Budget buzz builds, but is it back to normal?

With less than a week until the Australian Treasurer hands down the federal budget on March 29, anticipation is building for what this year’s papers will bring.

It’s a weighty milestone holding the bonus significance this year of coming just a matter of weeks ahead of the federal election, now certain to be held in May – the first since the COVID-19 pandemic upturned our lives and economy.

The usual pre-budget leaks and announcements have started to build a picture for what we might expect. While there will be plenty of surprises, it's very likely we’ll see a realignment of fiscal priorities.

When the pandemic first hit, the government’s main fiscal policy objective was to cushion the downturn and then support the recovery with the aim of lowering the unemployment rate from its 20-year high peak of 7.5 per cent in July 2020, to below 6 per cent.

That has well and truly been achieved, the unemployment rate continuing to surprise on the downside as it heads below 4 per cent – lower than the pre-pandemic 5.1 per cent rate, and the equal lowest since 1974.

The policy objective now pivots to fiscal repair. The Treasurer recently stated he is targeting a budget position to “stabilise and then reduce debt as a share of the economy”.

Of course, another key economic indicator that’s surprised on the upside has been inflation – driven primarily by global supply chain shocks, leading to increases in consumer prices, notably fuel and other imported materials.

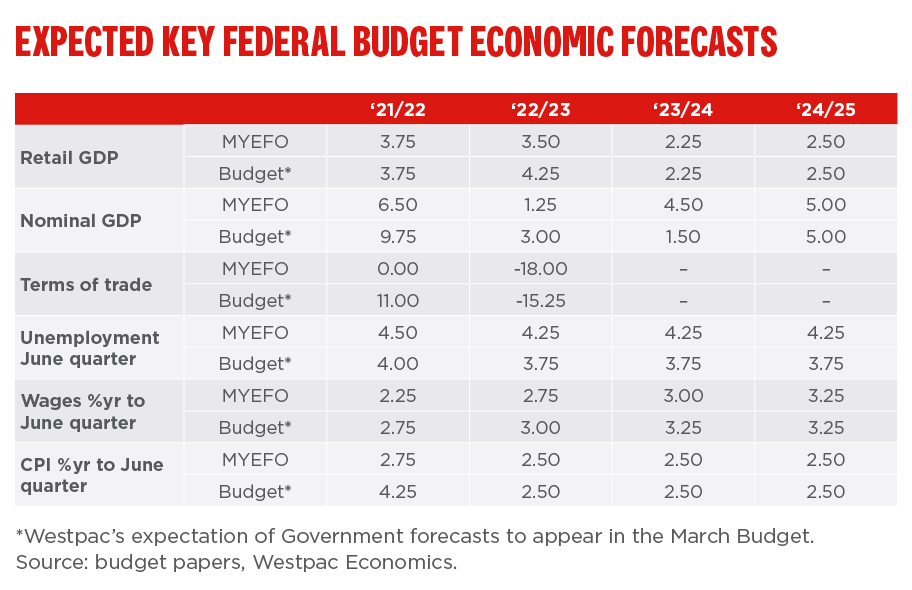

Inflation forecasts – along with labour market and wages – are projected to be revised in this budget. We expect inflation will be materially upgraded for 2021/22 to 4.25 per cent, up from 2.75 per cent. Beyond that, we think the budget will anticipate inflation settling at 2.5 per cent, as in the mid-year economic and fiscal outlook.

To address the big flow on effect of upward consumer prices, the Treasurer has already flagged budget measures to support families to meet cost of living pressures. The government is also considering some targeted relief on the fuel excise which is currently 44 cents a litre.

Beyond this, we expect new policy initiatives to be relatively modest – our calculations factoring in $20 billion of new measures across the four years to 2024/25. This is a commendable decision, given the government is facing an election and, currently, behind in the opinion polls.

In the first year, we estimate these new measures at $7.5bn, including the cost of living package of around $4bn to be paid to those receiving social security and on low and middle incomes, along with funding for flood relief.

We also anticipate new spending of around $8bn across the four years to boost the supply side of the economy. These will aim to lift productivity and encourage increased participation and engagement in the labour force, building on existing initiatives – such as the government’s signature stage 3 tax cuts from 2024/25 – that are already legislated and funded.

Indeed, the Treasurer has flagged further investments in “infrastructure, skills, digital transformation, energy, our regions and Australia’s sovereign manufacturing capability”.

We anticipate a further $3.5bn across the four years to address other key priorities, including health and housing affordability. And we’ve factored in additional defence funding of $1.5bn for 2024/25, given the need to address national security against a background of heightened geopolitical tensions globally, exacerbated by the Russia’s invasion of Ukraine.

As well as any new policy initiatives, the current fiscal forecasts already provide for $16bn of policy measures across the four years to 2024/25 which have yet to be announced. Some of this is expected to be directed towards infrastructure initiatives for the regions, including an NBN upgrade, while there is scope for the government to announce measures during the upcoming election campaign (that are already funded).

Arguably, the most controversial aspect of this budget will be the low and middle income tax offset. Originally introduced as a temporary measure in 2019/20, the LMITO – a maximum of $1080 lump sum for those earning between $48,000 and $90,000 – has been extended in the last two budgets, but we don’t think it will be extended for another year.

Overall, on our figuring, we expect to see a $78bn improvement to the budget deficit across the four years to 2024/25 compared to the MYEFO, due to the stronger than anticipated economy.

Of this $78bn windfall, we expect the bulk – or around $58bn – to be directed to lowering the budget deficit and reducing public debt, while $20bn will go to new policy measures with a focus on an $8bn package to boost the supply side of the economy.

But … all will be revealed by the Treasurer on Tuesday.

No doubt, like us, you’ll be eagerly tuned in.

Access Westpac’s full Federal Budget coverage.

The views expressed are those of the author and do not necessarily reflect those of the Westpac Group. The information in this article is general information only, it does not constitute any recommendation or advice; it has been prepared without taking into account your personal objectives, financial situation or needs and you should consider its appropriateness with regard to these factors before acting on it. Any taxation position described is a general statement and should only be used as a guide. It does not constitute tax advice and is based on current tax laws and our interpretation. Your individual situation may differ and you should seek independent professional tax advice. You should also consider obtaining personalised advice from a professional financial adviser before making any financial decisions in relation to the matters discussed.