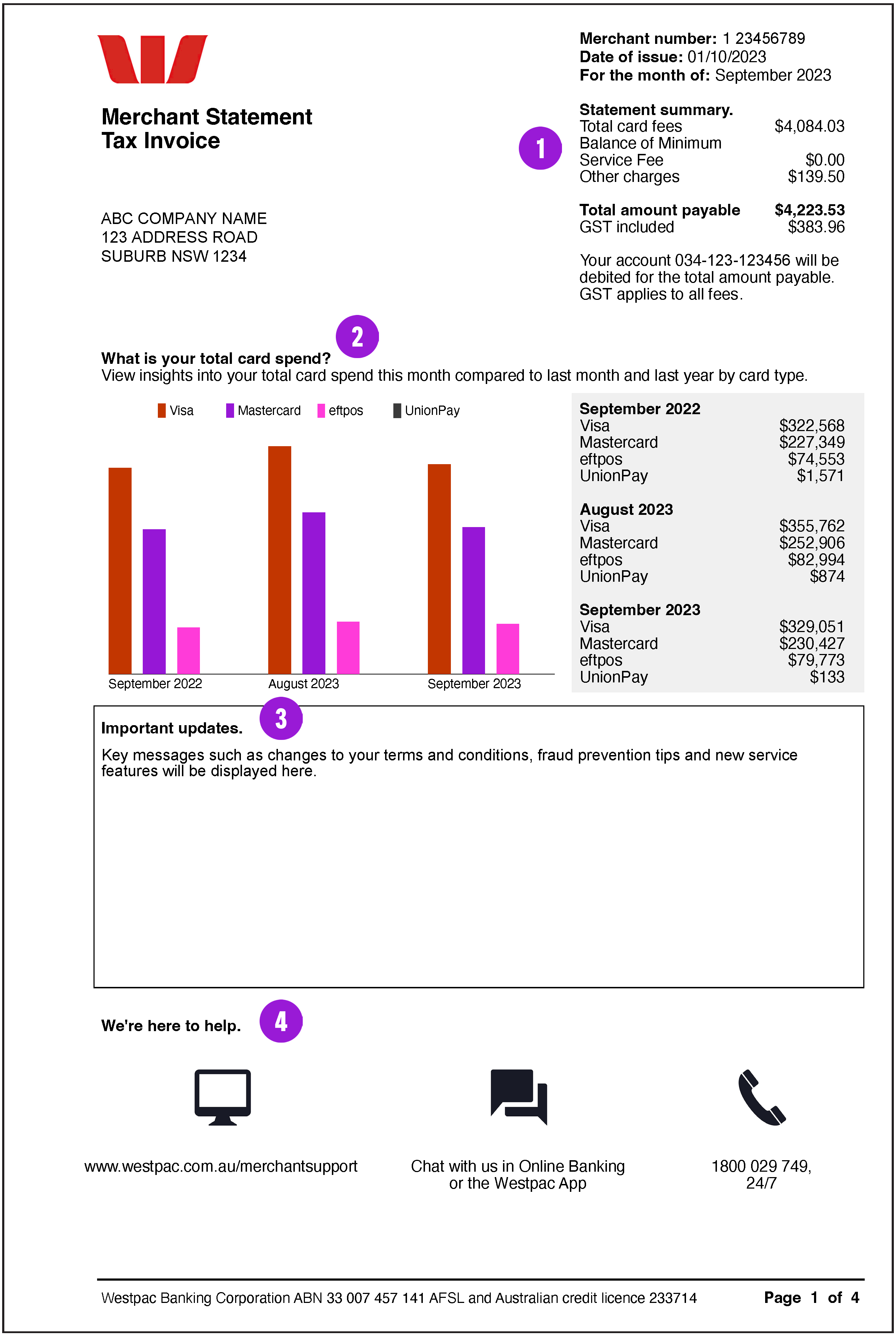

Understanding your Merchant Statement

Welcome to your merchant statement guide

Thanks for choosing us as your merchant services provider1. This guide will help you understand your merchant statement.

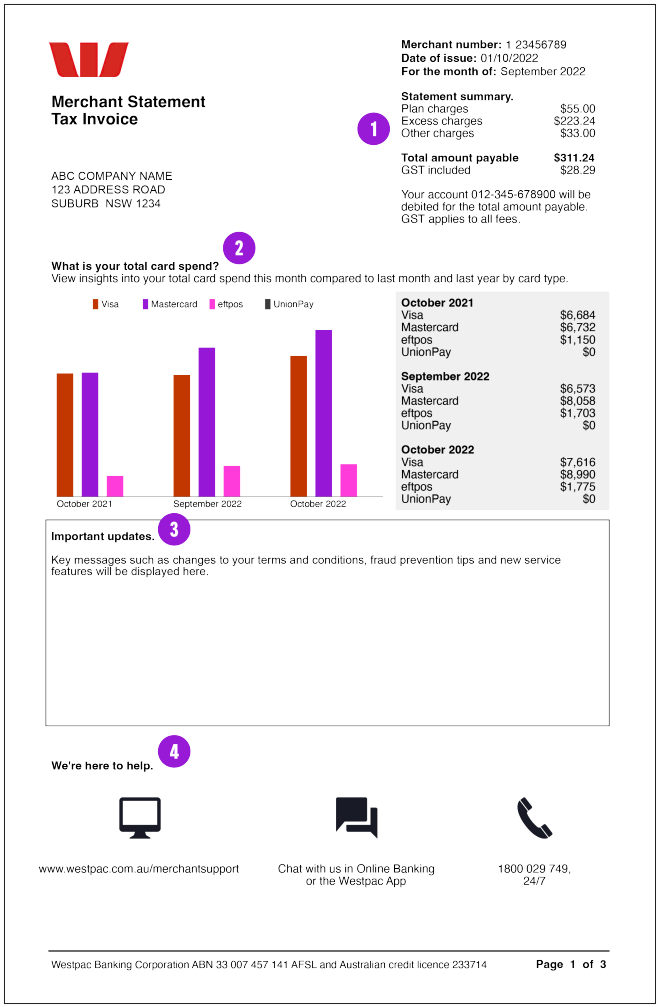

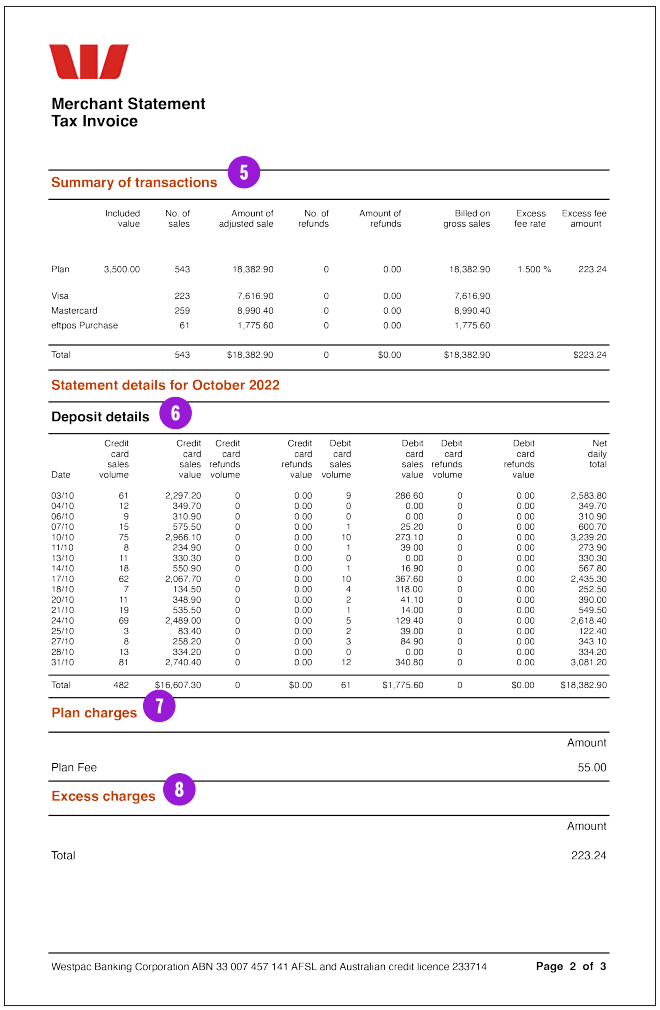

