What is compound interest?

Did you know that when you put your money into certain types of bank accounts it can earn even more money for you? This is because banks pay you something called interest. Read on to learn more about how interest works, and how it could help your money grow.

What is interest?

Banks need money to be able to provide loans to customers and operate their business. When you deposit your money with a bank, they may pay you a bit of extra money for keeping your money with them.

This extra money is called interest.

The bonus amount the bank pays you is based on its interest rate – which is a percent, or a fraction, of the total amount of money in your bank account.

For example: if you have $100 in your bank account and the bank has an interest rate of 5% p.a. per year (or per annum), you will get $5 extra for that year from the bank.

Or, if you have $50 in your bank account and the interest is 5% p.a. p.a., you will get $2.50 extra.

How to calculate interest

- Divide the interest rate by 100. Example: The interest rate 5% p.a. p.a. so 5/100 = 0.05

- Multiply the number you calculated in step one by the amount of money you have. Example: You have $50 so 0.05*$50 = $2.50

Tip: Westpac has a Savings Calculator that you can use to calculate your interest earned over time.

How your money grows with compound interest

Compound interest is when you start to earn interest not just on the money you started with, but also on the interest you earn over time.

For example: You deposit $100 in your bank account with a yearly interest rate of 5% p.a. p.a.

- Year one: You earn 5% p.a. of $100, which is $5. Now you have $105

- Year two: You earn 5% p.a. of $105, which is $5.25. Now you have $110.25

- Year three: You earn 5% p.a. of $110.25, which is $5.51. Now you have $115.76

- Year four: You earn 5% p.a. of $115.76, which is $5.79. Now you have $121.55

As long as you leave your money in your account, the interest will compound on top of it every year – helping it to grow and grow!

Even if you withdraw some money from your account, you will still earn compound interest over time, but it will be less.

For example:

- Year one: You earn 5% p.a. of $100, which is $5. Now you have $105

- Year two: You earn 5% p.a. of $105, which is $5.25. Now you have $110.25

- Year three: You withdraw $10. You earn 5% p.a. of $100.25, which is $5.01. Now you have $105.26

- Year four: You earn 5% p.a. of $105.26, which is $5.06. Now you have $110.52

The sooner you start saving the more opportunity you have to make your money grow.

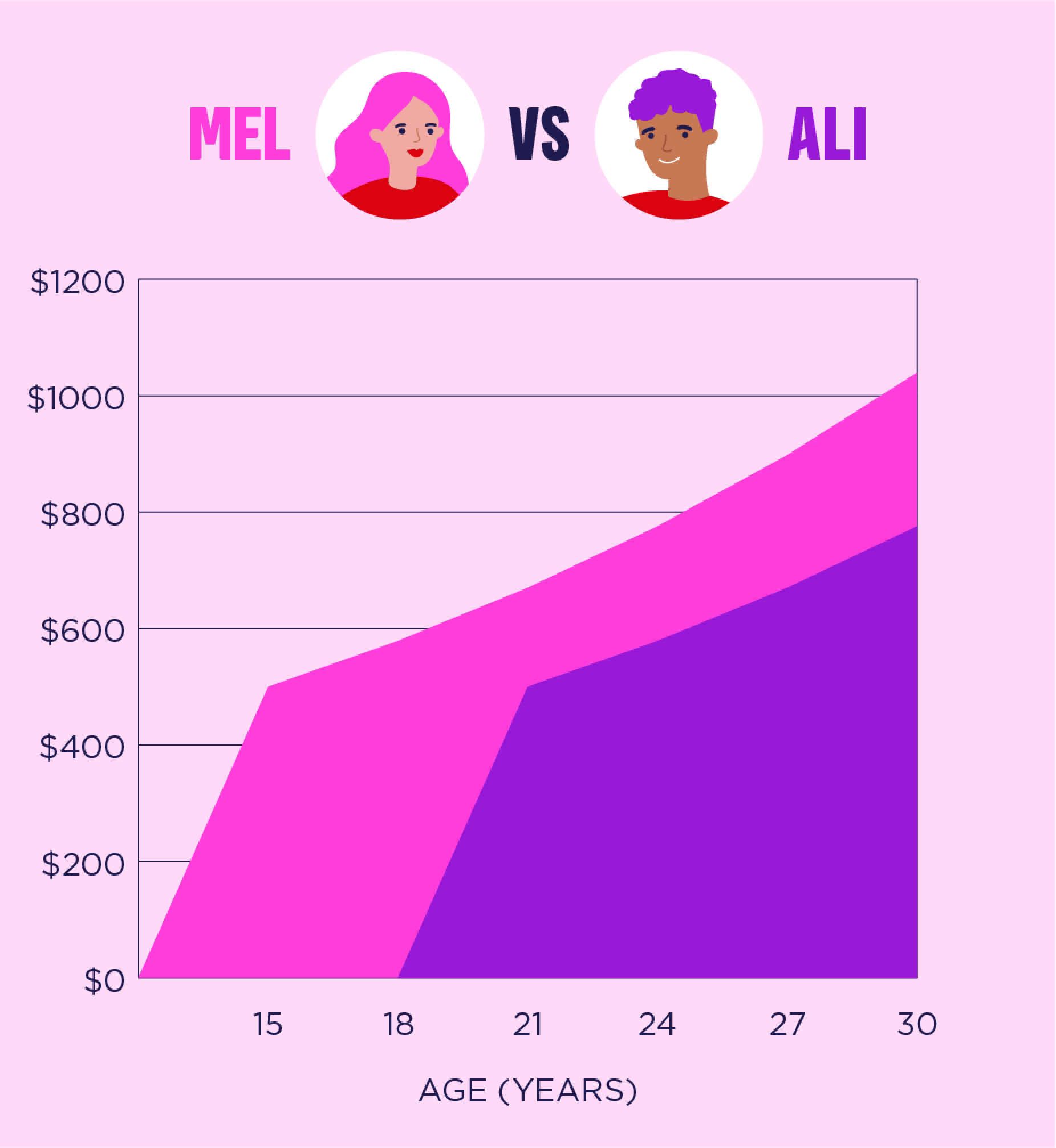

In the example below, both Mel and Ali started with $500 in their accounts, but Mel began saving at 15 years old and Ali began at 21.

By the time they are both 30 years old, with 5% p.a. annual interest, Mel’s original $500 will have turned into $1040, whereas Ali will have around $775. Mel has earned around $265 more than Ali!

Where you can earn interest

Most banks have different types of savings accounts that pay you interest.

Some require you to make a minimum deposit or leave your money in your account for a fixed period of time, such as a few months or even years.

Westpac has a Bump Savings Account for kids and teens. This account allows you to earn interest (even when you make a withdrawal)1 and you can access your account and track your savings through the Westpac App.

Quiz time: Calculate the interest earned

Charlotte puts $200 in a savings account that pays 4% p.a. interest per year. She doesn’t take out or add any other money. How much money will she have in her account after:

a. One year?

b. Two years?

c. Three years?

Calculate the interest earned for each year, then scroll to the bottom of the page for the answers.

Answers:

a. $208

b. $216.32

c. $224.97

You may find these useful

Things you should know

1. Bump Bonus interest: You will be eligible for bonus interest if during the month (subject to transaction processing times):

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount; and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility.