This tax time, don't splurge it, save it

This could be the start of something big

Sure it's fun to splurge when a tax return hits your bank account. But what if it could be the start of something bigger?

With your Westpac Life account, your tax return could work even harder for you and kickstart your savings. You can also earn bonus interest1 when you continue to save regularly and grow your balance1 - helping you hit your savings milestones even sooner.

Start kicking goals sooner

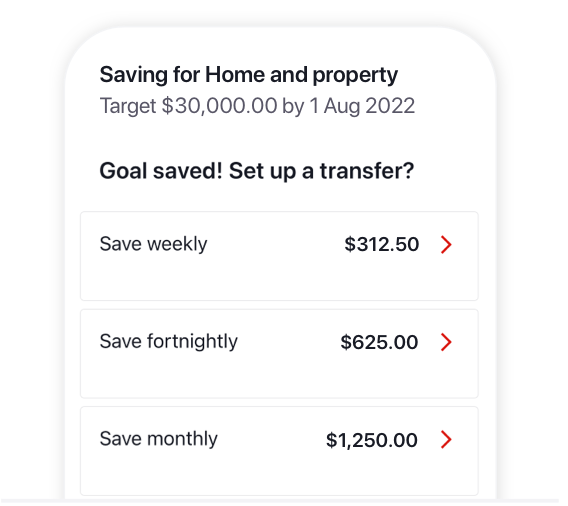

Why not put your tax return towards a Savings Goal?2 With a Westpac Life account you can have up to six goals with just one account – you can even go on autopilot with a regular transfer that automatically splits across your goals.

Put it away for a rainy day

You never know what life might send your way, and having a stash of cash could help smooth the way.

Head away

Whether it’s a local break or future escape, combining your tax return and regular savings could have you packing your bags sooner.

Get that home reno done

Dreaming of a new kitchen or updating the bathroom? Your tax return could be the first step to getting what you crave.

Earn up to 5.00% p.a. variable interest rate

2.00% p.a.

Standard variable base rate

plus

3.00% p.a.

Variable bonus rate each month you grow your balance1

Get rewarded for saving small and often

You can still earn bonus interest even if you’re only able to save a small amount, so long as you’ve grown your balance by the end of the month.*

Set up to 6 Savings Goals2

Set up to 6 different goals in just the one account. You can change the savings amount, date and category across all your goals and adjust them at any time.

Put your savings on autopilot

Make it easy by setting up a regular deposit from your everyday transaction account every payday that automatically splits your savings across your goals.

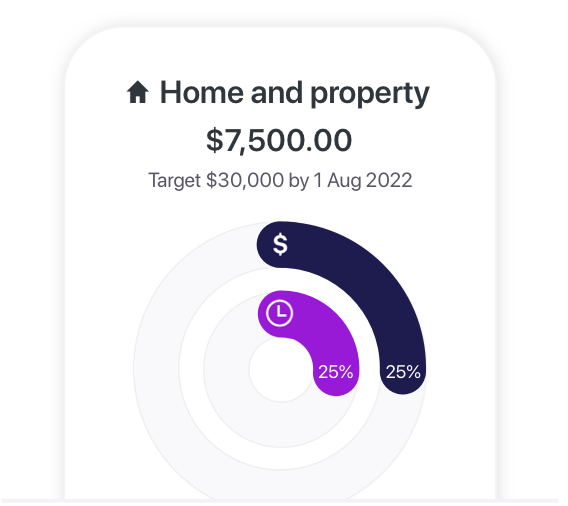

Track your progress

Keep tabs on your progress with the Westpac app. Just tap on your goal to see how much you need to save regularly to reach your goal.

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount (interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility); and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Note: Bonus interest is calculated in the system after 11:59pm on the last business day of the month. Any transaction processed before 11:59pm may impact bonus interest eligibility.