Home Ownership Hub

First home buyer, seasoned investor, or want to make the most of your current mortgage? The Home Ownership hub is the go-to for the latest research, expert tips, and practical guidance on all things home loans.

Where do the insights come from?

We draw on over 10 years of ongoing, independent research. We’ve tracked the latest trends and opinions of home buyers at different stages of their journey. This ensures our insights reflect the real experiences of Australians.

Our research approach

Between 19th and 29th September 2025:

- 2,000 adults from all over Australia (both capital and non-capital city areas) took part in a survey

- Organised by Westpac, the survey was held online by Lonergan Research.*

This research means we can now share up-to-date findings from our latest Westpac Home Ownership Report.

Latest home ownership insights

4 in 5 have changed their spending habits

3 in 4 expect challenges buying a next home

1 in 5 Aussies own an investment property

2 in 5 say finding the right home is a major pain point

★ FEATURED INSIGHT: Young buyers up their game

Despite ongoing affordability and tight supply, Gen Z are upping their home buying game.

What’s driving it?

The need for financial security and the desire to gain independence. Many are expanding location searches, targeting smaller deposits and changing their lifestyles to save more, all part of the push to buy their first home sooner.

Fast facts

35%

of Gen Z plan to buy their first home in the next 5 years

17.5%

is the average deposit for Gen Z first home buyers

53%

of Gen Z plan to put down a deposit of less than 10%

Case study: Gen-Z sisters get a foot in the door

For many young Aussies, buying a first home is tough. Sisters Hollie and Sam combined their incomes, cut back on expenses, and set a realistic deposit goal. This allowed them to buy an affordable apartment in Bentleigh.

First home buyer tips from Hollie and Sam:

- Think about what owning a home means to you

- Automate savings and track with calculators

- Get pre-approval early to turn intent into action

- Be flexible with location, size or properties that need a little work

- Avoid surprises by understanding upfront costs.

More on Hollie and Sam’s journey

James Hutton, Westpac Managing Director Mortgages

“Gen Z are leaning in despite higher hurdles. They’re maintaining flexibility in their plans, considering available support, and signalling they won’t stay renters forever. That upswing matters for supply and affordability conversations in Australia over the coming years.”

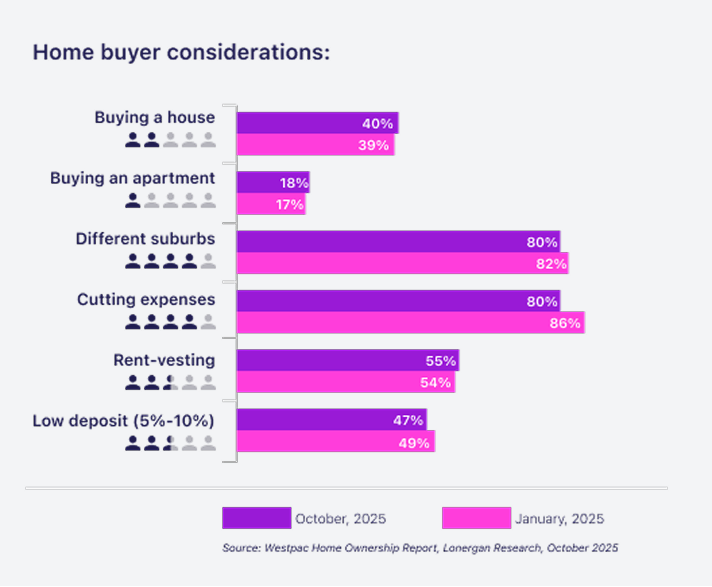

What are Gen Z buyers doing?

Changing preferences

Search flexibility

Lifestyle changes

Rent-vesting

Lower deposit

Biggest blockers?

For many first home buyers, the biggest barriers to home ownership remain:

- Saving enough for a deposit

- Limited property supply and strong competition

- High property prices in preferred suburbs

- Pressures from unpredictable interest rates.

With many planning a deposit of 10% or lower, options are further reduced. Add to that supply issues, it’s harder than ever to secure a property that meets buyers’ needs.

Talk to a home lending specialist

Book an appointment and a home loan specialist will call you back, answer questions or match you with a Westpac lender. They’ll arrange a meeting by phone, video, in branch, or at a venue of your choosing.

More insights

-

Buying your first home

The key to a smoother experience is knowing what to expect. We're here to help every step of the way.

-

Support opportunities

With a government-backed grant or scheme for eligible buyers, you could become a homeowner sooner.

-

Family security guarantee

Another way to make saving a deposit for a home easier. Find out how the guarantee works.

Help when you need it

Things you should know

For Westpac issued products, conditions, fees and charges apply. These may change or we may introduce new ones in the future. Full details are available on request. Lending criteria apply to approval of credit products. This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. Read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Target Market Determinations for the products are available. Unless otherwise specified, the products and services described on this website are available only in Australia from © Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714

*The research was in accordance with the ISO 20252 standard. After the survey, the data was weighted to the latest population numbers from the Australian Bureau of Statistics.