Share Trading

A broker you can trust

A Westpac Share Trading account gives you all the tools you need to buy, sell and manage your share portfolio with ease.

Low brokerage fees

Starting from $4.95^

A range of investment options

2,200+ Australian shares on ASX and Cboe, plus global markets, ETFs, bonds and more

ESG Risk Ratings

Risk ratings to assist in developing responsible investment strategies

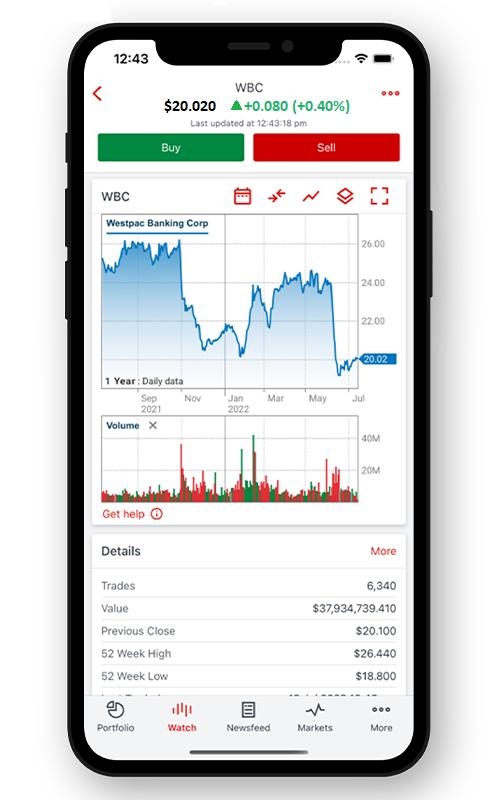

Westpac Share Trading app

Trade on the go with our four time 'Exceptional Share Trading App''

Award-winning share trading

Trade with confidence with our award-winning platform. We're proud to be recognised by WeMoney as the winners for Best for Quality and Best for long-term Investors at the 2024 WeMoney Investment Awards.

Why Westpac Share Trading?

Take a tour

We've been helping Australians invest in the share market for over 25 years with our easy to use share trading platform. Take a tour and discover our comprehensive range of trading and research tools.

Westpac Trader Advantage

What is Trader Advantage?

Trader Advantage is Westpac Share Trading’s exclusive program for active traders. The program was established to provide our valued clients with exclusive benefits, as well as dedicated service and support.

Won four in a row. Trade on the go

No matter where you are, you can trade, research and manage your share portfolio with the Westpac Share Trading app - winner of Mozo's 'Exceptional Share Trading App' award for the fourth year in a row.

Key features

- Free and unlimited alerts service

- Trade Australian shares, warrants and Exchange Traded Funds

- View, create and edit watchlists from your smartphone

- View live prices, announcements, charts and news

- View the portfolio value of all your linked equity accounts.

Access to a range of investments and powerful tools

A Westpac Share Trading account allows you to invest in a range of investment types and gives you access to a powerful suite of tools to help new and experienced investors trade smarter.

Applying is simple, get started online

1. Choose how you want to settle (pay for) your trades

Settle your trades with a Westpac Cash Investment Account or Westpac Online Investment Loan and trade from $4.95^. Or you can link any other Westpac bank account that allows direct debits and trade from $29.95.

Find out more about our settlement account types.

2. Enter your details

Fill in your details and get started with a Westpac Share Trading account.

3. Submit your application

Share Trading Frequently Asked Questions

Find your answers faster in our popular Frequently Asked Questions

Not sure where to start?

Things you should know

^For trades up to and including $1000 when you settle through a Westpac Cash Investment Account, Westpac Online Investment Loan, or DIY Super Working Account. The DIY Super Working Account is no longer available for sale.

Westpac Securities Limited ABN 39 087 924 221, AFSL 233723 (‘Westpac Securities’) (trading as ‘Westpac Share Trading’) provides the opportunity to trade listed financial products through our arrangement with Australian Investment Exchange Limited ABN 71 076 515 930, AFSL 241400 (‘AUSIEX’), a wholly owned subsidiary of Nomura Research Institute, Ltd (‘NRI’). AUSIEX is a Market Participant of the ASX Limited (‘ASX’) and Cboe Australia Pty Ltd (‘Cboe’), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Neither AUSIEX nor Westpac Securities are representatives of each other. Westpac Securities is not a related party of AUSIEX, NRI, ASX or Cboe. Under this arrangement, all trading, clearing, settlement and stock sponsorship arrangements are directly with AUSIEX. AUSIEX is not authorised to carry on business in any jurisdiction other than Australia. Accordingly, the information contained in this website is directed to and available for Australian residents only.

You should read the Westpac Securities and AUSIEX Financial Services Guides (“FSGs”), which provide you with information on the services Westpac Securities and AUSIEX can provide. You can access the FSGs via https://westpac.com.au/personal-banking/share-trading.

