55+ and Retired

Essentials

- For retirees who are aged 55 or over

- Earn interest on account balances

- Unlimited access across Online Banking, Telephone Banking, Westpac, St.George, BankSA and Bank of Melbourne ATMs and branches (daily transaction limits apply)

Did you know?

Adding a Debit Mastercard® to your 55+ and Retired Account will allow you to access your own money to make purchases overseas, online and over the phone - at 30 million locations worldwide1.

Apple Pay

Apple Pay offers a fast and secure way to pay in-store and online, using your favourite Apple device

$0 Account-Keeping Fee

Card on hold

Can’t find your card? Don’t panic, you can temporarily lock it in seconds with Card on hold while you search3

Fraud Money Back Guarantee

Shop securely with your debit card. We’ve got your back with 24/7 fraud monitoring and our Fraud Money Back Guarantee4

Earn bonus Cashback with ShopBack

Westpac customers can access exclusive bonus Cashback when shopping via the new Westpac Lounge on ShopBack.

Features

Multiple ways to access your bank account and to your money

- Online Banking

- Mobile Banking

- Telephone Banking

- Debit Mastercard or Handycard

- Bank@Post

- Branch

- ATMs

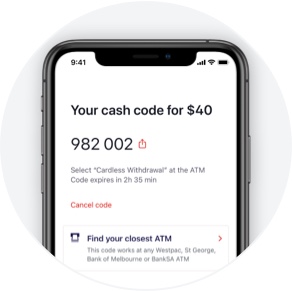

- Withdraw cash using your phone from any Westpac, St.George, Bank of Melbourne or BankSA ATM5

Access your money

Pay no ATM withdrawal fee at any Westpac, St.George, Bank of Melbourne and BankSA or at the Global ATM Alliance and partner ATMs (other fees may apply)2

When your Westpac 55+ and Retired account is open

- Register for Westpac Online Banking and/or Telephone Banking for more ways to access your money

- Choose eStatements for convenient online access to 7 years of account activity.

Fees

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 621KB)

Other accounts for

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

It is important to know that the functionality to withdraw money from a linked Westpac account via Credit Card is not available when using overseas ATMs, including Global Alliance ATMs. To ensure access to Savings and or Cheque account funds when overseas please speak to us about obtaining a Debit Mastercard®.

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.