International Shares

With access to 19 international markets, Westpac Share Trading makes it easier to trade international shares online.

Brokerage from

for online trades settling in AUD and subject to trade value

Invest in international markets with Westpac Share Trading

Low brokerage rate

Enjoy a competitive brokerage rate starting from USD$4.95*

24-hour support

Help when you need it with 24-hour phone support on U.S. trading days

Your choice of currency wallet

Trade using Australian dollars (AUD) or any one of seven other eligible foreign currencies1

Instant deposits^

Between your linked bank account and your International Markets AUD Wallet

Additional features

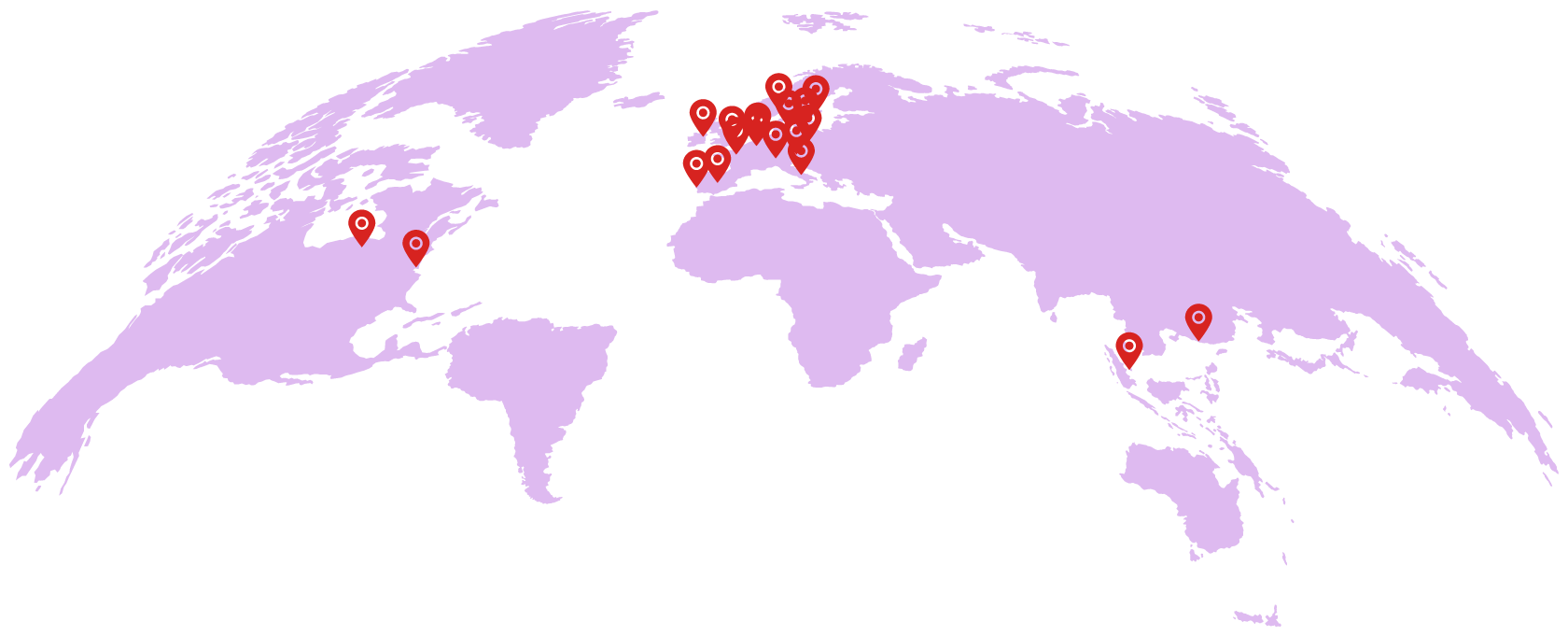

Access to 19 international markets

Westpac Share Trading provides you with access to major overseas exchanges within the United States, Canada, UK, Europe and Asia.

| North America |

|---|

| United States (NYSE, NASDAQ, AMEX, ARCA) |

| Canada (TSE, TSX) |

| Europe |

|---|

| Austria (VIE) |

| Belgium (BRU) |

| Denmark (CSE) |

| France (PAR) |

| Finland (HSE) |

| Germany (FSE) |

| Ireland (ISE) |

| Italy (MIL) |

| Netherlands (AMS) |

| Norway (OSE) |

| Portugal (LISB) |

| Spain (SIBE) |

| Sweden (SSE) |

| Switzerland (SIX) |

| Unted Kingdom (LSE_INTL, LSE_SETS) |

| Asia |

|---|

| Hong Kong (HKEX) |

| Singapore (SGX) |

Benefits and risks of international markets

When trading international shares, you should be mindful of several benefits and risks that can significantly impact the performance and value of your investments.

