HOME OPEN: The game changer

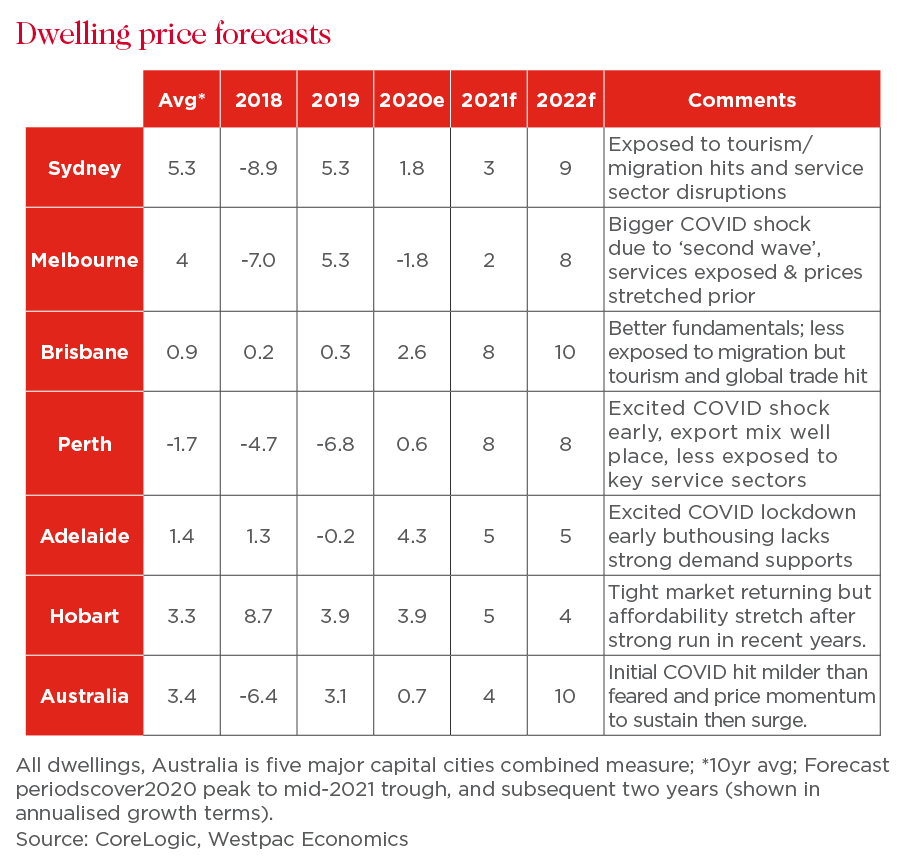

Westpac Economics expects national dwelling prices to rise 4 per cent in 2021 and 10 per cent in 2022. (Josh Wall)

While COVID outbreaks continue to wreak havoc abroad, the virus again looks to be under control locally. Restrictions are easing and borders opening up.

Further buoying local spirits, a vaccine is now highly likely to be available by mid-2021, perhaps earlier, with the three front-running candidates – Pfizer, Moderna and AstraZeneca – having all recently reported very promising initial results earlier than expected.

All of this bodes well for the Australian economy and solid gains are likely to be reported for the back end of this year, along with a lower than originally forecast unemployment rate. But of course, we aren’t out of the woods yet given the scale of the recession this year and the recovery will be gradual, with our forecasts having activity only just reaching its pre-COVID level by Christmas next year.

For the housing market, however, the recovery is looking even rosier than almost everyone feared, as laid out in our November Housing Pule report.

Turnover in the market ex Victoria is now slightly above pre-COVID and year-ago levels, prices are rising in most markets and housing–related sentiment has rallied strongly, the “time to buy a dwelling” index in our monthly consumer sentiment survey above its long run average.

Meanwhile, the game-changing earlier than expected vaccine suggests international border restrictions could be relaxed late next year, possibly even from the September quarter, suggesting the rebound in migration and population growth could come through much earlier than assumed.

Bringing this all together, the prospects for dwelling prices have clearly improved.

Back in September, we revised our call for a 10 per cent correction, acknowledging the milder than expected initial decline, the more material support coming from low interest rates and a somewhat milder recession.

In short, we pencilled in further declines that would take the total peak to trough fall to 5 per cent by mid next year, followed by a 15 per cent gain the two years to June 2023.

However, that further decline through to June now looks unlikely given the market momentum and sentiment, a milder “soft patch” in the economy for housing next year and the earlier timing on vaccines.

As such, we now expect prices nationally to rise 4 per cent in 2021 and 10 per cent in 2022 – in effect bringing our 15 per cent surge forward.

There will still be areas of weakness, parts of the Sydney and Melbourne high rise market – which could see further declines in the order of 10 per cent – comes to mind.

But the strong overall momentum will be welcome news to the central bank and governments. A warning note: ongoing strong gains will, however, start to test the nerve of regulators and the RBA in late 2022, bringing policy responses – ie “macro-prudential” measures that limit riskier types of lending (remember the investor and interest only caps?) – back into frame.

For more on what to expect in each state’s housing market, read our report.

The information in this article is general information only, it does not constitute any recommendation or advice; it has been prepared without taking into account your personal objectives, financial situation or needs and you should consider its appropriateness with regard to these factors before acting on it. Any taxation position described is a general statement and should only be used as a guide. It does not constitute tax advice and is based on current tax laws and our interpretation. Your individual situation may differ and you should seek independent professional tax advice. You should also consider obtaining personalised advice from a professional financial adviser before making any financial decisions in relation to the matters discussed.