Could your payment be a scam?

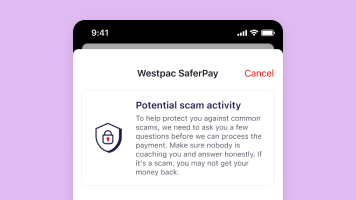

What is Westpac SaferPay?

Westpac SaferPay is designed to help alert you to potential scams.

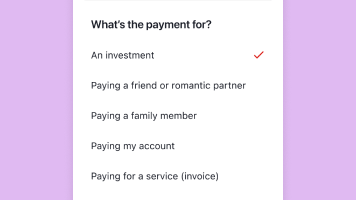

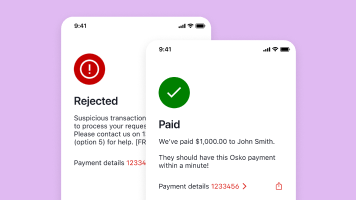

If we suspect you’re making a payment to a potential scammer, we’ll prompt you with a few quick questions to get more information, allowing us to help pinpoint and block a potential scam transaction.

How it works

Let’s stop scams together

In 2023, Australians lost over $2.74 billion* to scams.

This feature adds an extra layer of protection to your payments.

Things you should know

* Report of the National Anti-Scam Centre on scams activity 2023 (PDF 767KB).

If your Westpac account is compromised as a result of online fraud, we guarantee to repay any missing funds, providing you comply with our Westpac Online Banking Terms and Conditions. This includes keeping your sign-in details (including passwords, Westpac Protect™ SMS codes and SecurID® Token codes) private. You must inform us immediately if you suspect the security of your access details has been compromised, or you suspect an unauthorised transaction or potential fraud on your accounts. Please refer to the Westpac Online Banking Terms and Conditions (PDF 555KB).