Add your Tax File Number (TFN)

What is a TFN?

Your Tax File Number (TFN) is a unique 9-digit number issued by the Australian Tax Office (ATO), that’s used to identify you for tax and super purposes. You keep the same TFN for life, even if you change your name, job or address. If you don’t have a TFN, you can apply for one via the ATO website.

Why do I need to provide my TFN?

While it’s not compulsory to provide your TFN or TFN exemption, if you don’t, we may be required by law to deduct Withholding Tax at the highest marginal rate plus Medicare Levy on any interest earned on your accounts.

How to add your TFN?

You can easily add your TFN in Online Banking or the Westpac App

How to add your TFN

You can easily add your TFN in Online Banking or the Westpac App.

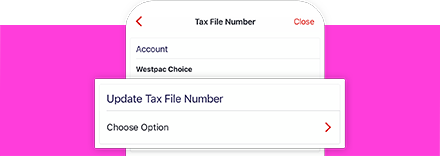

In the Westpac App

- Search Tax File Number

- Select the account you wish to update

- Tap Choose option

- Tap Enter Tax File Number or Declare Tax File Number exemption

- Enter details and tap Update

- Repeat above steps for all accounts you wish to provide TFN

In Online Banking

- Go to Services > Preferences > Tax File Number

- Select Update Tax File Number

- Enter the SMS Code sent to your registered mobile and select Authorise

- Select the account you wish to update

- Enter your TFN or TFN exemption and select Save

- Repeat above steps for all accounts you wish to provide TFN

Try our Tax organiser

Don't miss the small things at tax time with our handy tool. Mark tax relevant transactions to keep track of your expenses throughout the year and download a complete summary to stay on top.

Things you should know

Read the Westpac Online Banking Terms and Conditions (PDF 620KB) at westpac.com.au before making a decision and consider whether the product is right for you.

The taxation position described is a general statement and should only be used as a guide. It does not constitute tax advice and is based on current tax laws and their interpretation.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google LLC.