This website may contain material provided directly by third parties. This information is given in good faith and has been derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, no company in the Westpac Group nor any of their related entities, employees or directors (together, “Westpac”), nor AUSIEX, accepts responsibility for the accuracy or completeness of, or endorses any such material. This website may also contain links to external websites. Westpac does not accept responsibility for, or endorse the content of, such external websites. Except where contrary to law, Westpac intends by this notice to exclude liability for material provided directly by third parties and the content of external websites.

Neither Westpac nor any other company in the Westpac Group nor any of their directors, employees and associates nor AUSIEX, guarantees the security of this website, gives any warranty of reliability or accuracy nor accepts any responsibility arising in any other way including by reason of negligence for, errors in, or omissions from, the information on this website and does not accept any liability for any loss or damage, however caused, as a result of any person relying on any information on the website or being unable to access this website. This disclaimer is subject to any applicable contrary provisions of the Australian Securities and Investments Commission Act and Competition and Consumer Act.

The Westpac Cash Investment Account is issued by Westpac Banking Corporation ABN 33 007 457 141, AFSL and Australian credit licence 233714. Please read the Westpac Cash Investment Account Terms and Conditions (PDF 280KB) and consider if a Westpac Cash Investment Account is suitable for you. A Target Market Determinations for the product is available at https://www.westpac.com.au/tmd > Enter what you are looking for > Type in Cash Investment Account.

BT Securities Limited ABN 84 000 720 114, AFSL 233722 and Westpac Banking Corporation ABN 33 007 457 141 are together the issuers of the Westpac Online Investment Loan - Product Disclosure Statement ('PDS'). The PDS and other disclosure documents are relevant when deciding whether to acquire or hold this product and can be obtained by phoning 1300 551 744 or online at https://www.westpac.com.au. Neither Westpac nor any of its respective directors, officers, employees, associates or its subsidiaries guarantee or give any assurance in regard to the capital value, income return or performance of any securities or investments acquired through the PDS. For full details, please refer to the relevant Product Disclosure Statement (‘PDS’) of the products are available at https://www.westpac.com.au/personal-banking/share-trading/margin-lending/investment-loan/.

International securities trading and custody through Global Markets is provided by Pershing LLC, ARBN 108 110 149, AFSL 271837, member FINRA, NYSE, SIPC, a BNY Mellon company through Australian Investment Exchange. For full details, please refer to the Global Markets Trading Terms and Conditions. You can either request us to mail one to you, or alternatively, call one of our Trading Representatives on 13 13 31 between 8am and 7pm (AEST), Monday to Friday.

Exchange Traded Options (ETO’s) trading is a service provided by AUSIEX, the Issuer of ETO products. Your trading in ETOs is directly with AUSIEX.

For full details, please download and refer to the ETO Product Disclosure Statement (‘PDS’) and the Target Market Determination (‘TMD’). Alternatively you can request us to mail one to you, by calling one of our Trading Representatives on 13 13 31 between 8am and 7pm (AEST), Monday to Friday.

Trading Exchange Traded Options (i.e., ETOs, Options) can involve considerable risks. You should only trade Options if you understand the nature of the product (especially your rights and obligations) and the extent of the risks you are exposed to. Before trading in ETO’s, you should carefully assess your experience, investment objectives, financial resources, and other relevant issues and carefully consider the ETO Product Disclosure Statement and the relevant educational booklets regarding Options from the Australian Securities Exchange (ASX) at https://www.asx.com.au

The information contained on this website does not constitute the provision of advice or constitute or form part of any offer, solicitation or invitation to subscribe for or purchase any securities or other financial product nor shall it form part of it or form the basis of or be relied upon in connection with any contract or commitment whatsoever.

If a Product Disclosure Statement is available in relation to a particular financial product, you should obtain and consider that Product Disclosure Statement before making any decisions about whether to acquire the financial product.

Any securities or prices used in the examples on this website are for illustrative purposes only and should not be considered as a recommendation to buy, sell, or hold.

The information on this website does not take into account your objectives, financial situation or needs. For this reason, before acting on the information you should consider whether it is appropriate to you, having regards to your objectives, financial situation and needs and, if necessary, seek appropriate financial advice.

Westpac Securities is a wholly owned subsidiary of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (‘Westpac’) and part of the Westpac Group. A financial product acquired through Westpac Securities is not a deposit with, or any liability of Westpac or any other company in the Westpac Group. Investment in a financial product is subject to investment risk, including possible delays in repayment or loss of income and principal invested. Neither Westpac nor any of its related entities stands behind or otherwise guarantees the capital value or investment performance of any financial product acquired through Westpac Securities.

© Westpac Banking Corporation ABN 33 007 457 141, AFSL and Australian credit licence 233714.

The Westpac Group, 275 Kent Street, Sydney, NSW 2000, AUSTRALIA