Australian shares and investing in the domestic stock market

Australian shares are shares in companies that are based in Australia. These stocks may be easier to research because you're more familiar with the companies and the local market. Investing in Australian shares may also be easier to analyse as they generally carry less direct risk from geopolitical issues linked with foreign governments or swings in foreign currency exchange markets.

As such, investing in Australian shares is a common strategy for many local investors, as well as first-time or new investors. When you purchase shares, you acquire a portion of ownership in a company. As a shareholder, you may have the right to vote at shareholder meetings and receive dividends, which are a share of the company’s profits distributed to shareholders.

Shares of publicly listed companies are traded on stock exchanges, such as the Australian Securities Exchange (ASX), through brokers like Westpac Share Trading. The value of a share can fluctuate based on various factors, including the company's current earnings and future financial prospects.

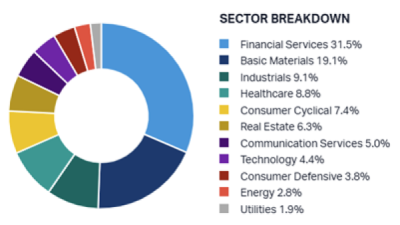

The ASX is split into 11 main sectors which include: materials, financials, health care, energy, industrials, consumer discretionary, consumer staples, information technology, utilities, real estate and communication services. Some examples of Australian shares include Westpac, BHP, CSL, Woolworths and Telstra.

Source: May 2025, https://www.marketindex.com.au/asx-sectors

Before investing in Australian shares, it is important to understand the risks involved. You should conduct appropriate research or consider obtaining an independent advice from a professional before making a decision.

*Source: May 2025, https://www.marketindex.com.au/asx-sectors

The information on this website has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should consider its appropriateness, having regard to your objectives, financial situation and needs and, if necessary, seek appropriate professional advice. If a Product Disclosure Statement is available in relation to a particular financial product, you should obtain and consider that Product Disclosure Statement before making any decisions about whether to acquire the financial product. The information contained on this website does not constitute the provision of advice or constitute or form part of any offer, solicitation or invitation to subscribe for or purchase any securities or other financial product nor shall it form part of it or form the basis of or be relied upon in connection with any contract or commitment whatsoever. Any securities or prices used in the examples on this website are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not a reliable indicator of future performance. This website may contain material provided directly by third parties. This information is given in good faith and has been derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, no company in the Westpac Group nor any of their related entities, employees or directors (together, "Westpac"), nor the Participant, accepts responsibility for the accuracy or completeness of, or endorses any such material. This website may also contain links to external websites. Westpac and the Participant do not accept responsibility for, or endorse the content of, such external websites. Except where contrary to law, Westpac and the Participant intend by this notice to exclude liability for material provided directly by third parties and the content of external websites.