Things To Consider When you’re thinking about Upgrading your Equipment Or Premises

4-minute read

4-minute read

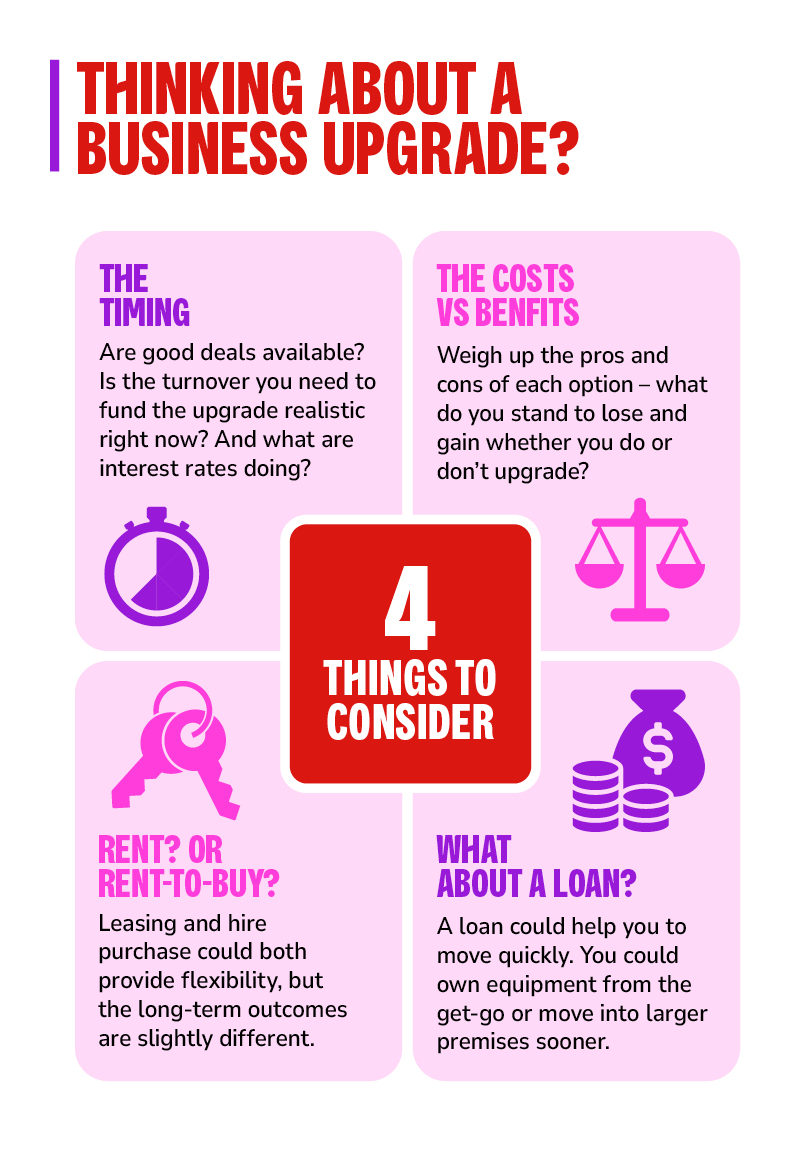

Your business is growing and pushing at the seams, so you’re thinking about investing to increase your capacity. Whether you are looking at new equipment, business vehicles or expanded premises, here are some things to consider before you take the next step.

The first thing to consider is the timing of your business expansion. Are you sure the market will support the extra turnover you envisage? Is this the right time to get the best deal on purchases or upgrades?

The answers will have as much to do with market forces as the strength of your business.

If prices and business loan interest rates are low, then you may be more confident about taking out finance to grow. Or there may be seasonal reasons to make purchases at a certain time, such as when demand is low and prices may be trimmed.

Your tax professional should be able to confirm all the details of what you can claim for, how much you can claim, and how to claim – some of which varies according to your business structure and turnover.

Upgrading your business equipment, vehicles or premises can be complex, as can the tax implications associated with the route you take. So, it’s a good idea to talk to your accountant, lawyer and business banker about what would be the best option for your business.

You’ll have to crunch some numbers and consider both sides of the ledger when making this assessment.

Questions to ask yourself include:

Balance your answers against other factors such as:

You may wish to seek professional advice as you weigh up the pros and cons of investing in new equipment or vehicles.

Questions to ask yourself include:

Balance your answers against:

You may wish to seek professional advice as you weigh up the pros and cons of investing in upgraded premises.

A business equipment loan or business car loan can help you own vehicles and equipment from the get-go without needing to pay the purchase price upfront. This type of business finance could help smooth out your cash flow via monthly repayments over an agreed period.

In common with hire purchasing, you may be able to depreciate the assets you purchase, claim the GST, and claim loan interest payments as tax deductions.

You may wish to talk to a Westpac specialist about your options for vehicle and equipment finance.

A business loan is a lump sum of money that’s loaned to your business with a predictable repayment structure and may be suitable if you require funding for things such as capital investment, property acquisition or development, or for refinancing other lending.

If you're considering expanding your business footprint—whether that means moving to a larger site, opening a second location, or renovating your existing premises—a Westpac business loan could provide the funding support you need.

Tailored for small to medium businesses, these loans can help cover the upfront costs of fit-outs, refurbishments, or even purchasing new commercial property. With flexible repayment options and dedicated support from Westpac business bankers, you can access the financial tools to grow your operations with confidence.

Ideal for smaller, emergency purchases and to cover shortfalls in cash, business overdrafts provide quick access to additional funds up to an approved amount. Attached to your business transaction account, it may help relieve strain on cash flow by providing funds to cover expenses, such as paying invoices and wages, until your business gets paid by its customers.

For a flexible solution that could suit your cash flow, you may wish to consider obtaining vehicles through hire purchase or leasing. The main differences are that:

You can learn more about the GST implications of hire purchase and leasing on the ATO’s website.

Westpac’s products are subject to terms, conditions, fees and charges; and certain criteria may apply. Before making a decision, read the disclosure documents including the T&Cs for your selected product or service, which are available on request; and consider if the product is right for you.

The information in this article (including any tax information provided) is general in nature; does not take your objectives, financial situation or needs into account; and does not constitute financial or taxation advice. Consider its appropriateness to these factors; and we recommend you seek independent professional advice about your specific circumstances before making any decisions.