Spending and savings accounts for young adults

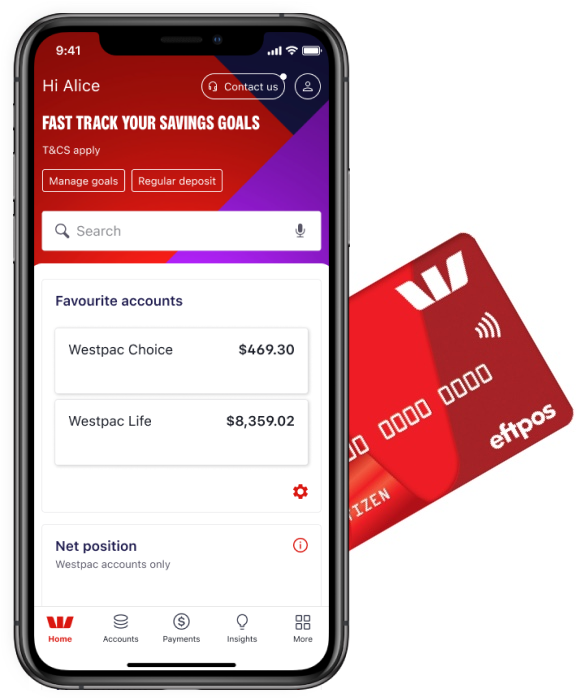

Make managing your money a breeze

- Pay and get paid

Get paid directly into your everyday account and use your Debit Mastercard 1 to shop online or in person and get cash out at ATMs 2. You can also set up regular bill payments on payday to keep on top of your expenses.

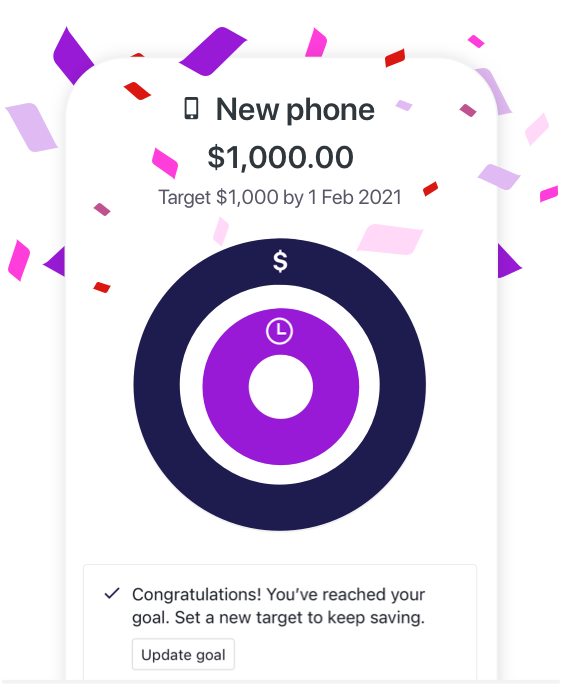

- Bucket your savings

Saving for more than one thing? With our handy Savings Goals 3 feature you can bucket your savings into different goals within the one account.

- Keep your money safe

Your money is protected with our Fraud Money Back Guarantee 4. Misplaced your card? You can lock 5 your debit card or report it lost through the Westpac app.

Put your savings on autopilot

Set up automatic transfers to your goals each pay day

Once you’ve set up your goal names, the amount you’d like to save and when you’d like to reach your goal by, you can set up regular recurring transfers to your different savings goals through our Mobile Banking app. We’ll also give you some tips about how much you can realistically afford to save.

Aged 18-29?

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a Life Savings and Choice bank account.

Pay and get paid any way you like

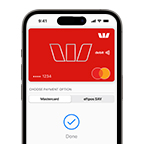

Apple Pay

Apple Pay offers a fast and secure way to pay in-store and online, using your favourite Apple device6

Digital card

Waiting for your card to arrive? Use the digital version7 instantly to shop online and pay bills

Beem It

Splitting a bill, or a present? Pay or get paid in an instant, no matter who your friends bank with8

Save when you spend

Access exclusive rewards and offers from major brands and retailers, helping you save big on travel, entertainment and more9

Learn how to make the most of your money

You might learn about econ or maths in school, but nobody ever really teaches you how to actually use money in everyday life. That’s why we’ve teamed up with Year13 to give you the rundown on earning, spending, and saving your money in the big wide world.

