HOME OPEN: Sydney looking ‘stretched’; Perth to outperform

The property market recovery that began earlier this year has gained momentum, with sales volumes starting to pick up along with prices, although it is a nuanced picture across the country’s major cities.

Strong population growth has been the key driver behind the turnaround, and it’s clear that the strongest performing cities are the ones that have seen the biggest gains in inward migration.

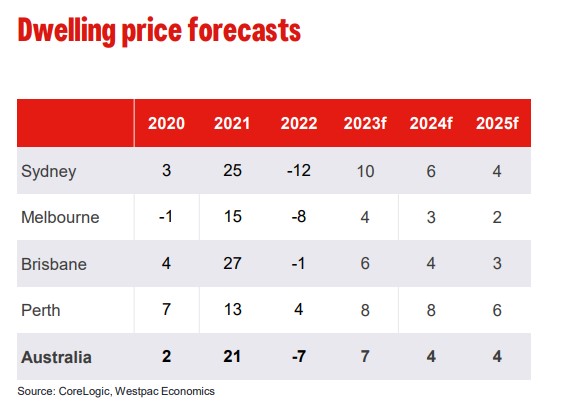

Sydney has led the way, but that market is already challenging in terms of affordability and by the end of 2023 we expect it will look very stretched. That’s likely to show up in softening demand, household formation rates changing, and a growing number of people moving to more affordable markets around the country.

Melbourne has also seen solid population growth, but the market has been more sluggish than other capital cities. That's partly because the Victorian economy was hit harder by COVID and is seeing a slower recovery, but there’s also been an overhang of stock to work through.

Vacancy rates in Melbourne's rental market have been slower to tighten that elsewhere, although they're clearly tight now and that’s likely to persist into next year. But, like Sydney, Melbourne prices will be constrained by affordability problems, and it's looking like an underperformer through this cycle.

Brisbane also has a positive population story, and Queensland generally tends to pick up spillover demand from Sydney and Melbourne as people are priced out of those markets. The supply-demand balance is tight, which will further support prices.

Still, affordability will be an issue. The Brisbane market had a big run up in prices prior to the pandemic and has had a milder correction than other places since then. Overall, we see it in the middle of the pack for this cycle.

Perth is looking like the outperformer. There’s a strong economic backdrop as Western Australia’s mining sector continues to support growth, while housing affordability is not as stretched as it is in the eastern cities. Supply is also tight, with very low rental vacancy rates.

South Australia and Tasmania have been largely bypassed by the population resurgence. There may be some spillover demand in those markets, but both are contending with quite stretched affordability, particularly for local buyers.

Those markets look less positive in terms of their price prospects, although we still expect them to post gains.