Savings Finder

Spot where your savings are hiding – it takes a little Westpac to turn everyday spending into everyday savings.

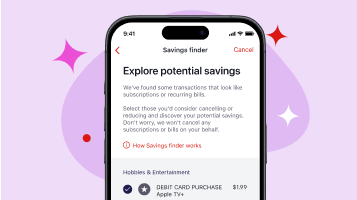

From forgotten subscriptions to found savings

Using the Savings Finder tool in the Westpac App, you can get a clearer view of your spending habits and spot opportunities to save:

See a list of regular bills and subscriptions.

Identify areas where you may be overspending.

Take action by reviewing which expenses you could lower or cancel.

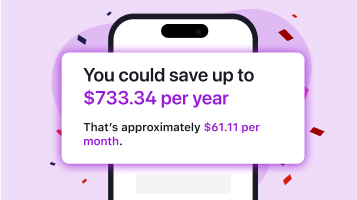

How Savings Finder could help you

Check your regular bills, fees and subscriptions

Spot areas where you might be overspending

Make confident money saving decisions

Double your $50 with us!

Open both a Westpac Choice everyday account and an eligible savings account. Deposit at least $50 into your Choice everyday account within 10 days, and we’ll add $50 to your savings. Ends 20/04/2026. New customers only. T&Cs apply.

How it works

Get started with Savings Finder

To enjoy the benefits of Savings Finder and other clever tech Westpac App features, you need to be a Westpac customer.

Personalised Insights, right where you need them

Get tips and alerts that help you spot trends, avoid surprises and stay in control of your money. You’ll find them on your Westpac App home screen or in the Insights tab. The more you use our money tools, the smarter and more personalised your insights become.

More ways to help you

Need help cancelling a direct debit?

The Westpac App also includes a helpful feature to assist with cancelling direct debits - supporting you through the final step of saving.

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

* Note that changes made in Savings Finder will not automatically update in your Bills Calendar. You will need to amend them separately to keep your records accurate.

Read the Westpac Online Banking Terms and Conditions (PDF 633KB) at westpac.com.au before making a decision and consider whether the product is right for you.

Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google LLC.

© Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian Credit Licence 233714.