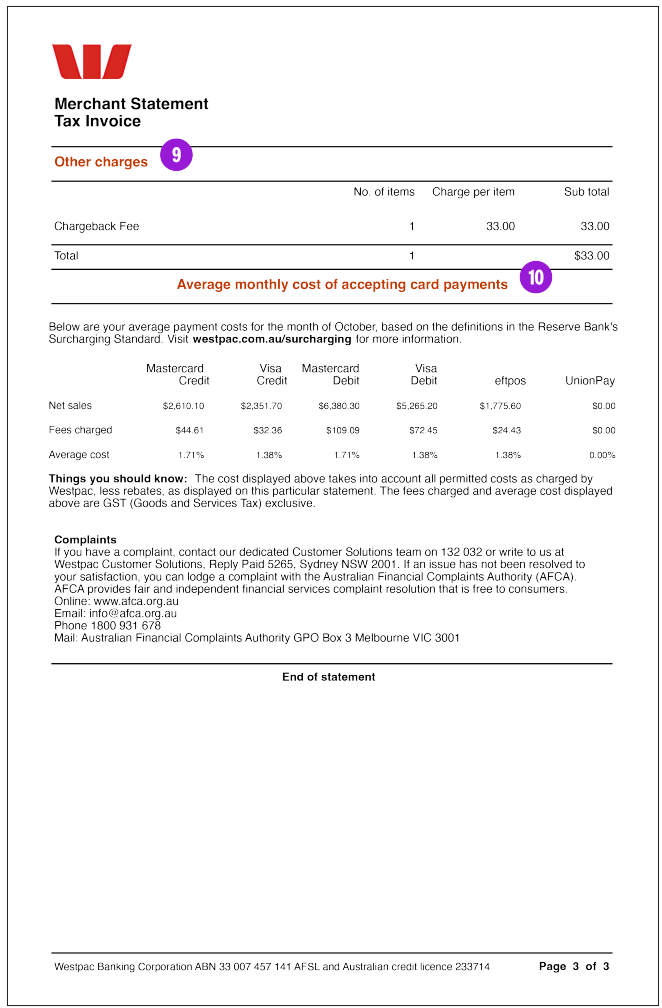

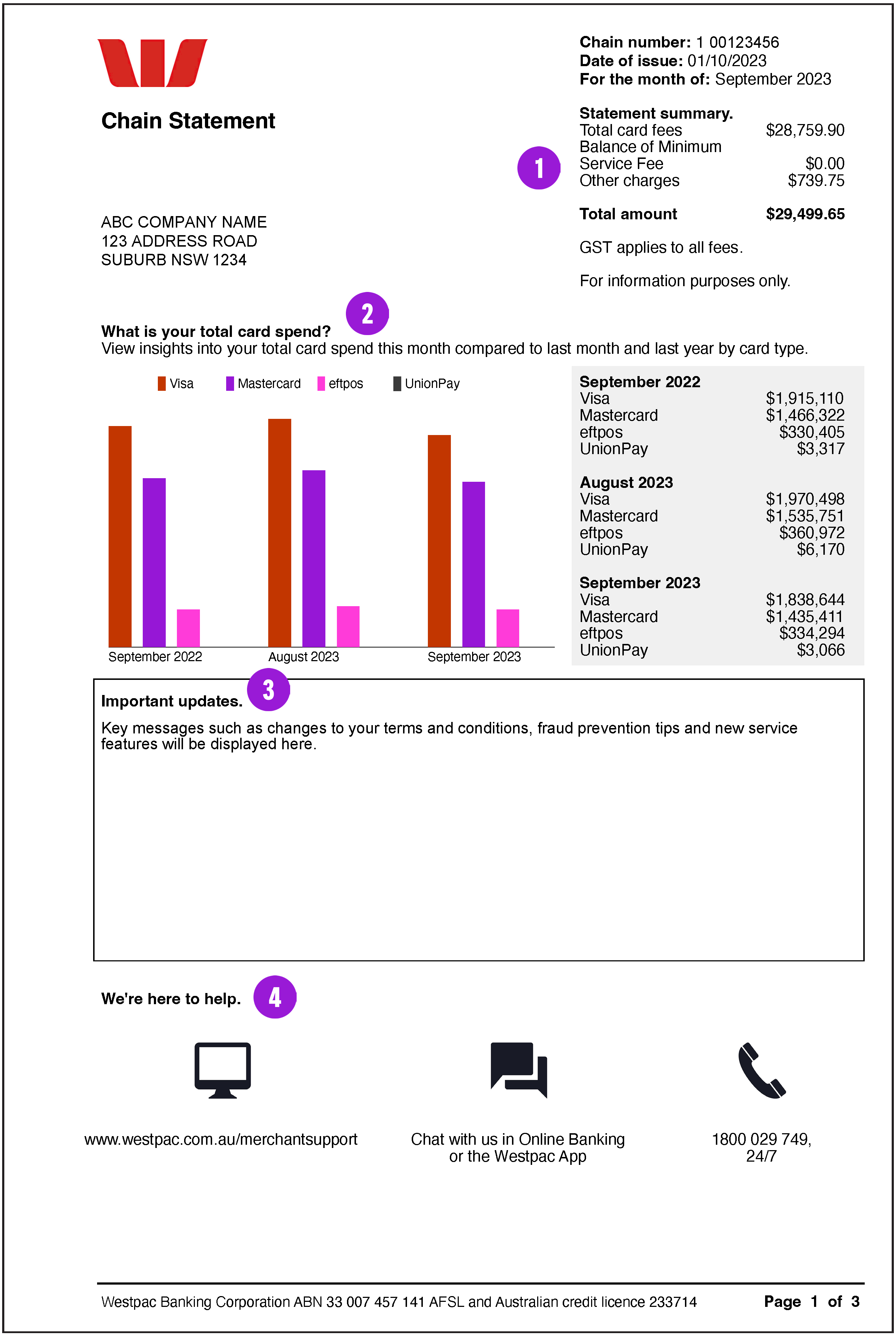

For every month you have a Westpac merchant facility, a statement is generated to show:

