Small business and MYOB accounting software

Running a small business means wearing multiple hats – you're the CEO, marketing manager, sales director, and often the bookkeeper too. But here's the thing: while you're brilliant at what you do, spending hours on manual bookkeeping isn't the best use of your time. As business needs evolve in 2025, features like real-time reporting, on-the-go expense tracking, automated invoice payment reminders, and cloud accessibility have become more than just nice-to-haves. The question isn't whether you need accounting software – it's which one will help your business thrive.

Every hour you spend entering transactions into spreadsheets is an hour you're not growing your business. So, having the right accounting software for your business could make it easier to manage your company’s cash flow, reconcile payments, and file your taxes. It'll free up your time (and reduce your stress levels), so instead of balancing the books, you can invest in activities that help your company flourish.

Think about it this way: if you're billing out at $100 per hour but spending 10 hours a month on basic bookkeeping, that's $1,000 of potential revenue you're missing out on each month.

But it's not just about time, either. Manual bookkeeping often leads to errors, missed tax deductions, and cash flow blind spots that can seriously impact your business's financial health.

Modern accounting software isn't just about replacing spreadsheets. It’s a part of digitising your business as a whole and becoming ready for the next digital age. According to MYOB’s Bi-Annual Business Monitor Insights report for June 2025, SMEs that have digitised more of their organisational processes enjoyed benefits such as improvements in profitability (24% of survey respondents) and faster payment times (27%). These are benefits you could enjoy from utilising quality accounting software tools.

Today, you can reduce repetitive data entry (say goodbye to spreadsheets) by automatically tracking your income and expenses, and make your business more efficient in turn. Plus, you can manage your client and vendor information in one place because you have one overall account management tool you can access from desktop or mobile devices.

Here's just some of the plusses that good accounting software could deliver for small businesses:

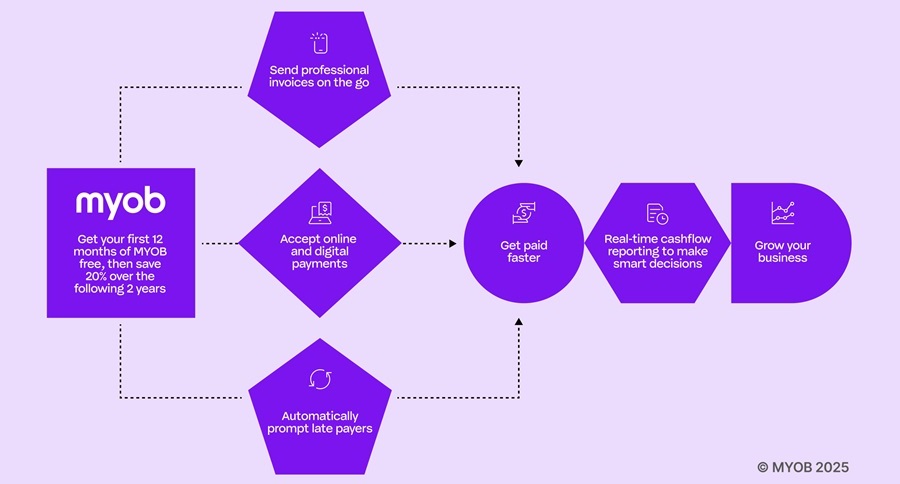

For over 30 years, MYOB has been backing Australian small businesses, helping them get their finances sorted. MYOB is not just an accounting software provider – it’s a helpful partner, providing simple yet powerful solutions that fuel growth for ambitious small businesses. The MYOB approach is straightforward: maximise your cash flow potential, put your admin on autopilot, and give you confidence so you can focus on what you do best. As a Westpac business customer, you have access to a special offer. Sign up and enjoy a base subscription of MYOB Business Lite, Pro, or Payroll Only completely free for the first year, and then get 20% off your base subscription in years two and three*.

Not all businesses are the same, which is why MYOB offers different solutions depending on your team’s size and other needs.

If you're running a growth business with 0-2 employees, MYOB Business Lite gives you what you need without unnecessary complexity. You'll get core accounting features, invoicing, expense tracking, and basic reporting.

The Business Lite solution is designed for consultants, tradies, freelancers, and small service businesses who need reliable accounting without the bells and whistles.

For growth businesses with 3-20 employees, MYOB Business Pro offers advanced features that scale with your team. You'll get everything in Lite, along with extras like advanced reporting, multi-user access, job tracking, and more sophisticated inventory management.

This product is designed for retail businesses, professional services firms, and businesses with multiple team members handling finances.

Some businesses already have their accounting handled, but need a reliable payroll solution.

Here's where it gets interesting for Westpac business customers. When your business banking and accounting software work together seamlessly, magic happens. Thanks to the Westpac-MYOB partnership, integration between your Westpac bank accounts and MYOB account could make your life even easier.

You can connect your Westpac Business account to your MYOB account to automatically send all your business transactions directly to your accounting software.

This is called a “bank feed,” and it could save you time and energy while also reducing the risk of manual entry errors. The bank feed automatically imports your transactions, categorises them intelligently, and keeps your books up to date in real-time.

Getting your Westpac bank feed connected to MYOB is easy and can be set up in minutes – simply sign into Online Banking to arrange the connection. Visit Westpac's bank feeds page for step-by-step instructions and further information.

Moving to new accounting software might seem daunting, but MYOB makes it simple.

The setup process is designed for business owners, not accountants. You can import your existing data, connect your Westpac account, and be up and running within hours, not weeks. MYOB’s support team is also on hand to help every step of the way, and there are plenty of online resources to get you comfortable with the system.

As a Westpac business customer, you have access to a special offer. Get a base subscription of MYOB Business Lite, Pro, or Payroll Only completely free in your first year. But it gets better - in years two and three, you'll receive a 20% discount off the standard full price on your base subscription.

The information provided is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information to your own circumstances and, if necessary, seek appropriate professional advice.

This article has been prepared by MYOB not Westpac Banking Corporation (Westpac). Westpac is not responsible for the accuracy or completeness of claims made in this article or in relation to the services or goods provided by MYOB. Westpac does not endorse or make recommendations about the services or goods provided.

MYOB services are not a Westpac product or service, or a feature of a Westpac product of service.