PartPay

What is PartPay?

You’ve probably heard of Buy Now Pay Later (BNPL) services. Our credit card feature – PartPay1 – is similar, in that it lets you split purchases of $100 or more into 4 payments over 6 weeks.

However, there are some big differences.

Unlike others, PartPay is a payment feature of your credit card – it’s not an account by itself. So you have the same credit card protection, and you can’t spend beyond your existing available credit limit.

Why use PartPay?

Split purchases

Split purchases of $100 or more into 4 payments over 6 weeks.

No separate application

No need to apply. Just turn on2 PartPay in the Westpac app to add a separate digital PartPay Card to your account.

Same credit card account

Same credit limit, same security, rewards and added extras.

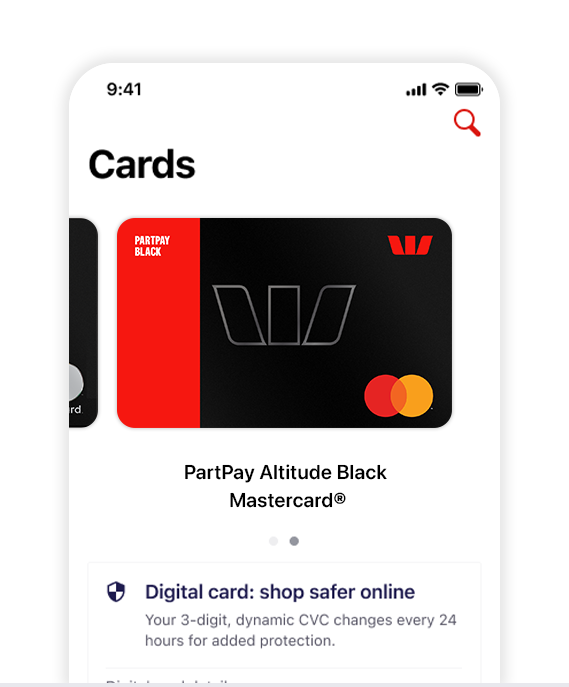

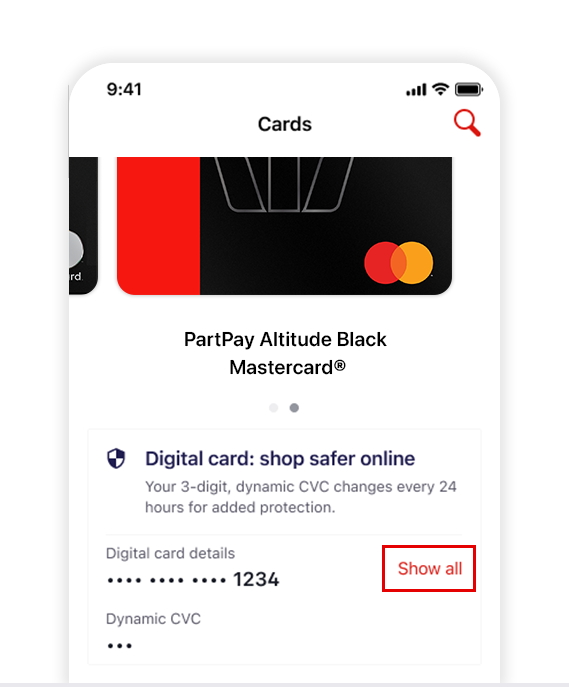

Digital card only

Using the Westpac App and through your digital wallet.

How PartPay works

Don’t have a Westpac Credit Card?

Check out our range of PartPay eligible Credit Cards.

Turning PartPay on

You'll need your account details handy if your Autopay payments will come from a non-Westpac account.

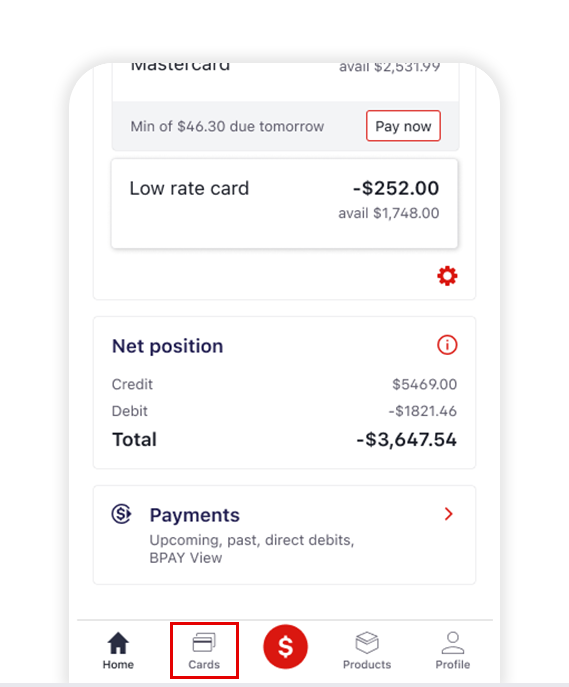

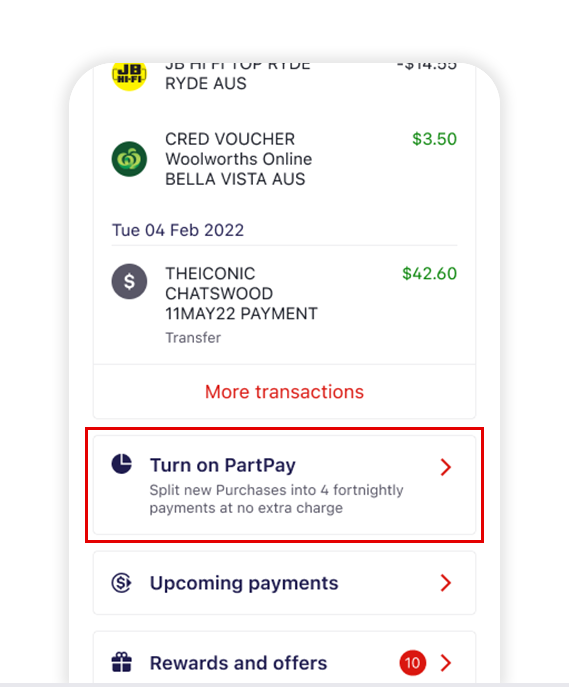

1. Turn on

Use the Westpac App, following the prompts, including setting up PartPay Autopay.

