Realistic budget, but tough calls to come

Westpac chief economist Bill Evans discusses the October budget announcement.

The Labor government has delivered a responsible budget, which shouldn’t further stoke inflationary pressures in the economy, but still has work to do to rein in its spending commitments in coming years.

The underlying economic forecasts were broadly in line with the Westpac economics team’s own thinking that growth will slow to 1.5 per cent in 2023/24, inflation will rise to 5.5 per cent this year and the unemployment rate will get to 4.5 per cent.

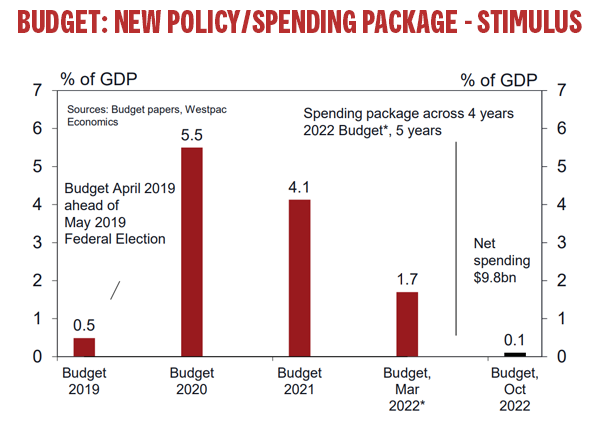

Spending on new policies, such as childcare subsidies and aged care, only amounts to 0.1 per cent of GDP. That compares with 1.7 per cent in the March budget and nearly 5 per cent during the COVID years.

There were also some welcome investment initiatives, including $2.4 billion more for the National Broadband Network, $1.2bn to improve connectivity in the regional areas, and an affordable housing plan which sets an ambitious target of one million new homes over five years.

But the big challenge facing the government is the structural risk associated with the budget. While the deficit starts from a much lower base of 1.4 per cent of GDP in 2021/22, it’s now expected to rise to 1.8 per cent over the four-year forecast period, whereas the March budget had projected a decline from 3.5 per cent to 1.6 per cent.

The change in trajectory is due primarily to growing expenditure pressure, with the cost of servicing the national debt and a growing burden from the NDIS the two main contributors.

Overall, there’s $80bn more expenditure in this budget than we saw in March. That means the debt-to-GDP ratio, which in the March budget was projected to stabilise at around 40 per cent of GDP, is now likely to get up to 47 per cent of GDP, and may even rise beyond that.

The government has got some big issues to deal with between now and the next budget in May, including whether to proceed with the Stage 3 tax cuts legislated by the previous administration. Dropping them could potentially save around $20bn a year - almost 1 per cent of GDP - but it would be bad economics to do so, in my view.

Coming two years out from the next election, May could be the right time for some serious budget repair, and I would expect to see much tougher decisions taken then.

For the full report, visit WestpacIQ.