at how much you earn, spend, save, and owe, plus what you already own. That’s because we want to make sure you can pay comfortably and not struggle.

How much money you can could borrow depends on things like your income, spending, and debts. Use our borrowing power calculator to check.

How much deposit do I need for a home loan?

The deposit you need depends on how much you want to borrow. Usually, you need 20% of the property’s value for your deposit, also known as an 80% loan-to-value ratio (LVR+). For example, if the home’s worth $600k you'd need $120k.

What if you don’t quite have 20%?

If you have between 5% and 20% of the property value you may have a few options.

- Check if you qualify for any government grants and schemes.

- Pay Lenders Mortgage Insurance (LMI). You can pay it upfront or add it to your loan, but adding it means it will attract interest charges. Estimate your LMI upfront costs.

- Consider our Family Security Guarantee^, allowing a family member to save you from paying LMI.

How can I access Westpac Rewards?

Westpac customers with a debit or credit card have access Westpac Rewards, unlocking discounts on the big brands you love. For more information on the perks and discounts visit the Westpac Rewards page or follow these instructions via the Westpac App:

Make sure you update to the latest version of the app.

- Tap on More and then Westpac Rewards

- Browse through offers from Discounts & Extras, ShopBack, Altitude Rewards or Westpac promotions

- Select the deal you want and follow the prompts.

You may also like

Things you should know

Conditions, credit criteria, fees and charges apply. Residential lending is not available for Non-Australian Resident borrowers.

This information is general in nature and has been prepared without taking your personal objectives, circumstances and needs into account. You should consider the appropriateness of the information to your own circumstances and, if necessary, seek appropriate professional advice.

Any tax information described is general in nature and it is not tax advice or a guide to tax laws. We recommend you seek independent, professional tax advice applicable to your personal circumstances.

+LVR stands for the loan-to-value ratio. LVR is the amount of your loan compared to the Bank's valuation of your property offered to secure your loan expressed as a percentage. Home loan rates for new loans are set based on the initial LVR and won't change during the life of the loan as the LVR changes.

++Package Savings: This is an estimate of potential savings; actual savings may differ depending on your situation. Estimated savings amount calculated on a $400,000 home loan receiving 2.34% p.a. discount on a packaged Rocket Repay owner occupier variable rate home loan compared to an unpackaged Rocket Repay variable rate home loan. Premier Advantage Package Conditions of Use $395 annual package fee applies.

Online Offer. Only available for online applications for new Flexi First Option Owner Occupier and Investment loans with Principal & Interest and Interest Only repayments. Rate includes a special life-of-loan discount with a loan-to-value ratio up to 80%. Excludes company and trust borrowers, bridging loans, construction loans and internal refinances within the Westpac Group.

#Premier Advantage Package: Conditions of Use and $395 annual package fee applies. You must either hold or be approved for a Westpac Choice transaction account in order to qualify and continue to receive the benefits of the Premier Advantage Package. Applicants must have a Westpac Choice transaction account linked to the home loan at the time of settlement and must keep this account open for 60 days after settlement. Before deciding to acquire a Westpac Choice account, read the terms and conditions, and consider whether the product is right for you. Tax consequences may arise from this promotion for investors and customers should seek independent advice on any taxation matters.

Premier Advantage Package Conditions of Use (PDF 1MB)

##The Property and Suburb Report information provided is sourced from RP Data Pty Ltd (CoreLogic) and shared with Westpac - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 ACL 233714. Westpac does not guarantee the accuracy or completeness of this data and recommends seeking independent advice before relying on it. All CoreLogic data remains the intellectual property of CoreLogic and its licensors. This information is general in nature and not intended as specific advice.

*Comparison rate: The comparison rate is based on a loan of $150,000 over the term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

**Home and Landlord Insurance: Premier Advantage Package customers may be eligible for an ongoing premium discount of up to 10% on their Westpac Home and Landlord Insurance policies. If you are also eligible for any other policy discount, Allianz will apply the Package discount to the already discounted premium which means the effect will be reduced. Any discounts may be subject to rounding and do not apply to taxes or government charges. If you purchase your policy online, the Package discount will be applied after purchase and Allianz will inform you of your revised premium (this may take up to 3 months). Allianz will then provide a refund for premium paid annually or provide a pro rata refund and reduce your remaining monthly instalments. If you take out a Premier Advantage Package after your policy has been issued, then the Package discount may only apply from your next renewal.

If you are eligible for more than one discount, Allianz applies them in a predetermined order. This means any subsequent discount will be applied to the reduced premium amount after applying any prior discounts and the effect of the subsequent discount will be reduced. For example, the aggregate effect of applying two 10% discounts consecutively means that you will not see the full benefit of both of these discounts. Discounts do not apply to taxes or government charges. Discounts may not apply to optional covers selected. Any discounts or entitlements may be subject to rounding. Most discounts won’t apply below the minimum amount payable for the policy.

If you are unsure if your discount has been applied, please contact Allianz on 1300 650 255.

Any financial product advice provided on this page is general in nature and does not take into account your personal circumstances. Before making a decision, please consider the relevant Product Disclosure Statement (PDS), supplementary PDS (if applicable) and Target Market Determination (TMD). To see some of the events covered and not covered, please refer to the Key Facts Sheet (KFS).

Home & Contents and Landlord Insurance are issued by Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz). Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (the Bank) arranges the initial issue of the insurance under a distribution agreement with Allianz but does not guarantee the insurance.

If you purchase Home & Contents or Landlord Insurance with Allianz the Bank will receive a commission of up to 12% of the premium excluding Government fees and charges, plus GST.

^ Family Security Guarantee: The guarantor should consider the risks associated with the Family Security Guarantee, primarily that if the borrower defaults on their loan, the guarantor is liable to pay up to the maximum of the portion of security they have put forward as a guarantee. You will be required to seek independent legal advice before offering to guarantee a loan. Credit criteria apply to the assessment of the adequacy of any proposed guarantee limit.

Offer available on all loans eligible under the Family Security Guarantee, for purchase or refinance of owner occupier or investment property. Note that for investment properties, the borrower must not have ownership of any other properties at the time of application, and for owner occupied properties a maximum of one other property may be owned which does not have sufficient equity to provide a security. For new Family Security Guarantee Home Loan applications received from 23 October 2020. Family Security Guarantee can be provided by parents or legal guardians, siblings, and children. Equity access, owner builder applications, Line of Credit and Bridging Loan products are not eligible under the Family Security Guarantee. Other Exclusions may apply. Not available for the purposes of debt consolidation, owner builder construction, cash out, or addition of a security guarantee to an existing loan. $150k minimum loan size applies. Credit criteria, fees and charges apply. Offer may be varied or withdrawn at any time. Full eligibility criteria on the Family Security Guarantee is available on request.

^^Pre-approval is an indication of borrowing capacity and does not constitute unconditional approval. Approval speed depends on loan complexity and access to required information.

1This claim is based on The Forrester Digital Experience Review™ of 4 Australian mobile banking apps in Q3 2025. Future findings are subject to change. Forrester does not endorse any company or brand, nor their products or services, nor advise anyone to select them based on this review. If you want to learn more, go to the Forrester website.