- Your merchant details

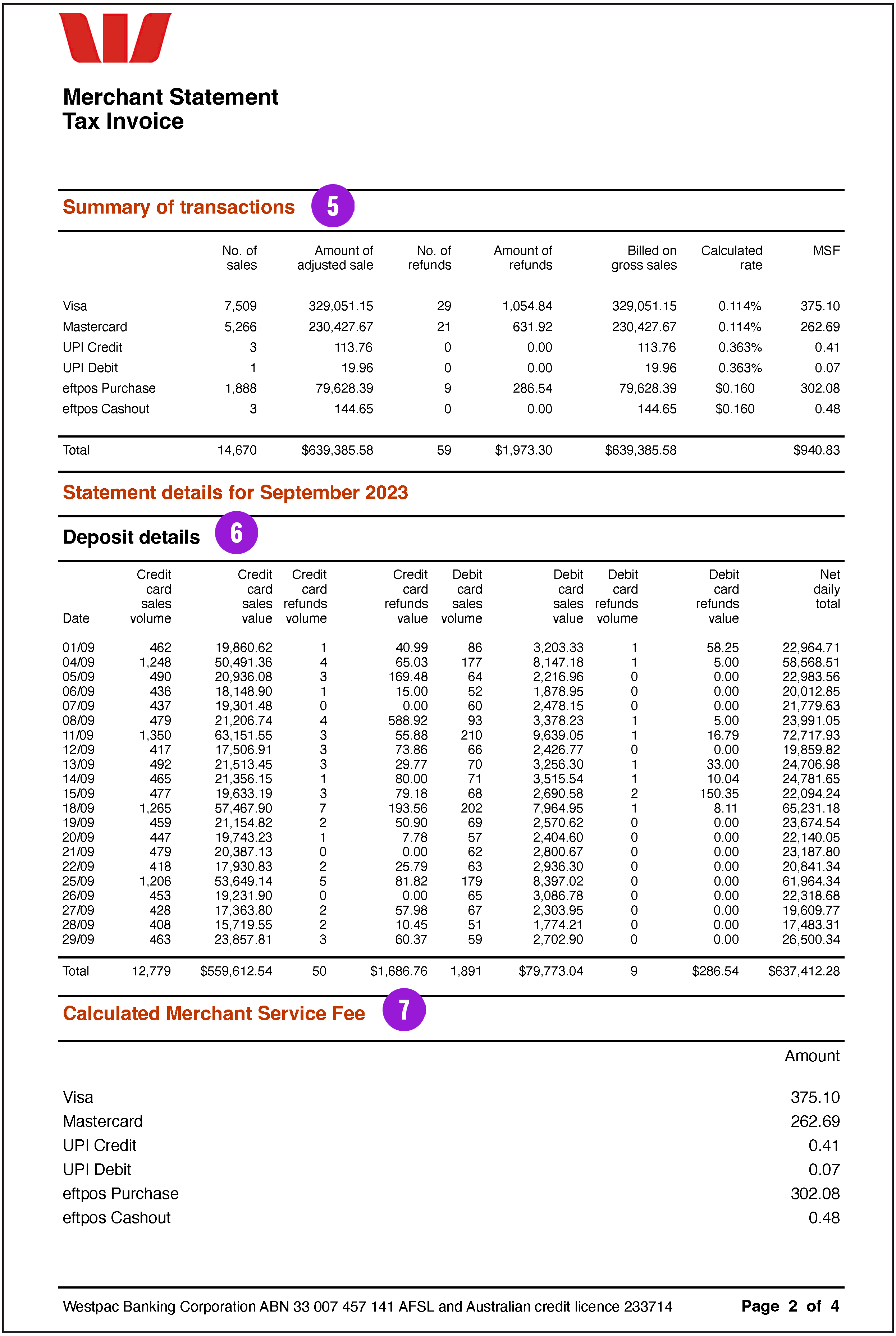

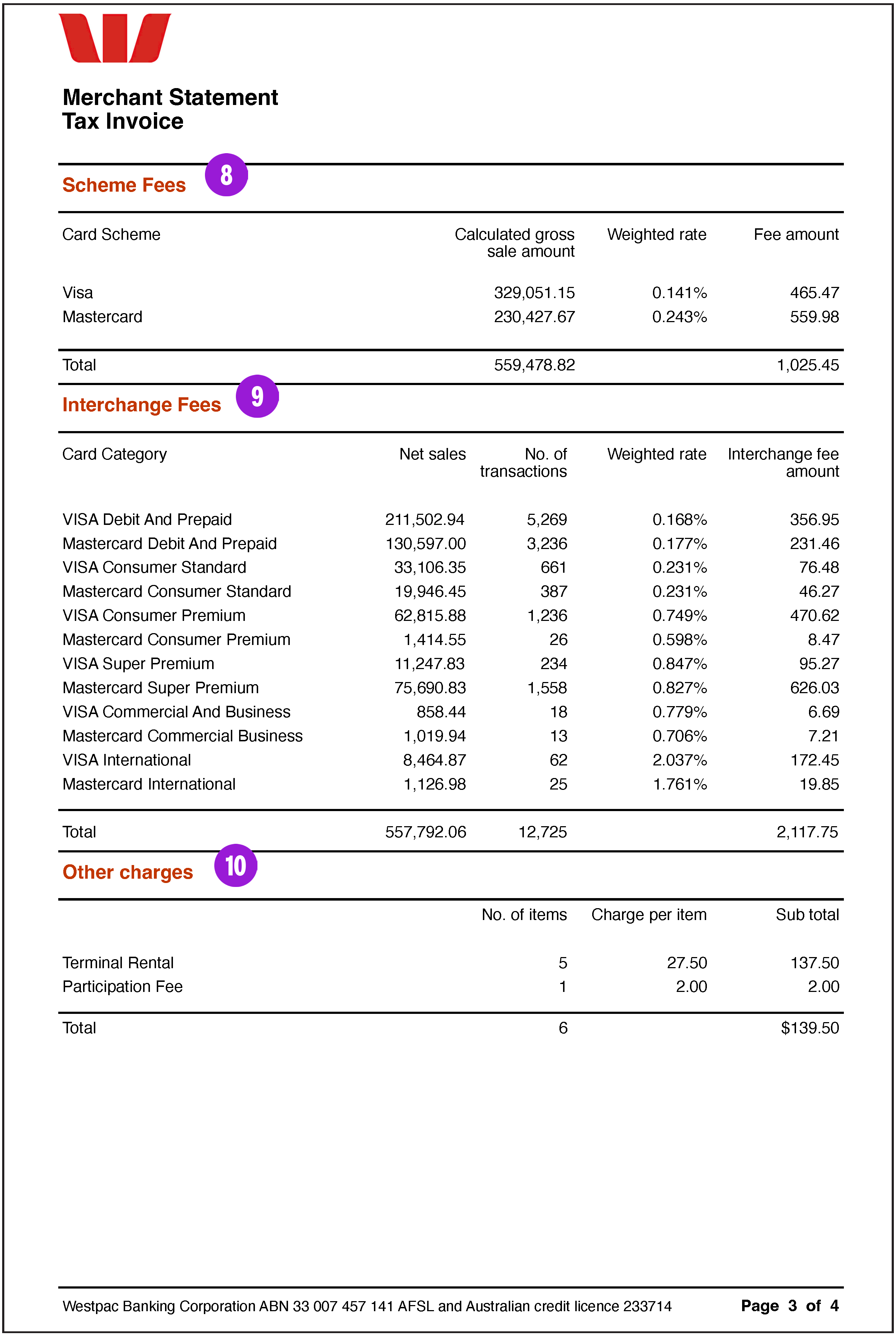

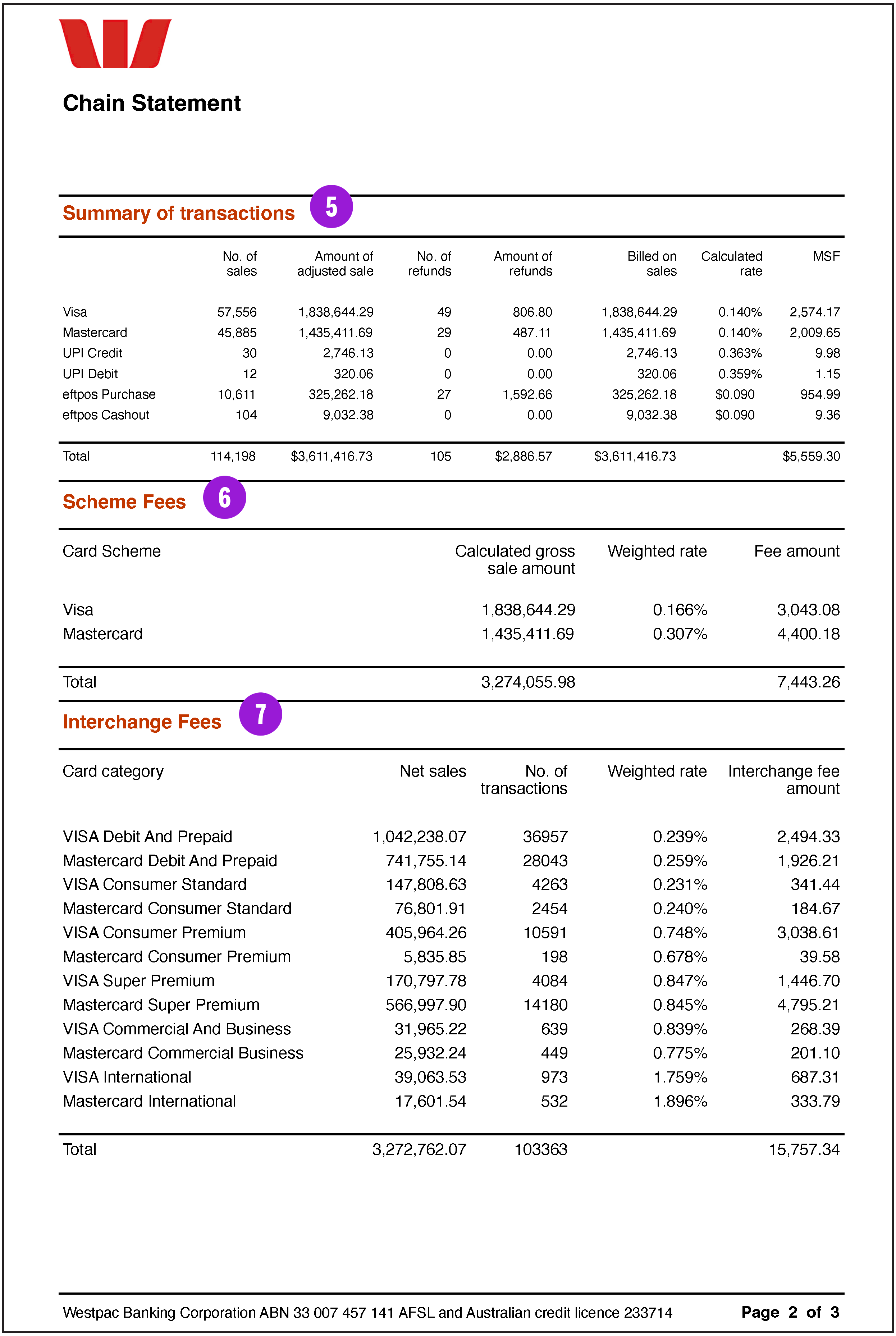

- Transactions processed and billed for the month^

- Fees paid for processing transactions and billed for the month

^Note: American Express®, Diners and JCB transactions are not included in merchant statements and are invoiced separately. UnionPay5 is only included for EFTPOS Connect, PayWay, Quickstream and Quest QT720 products.

Select your merchant statement

Select the plan or statement type that’s based on your Fee Schedule for an overview of your merchant statement.

Things you should know

1. Applications for merchant services are subject to approval. Terms and conditions and fees and charges apply. Full details are available on request.

2. To be eligible for the Westpac Merchant Pricing Plan you must hold and settle into a Westpac business transaction account in the same name as the Merchant Facility. Not available for use outside of the indirect tax zone. One terminal per Merchant Pricing Plan, per Merchant and available for EFTPOS Now, EFTPOS 1 and Presto Smart products only.

3. AMEX and Diners transactions are not included in merchant statements and are invoiced separately.

4. Included Value means the total maximum dollar value of Visa, Mastercard and eftpos transactions that can be processed through your Merchant Facility per calendar month included in the Participation Fee or Plan Fee. If this Included Value is exceeded in a calendar month, a 1.5% fee applies to the total dollar value of Visa, Mastercard and eftpos transactions processed that exceeds this Included Value. Other card types are not included in the Westpac Merchant Pricing Plans and are subject to separate pricing.

5. UnionPay is only included for EFTPOS Connect, PayWay, Quickstream and Quest QT720 products

Mastercard and the Mastercard brand mark are registered trademarks of Mastercard International Incorporated. American Express is a trademark of American Express. Visa is registered trademark of Visa in the United States. JCB is a registered trademark of JCB International. UnionPay is a registered trademark of UnionPay International Co., Ltd.

