Diversification

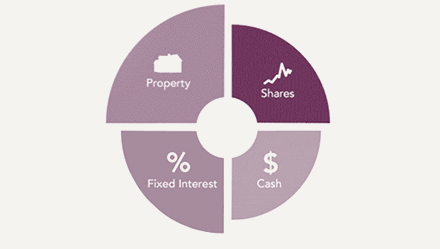

It's not always a great idea to put all your eggs in one basket by investing all your money in one asset class or type of investment.

Diversification is a way of managing the risk associated with investing. It involves spreading your money across different asset classes and investments, so as to potentially limit the impact of negative events that impact any one asset class or investment.

Diversifying across asset classes may protect you against underperformance in any one asset class. Your asset allocation will reflect how cautious or aggressive your investment strategy is.

Sector diversification

Within each asset class there are various sectors, each of which may have different investment characteristics (for example, mining companies are quite different to financial services companies). Diversifying across various sectors may reduce the risk of exposure to any one sector.

Some sectors with companies listed on the Australian Securities Exchange (ASX) include:

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Information Technology

- Mining

- Financials

- Telecommunications

- Healthcare.

How to achieve diversification

Achieving diversification requires planning and ongoing monitoring. You might need to consider the following:

- Set a target asset allocation as part of your investment strategy.

- Use ETFs or managed funds to achieve diversification or get exposure to an asset class if you are only investing a modest amount.

- Beware single stock and single asset class risk – don't put all your eggs in one basket!

- Regularly review your investments against your target asset allocation.

- Revisit your target asset allocation to ensure that it continues to be appropriate for you.

Stop-loss orders

In share trading, a 'stop-loss' order is a sell order that is conditional on the share price falling to a particular level (the 'trigger price'). When the trigger price is reached, a sell order is then placed on the market. Depending on the broker, this may be an 'at limit' or 'at market' sell order.

You'll need to keep in mind though that stop-loss orders aren't perfect – in a rapidly falling market your order may only get partially executed or not executed at all.

Alerts

Most online brokers will allow you to set up alerts. An alert allows you to be notified (via SMS, push notification or email) when a specific event occurs.

Common types of alerts are:

- Price alerts – receive an alert when the stock price crosses a specific value

- Announcement alerts – receive recurring alerts whenever a company releases a market sensitive announcement

- Volume alerts – receive an alert when the trading volume for a stock crosses a specific threshold

- Stock goes ex-dividend alerts – receive an alert when a stock's ex-dividend date is approaching.