Freeing up super for fintech innovation

Australian superannuation funds, which are large investors in the equity market, could become major providers of capital to the fintech sector via a new fund, says Max Nicholson. (Getty)

Australia’s $2.7 trillion of retirement savings means we have one of the largest pools of investments in the world.

So why is it our entrepreneurs can’t find funding?

Looking at the data, Australia’s significant pool of superannuation co-exists with a capital drought in private equity and venture capital investment, which is tiny when compared with global benchmarks.

In financial services, just like other industries, this isn’t just a problem for those who may not be able to access capital but a problem for all given investment is the engine room of innovation in our economy.

Financial Services employs 450,000 people and generates more than $13 billion in tax revenues annually, according to data from Treasury and The Australian Banking Association. But it is facing threats from limited investment in innovative financial technology, or “fintech”, companies relative to other countries globally and increasing competition from offshore technology companies.

Tech giants like Amazon, Apple, Google, and Facebook are looking to invest in financial technology and in turn, directly competing with our banks, insurers, pension, and investment funds. In the US, Apple makes 10-19 per cent of credit card interchange margins on purchases through Apple Pay, while in China, Alipay and WeChat now provide direct services for half of all consumer purchases.

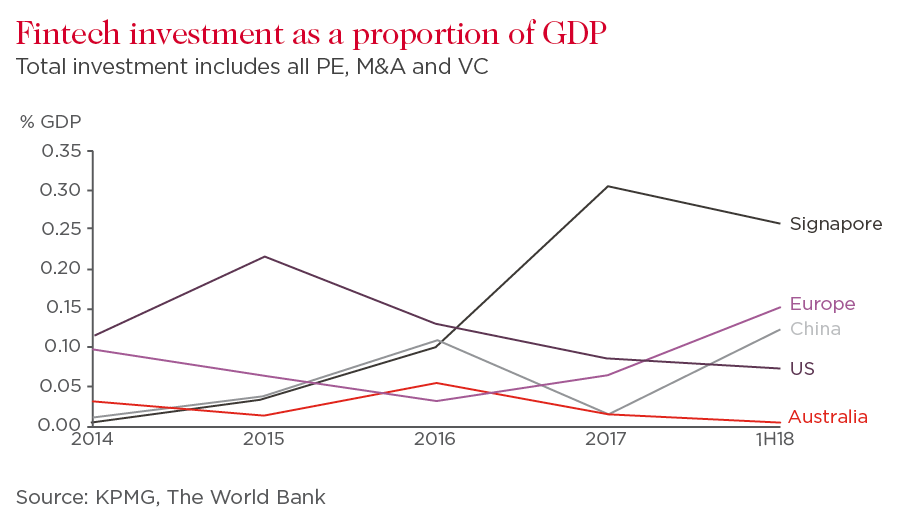

The paucity of investment in Australian fintech leaves us unprepared for these changes. Australia trails both the world and the Asia Pacific region both in absolute terms and relative to our GDP for fintech investment.

So the critical economic question is -- can we reverse the current trend?

The core of the problem is a cycle of “brain-drain” for talent and capital drought. Lack of investment in Australia has led to an exodus of some of our best and brightest start-ups and technology experts offshore. The problem compounds as the reduction in talent reduces investment opportunities, leading to Australian investment going offshore.

Current investment mechanisms also don’t support investment in this area for Australia’s largest groups of superannuation funds. Many super funds are dramatically underinvested in private equity and venture capital, suppressing potential returns for investors.

But I think there’s a solution: a Fintech Investment Fund.

Operated by The Future Fund and designed to meet the requirements of industry funds and large self managed superannuation funds, which are expected to command the largest proportion of the future pool of super assets, the Fintech Investment Fund could tap into pent-up demand for exposure to this asset class and release a large pool of fintech investment. With carefully targeted mandates, this fund could stimulate and grow the relatively new technology-based financial sector in Australia.

There’s strong demand from SMSFs to invest in innovative technology, but the current investment mechanisms don’t provide much support. For example, if SMSFs want to invest in private companies like Airbnb and Uber, they are not able to and due to their size, they often can’t meet the large minimum investments for private equity or venture capital funds.

Even if they do, it’s a daunting task for SMSF investors to commit part of their life savings in these funds for long durations of up to ten years.

Industry funds’ current 1.4 per cent allocation to private equity is dwarfed by the 10 per cent average among public pension funds in the US and UK, driven by higher fees associated and what has been dubbed a “culture clash” between the funds and private equity managers.

A government fund operated by the Future Fund could be tailored to suit SMSFs and industry funds, and facilitate investment in the fintech sector. It could offer low fees by negotiating at scale with private sector investment managers and operate on a not-for-profit basis. The fund could be set up so that superannuation investors could buy units at a small minimum investment, all under the support of the federal government.

Of course, the fund could also be open to investments from retail and public sector super funds.

Chairman of The Future Fund Peter Costello, who also established the fund when he was Federal Treasurer, speaking at an event in China in April. (Getty)

As a widely-trusted sovereign fund, The Future Fund is the natural home for a Fintech Investment Fund with a nation-building mandate.

As well as an existing investment management team, it has all the required prudential and compliance infrastructure and governance already in place. Of course, some new technology and capability in The Future Fund would be required to run a fintech fund, initially open to industry funds and SMSFs.

But once the fintech fund was operating at scale this additional operating expense to The Future Fund could be covered by a nominal fee to investors.

Based on my recent research for The Financial Services Council Future Leaders Award, a $20 million government outlay to cover initial start-up and early marketing costs could create a $20bn fintech investment fund by 2028 through this concept. From launch in 2021, investment would need to be scaled up slowly so as to not crowd-out investment opportunities, creating a positive feedback loop of access to capital and attraction of fintechs to start and remain in Australia.

Through focusing the investment power of our world-leading superannuation system and sovereign wealth fund, imagine the impact we could have on innovation in Australia.

This is an abridged extract from Max Nicholson’s submission for the Financial Services Council’s (FSC) Future Leaders Award in 2018, which he won. The piece reflects Max’s own personal views and research for the FSC’s Future Leaders Award and does not necessarily reflect those of the Westpac Group.