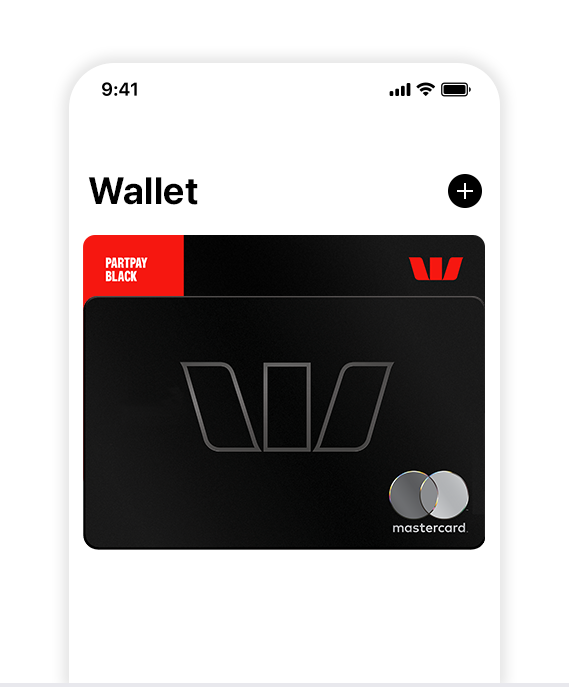

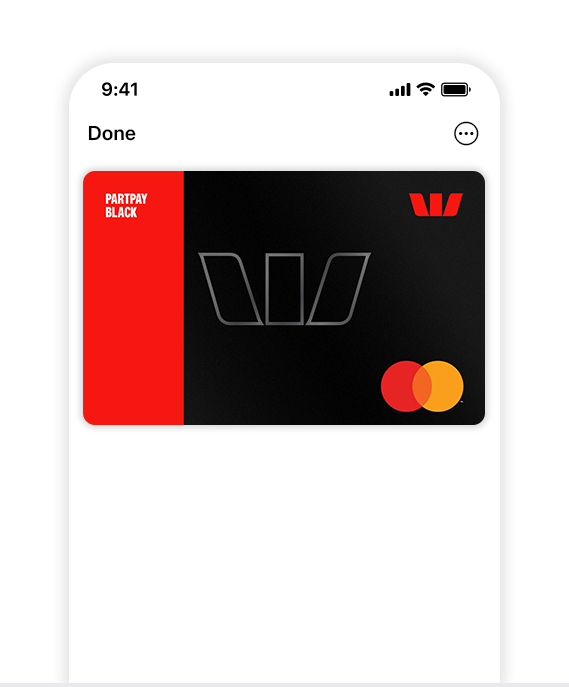

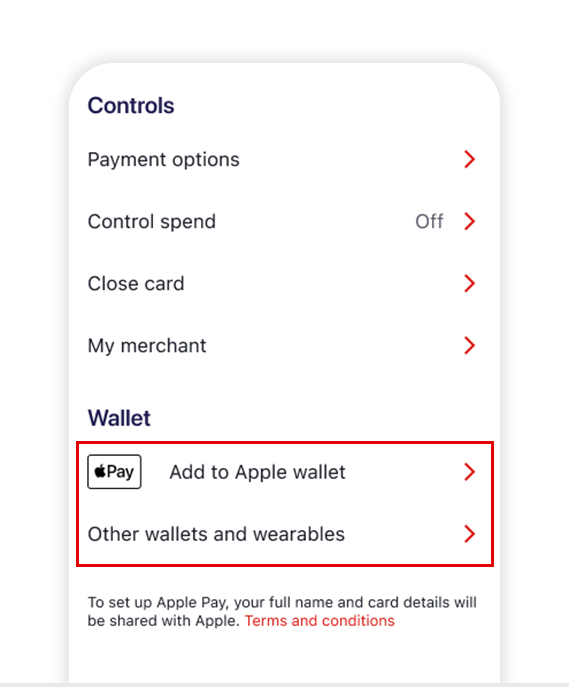

2. Add the PartPay Card to wallet

e.g. Apple Pay, Samsung Pay™, Google Pay™, Garmin Pay™ wallet for in-store shopping.

Shopping with PartPay

Once you’ve turned on PartPay, you can use it via your digital wallet for in-store shopping, or the Westpac App for online.

PartPay me up!

You’ll need the Westpac App (and an eligible credit card3) to use PartPay. If you don’t have the Westpac App, you can download it here.

FAQs

No, PartPay is not a BNPL product. PartPay is a payment feature that’s available on eligible Westpac credit cards. It’s similar to ‘Buy Now Pay Later’ services in that eligible purchases made on the PartPay Card are split into 4 payments over 6 weeks.

Unlike a standalone BNPL product, PartPay is part of an existing credit card account. For PartPay, if you miss a payment the amount will be moved to your linked credit card's Purchase balance, and you may be charged interest as a result. You aren’t charged a late payment fee for missing a PartPay payment, like some BNPL products.

Things you should know

1. PartPay Card Terms and Conditions apply.

2. To turn on PartPay you must be the primary cardholder of an activated, eligible credit card and must be up to date with your credit card payments, with no transaction blocks on your account. You must also agree to the PartPay Card Terms and Conditions.

3. Eligible credit cards for PartPay are Westpac’s Low Rate, Low fee, Altitude Rewards Platinum, and Altitude Rewards Black credit cards.

The Digital Card is only available in the Westpac App and supported with the latest version of the Westpac App. The terms and conditions applicable to your product also apply to the use of your Digital Card. Online Banking Terms & Conditions also apply. You may not always be able to access your Digital Card.

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Read the Samsung Pay Terms and Conditions (PDF 63KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Samsung Pay you will need to use a compatible phone with a supported operating system.

Internet connection may be needed to make payments using Samsung Pay and normal mobile data charges apply.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Read the Google Pay Terms and Conditions (PDF 125KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Google Pay you will need to use a compatible device with a supported operating system.

Internet connection may be needed to make purchases using Google Pay and normal mobile data charges apply.

Google Pay is a trademark of Google LLC.

Read the Garmin Pay Terms and Conditions (PDF 55KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Garmin Pay you will need to use a compatible device with a supported operating system.

Please be aware, to make a payment of over $200 with Garmin Pay, you must enter your physical card PIN at the contactless terminal. For security reasons, if you are not prompted for your card PIN, the transaction will not be accepted. This does not change current payments or transaction limits on your physical card.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

Please be aware, to make a payment of over $100 with Fitbit Pay, you must enter your physical card PIN at the contactless terminal. For security reasons, if you are not prompted for your card PIN, the transaction will not be accepted. This does not change current payments or transaction limits on your physical card.

Fitbit is a registered trademark(s) or trademark(s) of Fitbit LLC and/or its affiliates in the United States and other countries.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Registered to BPAY Pty Ltd ABN 69 079 137 518.

© Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.