Don't miss the small things at tax time

Set up Tax organiser

Track your transactions

Keep up to date

Mark your relevant transactions throughout the financial year.

Assign a percentage

Adjust the percentage of a transaction to reflect your tax relevant amount.

Download your summary

Tap on the Download your list of tax relevant transactions button to get your summary in a spreadsheet format (CSV).

Tips to consider at tax time

1. Stay alert to avoid tax scams

Check out our tax scams page to stay informed about the latest scams and how to avoid them.

2. Download your interest and tax summary

Scroll to the bottom of your Tax organiser screen, tap on Interest and tax to view and download your summary for the financial year.

3. Update your details

Check that your personal and contact details are complete and up to date.

4. Download your statements

Download your statements to help complete your tax return. Search Statements in the App to get going.

Let's help you get started

To enjoy Tax organiser and our other Westpac App features, you need to be a Westpac customer

FAQs

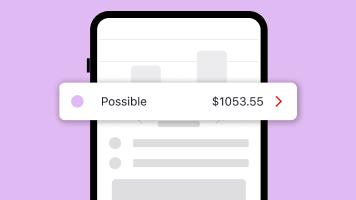

A possible transaction is a payment made from your bank account that may be relevant to you at tax time, such as charity donations or work-related expenses.

Tap Possible on your Tax organiser screen to review a list of possible transactions, based on your expense areas. To mark transactions that are tax relevant to your personal circumstances, select the transactions and tap Mark as tax relevant.

Things you should know

Read the Westpac Online Banking Terms and Conditions at westpac.com.au before making a decision and consider whether the product is right for you.

This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness having regard to these factors before acting on it.

Any tax information described is general in nature and it is not tax advice or a guide to tax laws. We recommend you seek independent, professional tax advice applicable to your personal circumstances.

Apple, the Apple logo and iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google LLC.

© Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.