Bank account with debit card

Choose Westpac Choice for easy day-to-day banking and more

Use your debit card for fast payments online and in-store, and if you have an eligible Westpac home loan, link it as an offset account to reduce interest repayments.

Spend securely with your Debit Mastercard1

Add to your mobile or wearable wallet, buy in store and online, and withdraw cash at ATMs worldwide.2

Get spend and cash flow insights

Track trends in Cash flow to stay in control of your monthly budget while tagging expenses in Categories to better understand your spending.

Earn Sweet Discounts

Make full use of our exclusive discounts, cashbacks and deals. Take advantage of our Rewards & Offers.

$0 international transfers5

When you send foreign currency overseas via Online Banking or the Westpac App. See our conversion rates and included countries.

Enjoy $0 monthly fees for 12 months

Open a new Westpac Choice account online between 01/02/24 and 30/09/24 to have the monthly Account-Keeping Fee waived for the first 12 months.

Pay no Account-Keeping Fee for the first 12 months on your new Westpac Choice account and save $5 a month.

Make payments your way

Choice makes buying, paying, and withdrawing cash simple and convenient, even before you’ve received your debit card.

- Use the digital card in the Westpac App while waiting for the plastic one to arrive. The CVC refreshes every 24 hours for extra security

- Link your card to Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay to make fast contactless payments with your mobile or wearable

- Get cash out of Westpac, St.George, Bank of Melbourne and BankSA ATMs without a card using the Westpac App⁶

See, review and authorise new PayTo7 payments before money leaves your account

Save time, apply online

Get up and running the fast way

Your Choice account could be active in less than 3 minutes.

Earn Bonus Cashback with ShopBack

Westpac customers can access exclusive Bonus Cashback when shopping via the new Westpac Lounge on ShopBack.

Security guaranteed

Online banking guarantee

We’ll repay any funds missing from your account due to fraud, as long as you’ve complied with our T&Cs.4

Temporary card lock

If you’ve misplaced your debit card, you can immediately lock it while you look, in the Westpac App.3

Westpac Protect™ SMS Code

For greater peace of mind, we can send a one-time SMS Code to your mobile to authorise online transactions and features.

Aged 18-29?

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a Life Savings and Choice bank account.

Get the Westpac App for even easier banking

View and transfer funds fast

Quick Balance lets you view the balance of three main accounts and quickly transfer money without signing in.

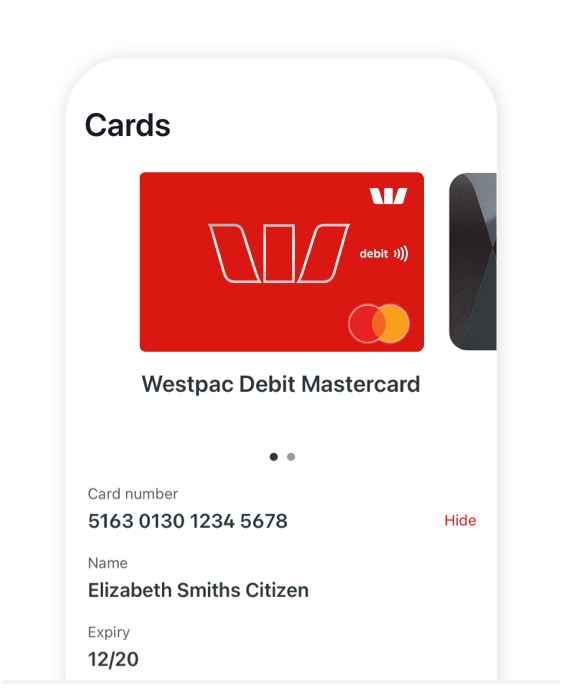

Manage your cards in one place

Misplaced your card? Temporarily lock it while you’re looking, order a new one, or change your PIN, all in the app’s convenient Cards Hub.

Get sorted with in-app budget tools

Track your month-to-month Cash flow and spot areas where you could be making savings with your spend sorted in Categories.

Fees

| Standard fees (fees may change) | Amount |

|---|---|

|

Account-Keeping Fee

|

$5 |

|

This fee is waived for:

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 620KB)

Other accounts for

Feature articles

More options

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

2. Global ATM: A 3% Westpac Foreign Transaction Fee applies to overseas debit card withdrawals. A list of Global Alliance members is available. To ensure access to savings and/or cheque account funds when overseas obtain a Debit Mastercard®.

3. Card on hold: Available on personal credit and Mastercard® debit cards only. Cards to which a temporary lock can be applied will be listed when you sign in to Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

5. Westpac transfer fees still apply for funds sent in Australian dollars. Receiving bank fees may also apply, check the currency converter for indicative rates and fees.

6. Cardless cash: available on eligible Westpac everyday accounts with a linked debit card for customers 18 years and over. Limit of 3 withdrawal transactions per day applies, subject to $500 daily withdrawal limit and $1,000 weekly withdrawal limit. Only available at Westpac Group ATMs or select Westpac Group partner ATMs in Australia. To access Cardless Cash on your mobile you must be registered to use Online Banking and download the Westpac App. You'll also need the Westpac App (version 6.1 or above) installed on your iPhone. You must be 18 years or older to use Cardless Cash.

Fast or real-time payments are sent and received using Osko® by BPAY® and can be addressed to either a PayID or a BSB and account number. Real-time payments require both the payer and payee to have Osko enabled accounts. BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.

Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trademarks of Google LLC. Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

PayID® and PayTo® are registered trademark of NPP Australia Limited.