Low consumer sentiment signals a penny-pinching Christmas

Consumer sentiment has plunged yet again, heavily influenced by the RBA's November rate hike, says Westpac senior economist Matthew Hassan. (Thomas Evans)

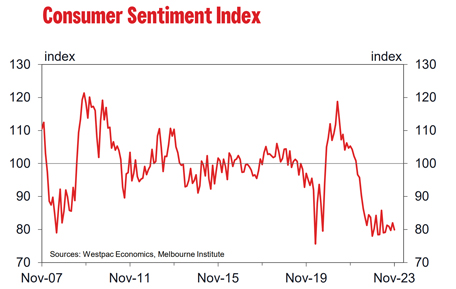

The latest Westpac-Melbourne Institute index of consumer sentiment dropped 2.6 per cent this month, back slightly below 80 – a deeply pessimistic level twenty points below neutral.

The RBA’s decision to raise rates by a quarter of a percentage point in November played a clear role in the decline. Results received before the RBA move pointed to a slight improvement on October. That changed dramatically post-RBA, the move delivering a six percentage point hit to confidence leading to the weaker result for the month as a whole.

Consumers remain wary of more RBA moves. Amongst those surveyed after the decision, 73 per cent expect mortgage interest rates will move higher over the next twelve months. That compares to about 63 per cent last month and less than 50 per cent back in September. Only 4 per cent expect rates to be lower this time next year.

A closer look at the survey tells us that the weakness is around the views on family finances, particularly for the mortgage belt and assessments of time to buy major household items. Time to buy assessments saw a particularly large 15 per cent drop following the RBA rate hike. These are ominous signs heading into the festive season with the components having close links to actual spending.

Consumers are also becoming more concerned about long term outlook, with a 6.5 per cent drop in expectations for the economy over a five-year horizon. This speaks to fears that the task of bringing inflation back under control may be harder and take longer.

With Christmas knocking at the door, the season of giving is shaping up to be the season of saving. Nearly 40 per cent of Aussies are planning to spend less than they did last year, suggesting we're heading for a repeat of the penny-pinching Christmas spend we saw in 2022. With cost-of-living pressures and price increases thrown into the mix, spending on a tighter budget may prove difficult.

The key for the RBA is the extent to which these very weak consumer sentiment rates feed through to domestic demand. Our most recent Westpac card tracker shows consumer spending remains patchy, slightly improving in the third quarter, but softening again in October as we move into November. The real litmus test for spending is set to come with the Black Friday and Cyber Week sales in the weeks ahead.

It isn’t all doom and gloom – within the details we can see slight improvements in family finances and buyer sentiment across some older age groups, in high income brackets, and those that own investment properties.

But overall it's shaping up as another austere Christmas season as far as consumers go.