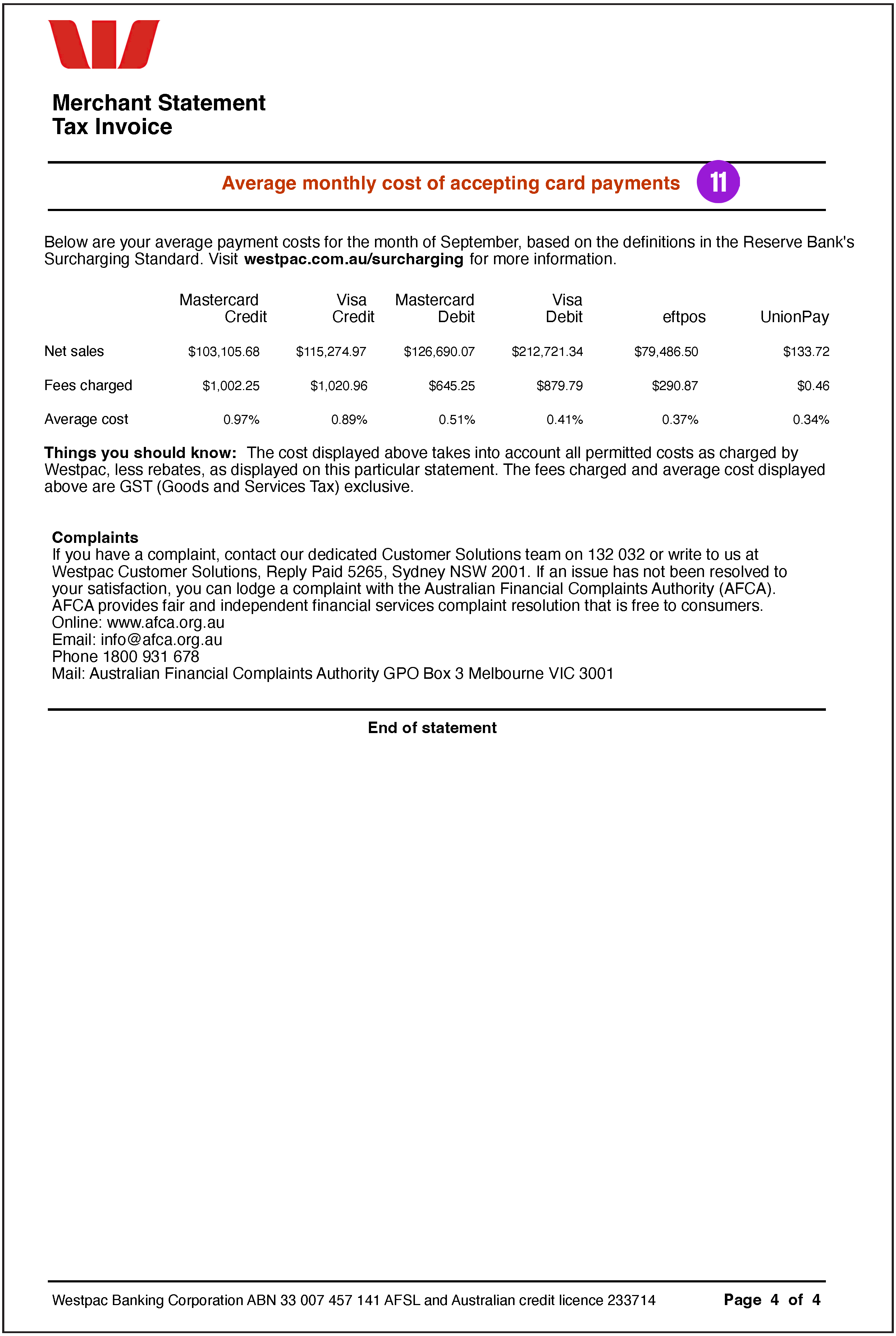

Information should be read in conjunction with your Fee Schedule and Merchant Fees and Charges Brochure (PDF 210KB). This advice has been prepared without considering your objectives, financial situation or needs. Before acting on the advice, please consider if it’s right for you. Bank fees and charges may apply. Download the Card Acceptance by Business Terms and Conditions (PDF 670KB) for more information.