A saving and an everyday kids bank account

Get the best of both worlds when you spend and save

Pay no fees

$0 monthly fees3 on both accounts, so every dollar will help your savings grow.

Rewards for savers

Make regular deposits to grow your savings and get rewarded with bonus interest1.

Keep tabs on spending

Bank easily using your phone, tracking savings and spending in the Westpac App.

Exclusive offers and discounts

We’ve partnered with major brands to help you save – think movie tickets, fashion and more.

Interest rates

On your Bump savings account earn interest of up to:

5.00% p.a. Total variable interest rate1 |

2.00% p.a. Standard variable base rate |

| The total variable rate is a combination of: | |

|---|---|

| Standard variable base rate (when no standard variable bonus rate applies) | 2.00% p.a. |

| Standard variable bonus interest rate2 | 3.00% p.a. |

Manage your money with a Debit Card

If you’re at least 8 years old, you can link a Debit Mastercard®7 to your Westpac Choice Youth account, giving a kick-start to your money skills with kid-friendly features that will keep you safe and secure.

The debit card is automatically linked when the account is opened, except for children under 14. For children 8-13, a parent or guardian must order their card separately.

How do I open a kids savings and everyday account?

You can open both accounts online now. We'll ask for your name, date of birth and a few other details, along with a form of ID.

As the account holder you can decide if you want your parent or guardian having access to your accounts with the Parental Control4 function.

Two forms of ID:

- Australian birth certificate

- Australian driver licence

- Passport

- Medicare card

Your tax residency status:

If you’re not required to pay tax in another country, put NO on your application. Otherwise, please give us the details.

Don’t need both types of kids bank account?

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view the balance of three main accounts and quickly transfer money without signing in.

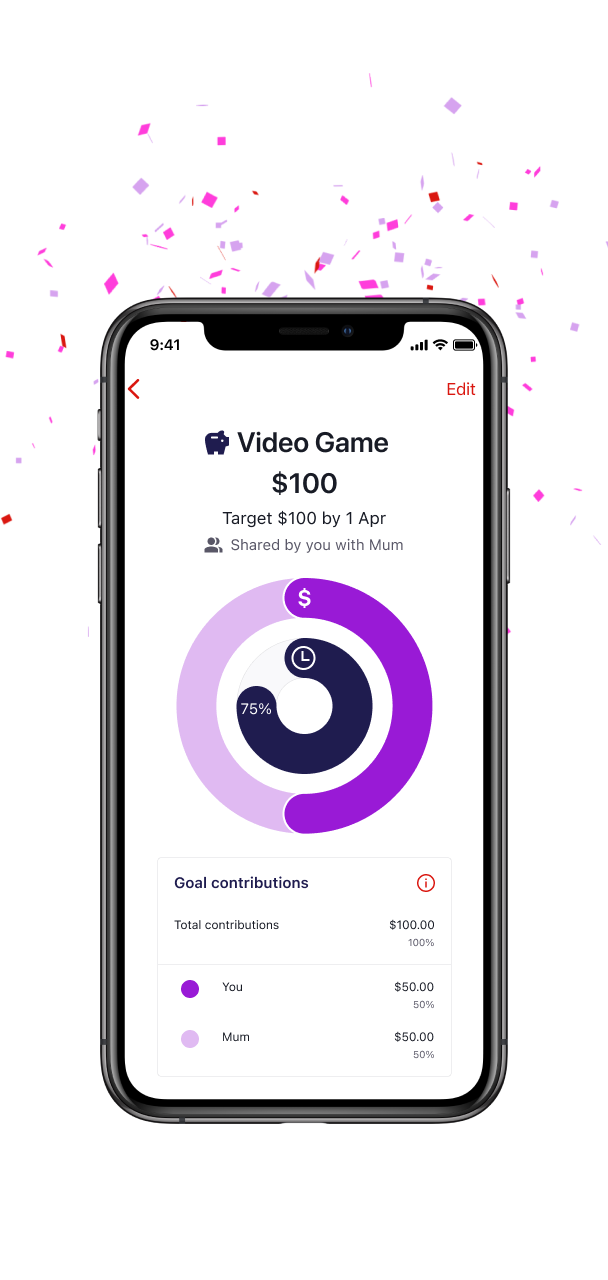

Set and track savings goals

Set up to 6 savings goals for things that matter to you, like saving for a new bike, clothing or holiday spending money. You can even share goals with family and friends to boost savings, tracking your progress with Savings Goals.

Get sorted with in-app budget tools

Track your month-to-month Cash flow and spot areas where you could be making savings with your spend sorted in Categories.

Account fees

| Standard fees (fees may change) | Westpac Bump | Westpac Choice Youth |

|---|---|---|

| Account-keeping fee | $0 | $0 (usually $5, waived for under 30s) |

| Online Banking withdrawal (including Mobile Banking) | $0 | $0 |

| Telephone Banking withdrawal (self service) | $0 | $0 |

| Telephone Banking withdrawal (staff assisted) | $0 | $0 |

| Branch staff assisted withdrawal | $0 | $0 |

| ATM cash withdrawals in Australia (ATM providers may charge a fee – watch out for that!) | $0 | $0 |

| Overdrawn Fee | N/A | $15 |

Funds can be withdrawn from a Bump Savings account via online transfers to a Westpac everyday account5 held by the Bump Savings account holder or an account signatory, or by visiting a branch. There are no fees for these withdrawals.

Other fees may be charged for banking services.

Direct debits, periodical payments , BPAY®, Pay Anyone, cheque withdrawals and ATM transactions are not available from a Bump Savings account.

Telephone Banking is not available for a parent signatory6, and self service Telephone Banking is not available for children under 12.

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 622KB)

Frequently asked questions

Make a monthly deposit into the account (by the last business day of the current month), ensuring your balance always stays above $0 and is higher than the account balance on the last business day of the previous month.2

Important: any interest earned and credited to the account does not count as a monthly deposit.

Things you should know

1. Westpac Bump variable interest: includes a standard variable base rate plus a variable bonus rate. Interest is calculated on the daily balance of your Westpac Bump account and paid on the last business day of the month. For the purpose of calculating interest paid, a month is the period between the last business day of the previous month to the second last day of the month (inclusive). Therefore, interest calculated on closing balances on and after the last business day of a month won't be included in the interest payable for the month but will be included in the interest payable for the next month. Balances include deposits made to your account, however interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility.

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount (interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility); and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Note: Bonus interest is calculated in the system after 11:59pm on the last business day of the month. Any transaction processed before 11:59pm may impact bonus interest eligibility.

3. Account fees: Monthly account keeping fees are free on a Bump account and are waived for customers under 30 on a Choice Youth account. Other fees may be charged for banking services. For a full list of fee waiver eligibility, refer to our Terms and Conditions (PDF 621KB) (PDF 622KB)

Mastercard® is a registered trademark of Mastercard International Incorporated.