Benefits

Potential capital gains

An increase in international share prices could result in a potential capital gain.

Invest in global brands

An international markets account will allow you to invest in some of the biggest global businesses, including Apple, Amazon, Alphabet, Microsoft and many more.

Diversify your portfolio

Investing in international shares can allow you to diversify your portfolio and help you manage risk by accessing international markets and sectors not available in Australia.

Access to emerging markets

Investing in international shares provides access to countries which may have faster growing economies than developed markets offering new opportunities for growth.

Risks

Potential capital losses

If your share investment doesn’t perform well, you could make a potential loss on the initial value.

Foreign currency risk

Your international shares will be denominated in a currency other than Australian dollars. Adverse movements in foreign exchange rates could more than offset any gains in share prices.

Market risk

Foreign markets may exhibit higher price volatility and lower liquidity compared to domestic markets. The value of your international shares may be affected by variables such as economic conditions, natural disasters, political, legal and regulatory changes in the country you are investing.

Taxation Risk

Foreign investments are subject to the taxation laws of the respective countries. These laws can vary significantly from those in Australia and may affect the net returns on investments.

Fees and charges

For a full list of applicable fees and charges please see the Westpac Share Trading and AUSIEX Financial Services Guides.

When you choose to settle your trades to your:

Australian dollar (AUD) wallet

| Market | Currency | Internet Trading Brokerage Fee (in local currency)2,3,4,5,6,7,9 |

|---|---|---|

| United States | USD | $4.95 or 0.11% |

| U.S Over the Counter Securities | USD | $57.95 or 0.65% |

| Canada | CAD | $39.95 or $0.02 per share8 |

| Hong Kong | HKD | $129.95 or 0.39% |

| Singapore | SGD | $24.95 or 0.39% |

| United Kingdom | GBP | £11.95 or 0.39% |

| Eurozone | EUR | €11.95 or 0.39% |

| Denmark | DKK | kr154.95 or 0.39% |

| Norway | NOK | kr174.95 0.39% |

| Sweden | SEK | kr154.95 or 0.39% |

| Switzerland | CHF | CHF16.95 or 0.39% |

Frequently asked questions

To apply for an international markets account you must have an existing Westpac Share Trading account in the same name.

Opening an international markets account is free and there are no ongoing account keeping fees. Brokerage fees start from a minium of USD$4.95*. The transaction value, the market you trade in, the currency wallet used for settlement and how your order is placed i.e. online or by phone. In some cases, brokerage will be higher than the minimum. For a full list of our fees and charges please see the Westpac Share Trading and AUSIEX Financial Services Guide

Once your international markets account is setup, login to Westpac Share Trading and navigate to Trading > International Markets. Before you can place an order you must transfer sufficient funds into your Australian dollar (AUD) wallet or an eligible foreign currency wallet.

Other investment types

Australian shares

Exchange Traded Funds (ETFs)

Warrants

Options

Things you should know

*Minimum brokerage payable when an online International Markets trade settles through your Australian dollar (AUD) wallet. Brokerage fees will vary depending on the transaction value, the market you trade in, the currency wallet you use to settle your trade and method in which your order in placed (i.e. online or by phone). In some cases, brokerage will be higher than the minimum. Please refer to the Westpac Share Trading and AUSIEX Financial Services Guides for a complete list of our applicable brokerage rates for all available share markets and currency wallets. Other fees and charges may also apply.

^available for transfers up to $50,000

1Eligible currencies include Australian Dollar (AUD), US Dollar (USD), Canadian Dollar (CAD), Euro (EUR), British Pound (GBP), Hong Kong Dollar (HKD), Singapore Dollar (SGD) and Swiss Franc (CHF).

2Alternative brokerage rates may be agreed from time to time and (if agreed to) will be payable under clause 10.1 of the International Markets Terms and Conditions.

3Brokerage is calculated as the greater of the minimum brokerage or percentage of the transaction value.

4Brokerage for U.S. and Canadian markets include SEC Transaction fees and FINRA Trading Activity fees.

5A foreign exchange fee applies to each currency conversion. Currency conversions are automatically executed for every trade inclusive of any fees and charges unless a trade has executed through its local currency via a respective Foreign Currency Wallet.

6For orders not fully executed within the same trading day, the minimum brokerage will be charged each day the order remains in the market and partially executes (no fee will be charged if no units are executed).