How to get started

- Open online in less than 3 minutes

You’ll need to verify your student status with two types of ID. The first is for your security check and includes:

- Australian driver’s license

- Australian birth certificate

- Passport

- Medicare

- Set up Online Banking

To set up Online or Mobile Banking10, you can follow these easy steps to set up online or through the Westpac App. You will then be able to transfer money into your new spending and savings accounts.

- Activate your Debit Mastercard

Your Debit Mastercard will arrive in the mail within two weeks. While you wait, instantly access your Digital Card through the Westpac App and add it to your Apple Pay, Google Pay, or Samsung Pay.

You won’t pay any Account-Keeping Fee, but here’s some to keep in mind

| Fees | ||

|---|---|---|

| Westpac Life savings account | $0 | |

| Westpac Choice bank account | $0 (Account-Keeping Fee waived for under 30s) | |

This fee is waived for:

|

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 621KB)

Things you should know

Westpac Debit Mastercard® Terms and Conditions (PDF 204KB)

Apple Pay Terms and Conditions (PDF 42KB)

Samsung Pay Terms and Conditions (PDF 63KB)

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

2. Global ATM: A 3% Foreign Transaction Fee applies to overseas debit card withdrawals. A list of Global Alliance members is available. To ensure access to savings and/or cheque account funds when overseas obtain a Debit Mastercard®.

3. Savings Goals: Both an account holder and an account signatory (where applicable) can use the Savings Goals feature, including to view, add, edit and delete the savings goals on a Bump Savings or Westpac Life account.

4. Westpac Fraud Money Back Guarantee: Customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly.

5. Card on hold: Available on personal credit and Mastercard® debit cards only. Cards to which a temporary lock can be applied will be listed when you sign in to Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

6. Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co. Android, Google Pay and Google Play are trademarks of Google Inc.

7. The Digital Card: The Digital Card is only available on the Westpac App and supported with the latest version of Westpac Mobile Banking. The terms and conditions applicable to your product also apply to the use of your digital card. Online Banking Terms & Conditions also apply. You may not always be able to access your digital card.

8. Beem It is a facility provided by Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 and made available through its authorised representative, Digital Wallet Pty Ltd ABN 93 624 272 475. Before downloading the app please consider the Product Disclosure Statement and Terms and Conditions, available at beemit.com.au. As this advice has been prepared without considering your objectives, financial situation or needs, you should, before acting on it, consider the facility's appropriateness to your circumstances. Before making a decision about any of our products or services, please read relevant terms and conditions available at westpac.com.au. Fees and charges apply and may change. A Debit Mastercard attached to a Westpac Choice account is required to use the Beem It app.

9. Partner offers are subject to Terms and Conditions and may be varied or change at any time. Images are shown for illustrative purposes only.

10. Safe Online Banking guarantee: ensures that customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Online Banking Terms and Conditions (PDF 313KB) for full details, including when a customer will be liable.

* 5.2% p.a. variable interest: earn up to 5.2% p.a. variable interest each month when you meet the criteria for both Westpac Life variable interest and Spend&Save Bonus variable interest. For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month.

Westpac Life variable interest: includes a standard variable base rate plus a variable bonus rate. To earn the variable bonus interest you must make a deposit to your Westpac Life account, ensure the account balance is higher at the end than the beginning of the month and keep the account balance above $0. Interest is calculated on the daily balance of your Westpac Life account and paid on the last business day of the month.

Spend&Save bonus variable interest:

- You must be aged 18-29 with a Westpac Life and a Westpac Choice account – both in the same name. Joint accounts are not eligible.

- If you have multiple Westpac Life or Choice accounts, only the earliest opened account is eligible.

- You must make 5 eligible purchases with the debit card linked to your Westpac Choice account and have these settled (not pending) within a calendar month. The following transactions are ineligible: ATM transactions, PayID, BPAY, EFTPOS cash-out only transactions, direct debits and paying off a credit card account.

- For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. Bonus interest is calculated on the daily balance of your eligible Westpac Life account up to $30,000, and paid to your eligible Westpac Life account by the 20th day of the following month.

- If your eligible Westpac Life account is closed before 21st day of the following month, the bonus interest will not be paid.

- Only one Spend&Save bonus interest offer per customer.

- Offer may be varied or withdrawn at any time in accordance with the Deposit accounts for Personal customers Terms and Conditions. (PDF 621KB)

Westpac everyday account: To open a Westpac Life or Bump account, customers must hold a Westpac everyday account in the same name and be registered for Online and Phone Banking. Fees and charges may apply on the everyday account.

Financial Claims Scheme: payments under the FCS are subject to a limit for each depositor. For more information visit www.fcs.gov.au.