.jpg)

Business lending pathways

Explore ways to apply for business loans or finance — quickly and conveniently.

Lending options to suit you

We offer a range of lending options that help support your unique business needs. Whether you’re just starting out, scaling up, or looking for a simpler way to access funding, we’ve got an application pathway that’s right for you.

Lending made simple

Keep it simple with SIMPLE+

Running a business with a solid track record or looking to scale up? Applying for funds up to $5mil just got easier.

Borrow up to

$5M

Why choose this path

- Borrow up to $5mil with fewer financials compared to a full application pathway

- Business Activity Statements (BAS) can be used for lending up to $1.5m

- You may be able to borrow up to $500K without property as security

- Available for Business Loan, Business Overdraft, Equipment Finance and Insurance Premium Finance

Refer to the lending pathways conditions for more detail

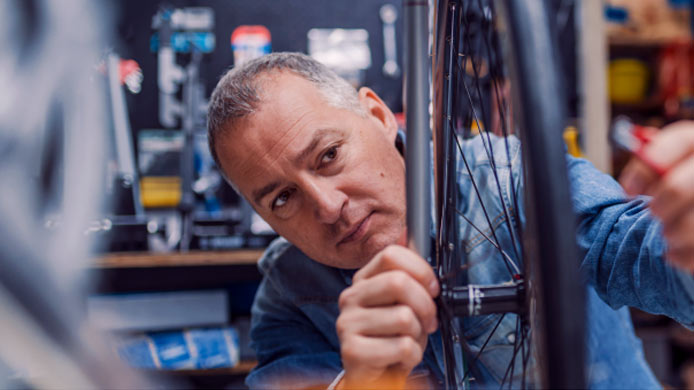

Fast vehicle and equipment finance

Express funding with DriveXpress

Need to purchase a car or equipment fast? Apply with DriveXpress and eligible businesses can get same-day approval and funding.

Access approved funds within

1 BUSINESS DAY

DriveXpress is the quicker, smarter way to get the tools you need without having to submit financials where eligible.

Why choose this path

- Faster funding to meet your business vehicle and equipment needs

- No financials needed if equipment finance criteria is met

Refer to the lending pathways conditions for more detail

Business loan for startups

Fuel your small business journey

Starting a new business or turning a side hustle into something bigger? We’re here to help you access the right funding to set things up or grow with confidence.

Borrow up to

$50K

If you’ve been trading for less than two years, and you have a business plan with forecasted financials, you could be eligible for a business loan that suits your goals.

Why choose this path

- Access up to $50k without using property as security

- No need for past profits and loss statements

- Loan terms of up to 5 years

Refer to the lending pathways conditions for more detail

Fast track credit offer

Available for existing business customers

Has your business been banking with us for over 12 months? You could be eligible to fast track your lending application without needing to submit financials.

Borrow up to

$1M

Unlock a range of lending options to help maintain a healthy cash flow and take your business to the next level.

Why choose this path

- Get a Business Loan from $5k

- Potential offers available in Online Banking

- Unsecured options available

- Available for Business Loans, Business Overdraft and Equipment Finance

Refer to the lending pathways conditions for more detail

Book a free health checkup for your business cash flow

A faster, easier way to apply for business loans and finance

Eligibility, credit criteria, fees, charges, terms and conditions apply.

- Available for non-complex business customers.

- Maximum limits may be less than $5mil in some cases. Confirm with your banker.

- Business must have been trading for over a year, without losses.

- Property security may be required for consumer lending, construction and certain sectors. Confirm requirements with your banker.

Help when you need it

Things you should know

If you are deaf, hard of hearing, or have trouble communicating, you can message us in the Westpac App or contact us using the National Relay Service. We can also arrange an interpreter if English is not your preferred language. Visit Westpac Access and Inclusion for more information.