BANK ACCOUNT AND DEBIT CARD

Westpac Choice for Young Adults (18-29)

$0 Account-Keeping Fee

You’ll pay no Account-Keeping Fee as long as you’re under 30 or a fulltime student. Other fees may apply.1

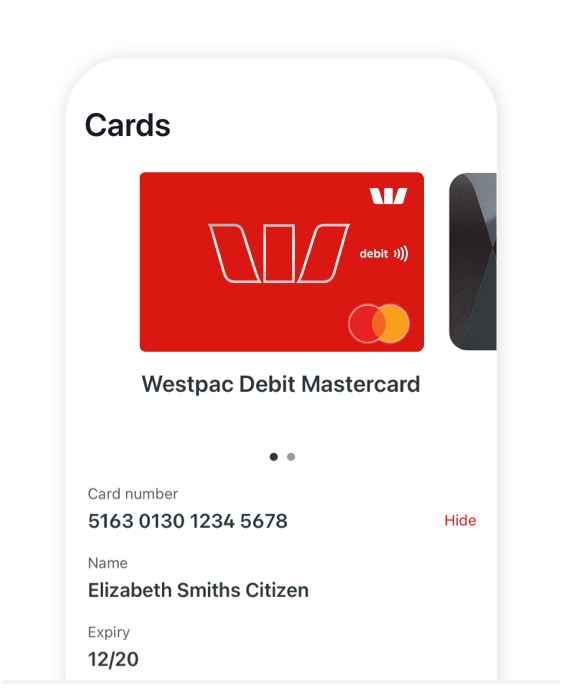

Debit Mastercard®

Why carry cash when you’ve got a Debit Mastercard? It’s more secure and you can use it to spend your own money to shop online or in stores (You’ll need to be at least 8 years old to get a Debit Mastercard)2

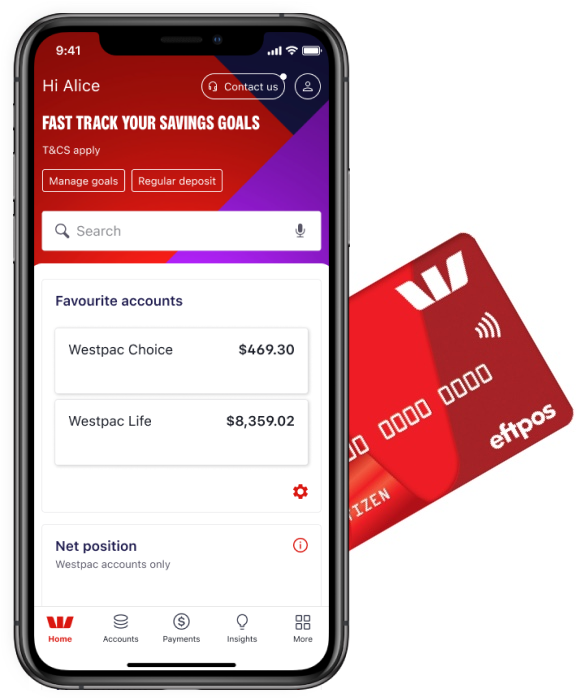

Online banking + Westpac app

More than just a place to check your balance, Westpac Online Banking has heaps of tools and functions to help you manage your money, plus you can take your bank wherever you go when you download the Westpac App on your phone

Online banking guarantee

We’ll repay any funds missing due to online fraud, as long as you’ve complied with our T&Cs.5

Bonus variable interest with Spend&Save

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a linked Life Savings and Choice bank account.

Find out more

Save time, apply online

Get up and running the fast way

Your Choice account could be active in less than 3 minutes.

Make payments your way

Choice makes buying, paying, and withdrawing cash simple and convenient, even before you’ve received your debit card.

Digi Card

Use the digital card in the Westpac App while waiting for the plastic one to arrive. The CVC refreshes every 24 hours for extra security

More ways to pay

Link your card to Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay to make fast contactless payments with your mobile or wearable

Access cash via the app

Get cash out of Westpac, St.George, Bank of Melbourne and BankSA ATMs without a card using the Westpac App6

Learn how to make the most of your money

You might learn about econ or maths in school, but nobody ever really teaches you how to actually use money in everyday life. That’s why we’ve teamed up with Year13 to give you the rundown on earning, spending, and saving your money in the big wide world.

Get access to exclusive offers and discounts

Your Westpac Choice account is more than just a bank account – it also gives you access to exclusive discounts across a vast range of retailers. We’ve partnered with some major brands to provide you with savings across travel, entertainment, fashion, your everyday shopping, and more

Our range of discounts are regularly updated, to bring you seasonal and limited time offers.7 To find out what offers are currently available – simply sign in to Online Banking and go to Rewards & Offers

Earn bonus Cashback with ShopBack

Westpac customers can access exclusive bonus Cashback when shopping via the new Westpac Lounge on ShopBack.

Spend & Save with Westpac

You could earn up to 5.2% p.a. variable interest on your first $30,000 of savings with a Life Savings and Choice bank account. 18-29 year olds only.

Helpful Guides

Fees

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 621KB)

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

6. Cardless cash: is available on eligible Westpac transaction accounts with a linked debit card. Get Cash limit of 3 withdrawals per day applies, subject to $500 daily withdrawal limit and $1,000 weekly withdrawal limit. Only available at Westpac Group ATMs in Australia. To access cardless cash on your mobile you must be registered to use Westpac Online Banking and download the Westpac Mobile Banking App. To use Westpac Mobile Banking on Apple Watch you’ll need to pair your Apple Watch with an iPhone 5 or above with iOS 8.2 or above. You’ll also need the Westpac Mobile Banking app (version 6.1 or above) installed on your iPhone.

Fast or real-time payments are sent and received using Osko® by BPAY® and can be addressed to either a PayID or a BSB and account number. Real-time payments require both the payer and payee to have Osko enabled accounts. BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.