New year fails to lift the mood among consumers

One word best sums up the mood of the Australian consumer as 2024 gets under way: stressed.

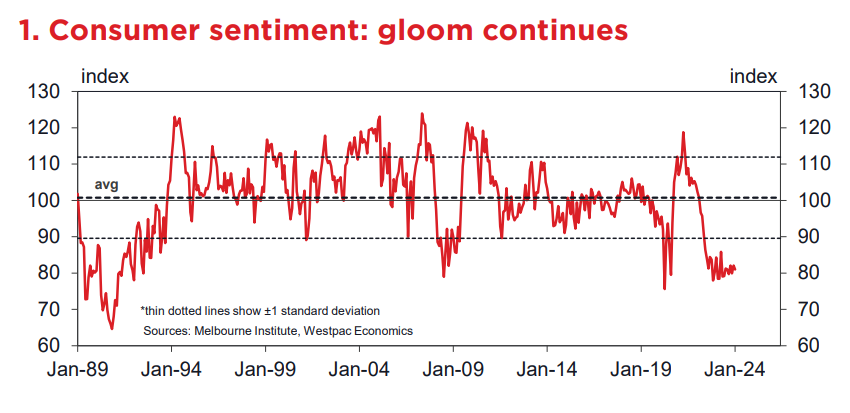

The Westpac–Melbourne Institute Consumer Sentiment Index remains stuck at very weak levels, running around 20 per cent below its long-term average as cost-of-living pressures continue to dominate.

Concerns centre around family finances and how those pressures are weighing on disposable incomes.

The “time to buy a major item” sub-index is languishing at historic lows after falling 5.4 per cent in the three months to January, while the “time to buy a dwelling” component dropped 5.3 per cent.

Risk aversion among consumers also remains high. The Westpac Risk Aversion Index rose 3.1 points to 57.2 in December, marking the second highest read since the start of the survey in the mid-1970s. Consumers are more inclined to favour deposits, in part reflecting the higher interest rates on offer.

So far, we haven’t seen much improvement in sentiment off the back of better news on inflation and interest rates. That may start to feed through as inflation returns closer to the RBA’s 2-3 per cent target range, and of course we also have Stage 3 tax cuts scheduled to come in from July.

More good news on the economy may help to turn the dial on sentiment, but it still looks like quite a challenging outlook. Even as inflation stabilises, cost of living is still going to be high relative to incomes for several years to come.

Beyond an initial rebound in sentiment, that we still haven’t seen yet, it could be a long, slow recovery path for consumers over the next couple of years.

To read Matt’s full report, visit the WestpacIQ website.