ROUNDTABLE: Untangling data imperative

The quandary of unlocking data’s potential has elevated from innovation labs to boardrooms. (Getty)

Perhaps unsurprisingly, data was the theme that cut through almost every session at the recent Money 20/20 Asia fintech and payments conference in Singapore.

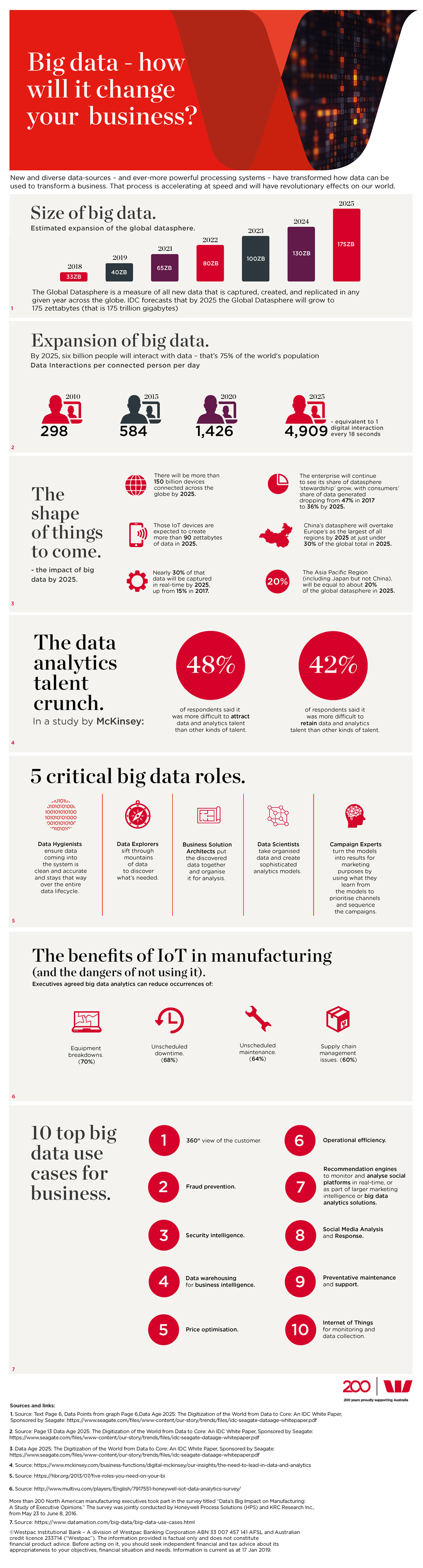

Data has been described by The Economist as the new oil. It is growing exponentially as mobile devices proliferate and computing power increases, the global ‘datasphere’ projected to grow from 33 Zettabytes (a Zettabyte being a trillion Gigabytes) to 178 Zettabytes by 2025, according to consultancy IDC.

But data is problematic.

As yet, it can’t be valued easily, and needs analysis and insight. Unlike oil, it can’t be traded. Transacting data is fraught with difficulties – from protecting consumer privacy to data leakage that causes competitive disadvantage – so it doesn’t have a market price.

Data isn’t recognised on a corporate balance sheet yet its importance is reflected in the valuations of tech giants like Apple, Google, Facebook, Tencent and Alibaba.

Despite these problems the strategic imperative is clear.

Stephen Scheeler, the former CEO of Facebook Australia and New Zealand recently told Westpac Wire: “Every manager on Earth now needs to be as dexterous and able to use data and understand data and converse with data experts in the same way they converse with the person who runs HR, or…strategy or … finance or … operations.”

Given this imperative, Westpac recently hosted a roundtable in Singapore on how to approach the data economy, which included institutional clients, tech companies and Data Republic – a company within Westpac backed venture capital firm Reinventure’s portfolio.

The first point, as Danny Gilligan, co-founder and managing director of Reinventure Group, and co-founder of Data Republic, explained is that the regulatory environment around data is evolving and dynamic.

On one end of the spectrum is China, where data is readily available and happily shared between consumers and the large tech platform companies. In Danny’s words China demonstrates what is possible with data but is a jurisdiction where the concept of privacy is different to that understood in many western markets. Interestingly the other giant country of tech, the United States, does not have a unified Federal approach to data privacy, although California is introducing a new framework with CCPA.

Most recently the EU’s GDPR guidelines have imposed further regulations around data which in Danny’s words could be classified as “one of the biggest regulatory own goals” in terms of the impact it may have on Europe’s own digital economy. While in India, and other emerging economies, data nationalism has emerged as a theme that imposes restrictions around data sovereignty – essentially where data can be domiciled and analysed.

Somewhere in the middle sit Commonwealth countries such as the UK, Singapore, Canada, New Zealand and Australia which have long-established privacy foundations that act as a natural advantage in managing data. In those countries, the focus is on a balanced approach.

For an enlarged version of infographic, visit Westpac IQ.

“Data must be equitable for everyone,” Dr David Hardoon, chief data officer at the Monetary Authority of Singapore said at a recent event at Westpac’s Singapore Co.lab, adding “I strongly believe that good regulation is fertile ground for innovation.”

Consumers may be happy to give data away for free where they feel value is created but rightly they are concerned about their private information being used for purposes that they may not have realised they are consenting to, or purposes for which they don’t agree.

Companies typically only touch consumers in their own spheres of operation, for example, in the case of banks, when a consumer transacts. That limits the ways in which they can use data to delight the customer and provide them with the services they want, when they want it, based on data analytics.

Technology such as Data Republic’s Senate platform attempts to address the data sharing issue. Senate provides a safe space for companies to share data consensually, privately and securely, and is already being explored by major Australian and Singaporean companies like Westpac, Singtel and Singapore Airlines.

One thing that is for sure, the data imperative is not going away and some companies, particularly in emerging Asia, have been quick to understand the potential uses of structured and unstructured data.

In an interview with Westpac’s chief development officer, Macgregor Duncan at Money 20/20 Asia, Jonathan Larsen, chief innovation officer at the Chinese insurer Ping An, described founder Yuan Geng’s own data epiphany.

“He could see the exponential growth of the platforms Tencent and Ali and the way in which those platforms were transforming their businesses. He recognised we were entering a new era, what we call the era of the data economy and of the technology ecosystem."

As a result Ping An’s entire business model and strategy is built around the digital economy from chatbots that support sales agents, to AI and even facial recognition, to support innovation in areas such as health care provision.

In the area of payments, it’s clear that the data economy is one of the five most powerful themes and opportunities. Capturing and understanding data from payment interactions can potentially change the conversations we have with our clients and the way they engage with their customers.

The potential is there for payments data to become a much more powerful strategic asset.

At this stage it’s hard to tell where precisely the guardrails are going to be in the data economy but it’s clear that the data conversation has been elevated from the innovation lab to the boardroom and corporates are increasingly looking for robust frameworks to guide that process.

This article was first published on Westpac IQ.