7If an amendment is made to a partially executed order, the existing order is cancelled, and a new order is placed. This will be treated as a new order and brokerage will be charged independently upon execution.

8For Canadian Shares, you will be charged on a cents per share basis, subject to the minimum brokerage charge. Please keep this in mind when purchasing low priced securities where the number of shares purchased may be comparatively large, leading to high brokerage charges.

9Unless otherwise indicated, where a fee or charge is expressed as a percentage, it refers to a percentage of the transaction value. For rounding reasons, the final brokerage may result in a slight variance from the stated or expected charge, which may exceed two AUD cents for large trades.

Westpac Securities Limited ABN 39 087 924 221, AFSL 233723 (‘Westpac Securities’) (trading as ‘Westpac Share Trading’) provides the opportunity to trade listed financial products through our arrangement with Australian Investment Exchange Limited ABN 71 076 515 930, AFSL 241400 (‘AUSIEX’), a wholly owned subsidiary of Nomura Research Institute, Ltd (‘NRI’). AUSIEX is a Market Participant of the ASX Limited (‘ASX’) and Cboe Australia Pty Ltd (‘Cboe’), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Neither AUSIEX nor Westpac Securities are representatives of each other. Westpac Securities is not a related party of AUSIEX, NRI, ASX or Cboe. Under this arrangement, all trading, clearing, settlement and stock sponsorship arrangements are directly with AUSIEX. AUSIEX is not authorised to carry on business in any jurisdiction other than Australia. Accordingly, the information contained in this website is directed to and available for Australian residents only.

The Westpac Share Trading International Markets service (‘International Markets’) is an international share trading, nominee and custody service provided by Australian Investment Exchange Limited (‘AUSIEX, We, Us, Our’) ABN 71 076 515 930, AFSL 241400, a wholly owned subsidiary of Nomura Research Institute, Ltd. (‘NRI’). AUSIEX has appointed Saxo Bank A/S Company Reg. No: 15731249 as its International Custodian.

You should read the Westpac Securities Share Trading and AUSIEX Financial Services Guides (“FSGs”), which provide you with information on the services Westpac Securities and AUSIEX can provide. You can access the FSGs via https://westpac.com.au/personal-banking/share-trading.

This website may contain material provided directly by third parties. This information is given in good faith and has been derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, no company in the Westpac Group nor any of their related entities, employees or directors (together, “Westpac”), nor AUSIEX, accepts responsibility for the accuracy or completeness of, or endorses any such material. This website may also contain links to external websites. Westpac does not accept responsibility for, or endorse the content of, such external websites. Except where contrary to law, Westpac intends by this notice to exclude liability for material provided directly by third parties and the content of external websites.

Neither Westpac nor any other company in the Westpac Group nor any of their directors, employees and associates nor AUSIEX, guarantees the security of this website, gives any warranty of reliability or accuracy nor accepts any responsibility arising in any other way including by reason of negligence for, errors in, or omissions from, the information on this website and does not accept any liability for any loss or damage, however caused, as a result of any person relying on any information on the website or being unable to access this website. This disclaimer is subject to any applicable contrary provisions of the Australian Securities and Investments Commission Act and Competition and Consumer Act.

The information contained on this website does not constitute the provision of advice or constitute or form part of any offer, solicitation or invitation to subscribe for or purchase any securities or other financial product nor shall it form part of it or form the basis of or be relied upon in connection with any contract or commitment whatsoever.

If a Product Disclosure Statement is available in relation to a particular financial product, you should obtain and consider that Product Disclosure Statement before making any decisions about whether to acquire the financial product.

Any securities or prices used in the examples on this website are for illustrative purposes only and should not be considered as a recommendation to buy, sell, or hold.

The information on this website does not take into account your objectives, financial situation or needs. For this reason, before acting on the information you should consider whether it is appropriate to you, having regards to your objectives, financial situation and needs and, if necessary, seek appropriate financial advice.

Westpac Securities is a wholly owned subsidiary of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (‘Westpac’) and part of the Westpac Group. A financial product acquired through Westpac Securities is not a deposit with, or any liability of Westpac or any other company in the Westpac Group. Investment in a financial product is subject to investment risk, including possible delays in repayment or loss of income and principal invested. Neither Westpac nor any of its related entities stands behind or otherwise guarantees the capital value or investment performance of any financial product acquired through Westpac Securities.

© Westpac Banking Corporation ABN 33 007 457 141, AFSL and Australian credit licence 233714.

The Westpac Group, 275 Kent Street, Sydney, NSW 2000, AUSTRALIA