Don’t let negativity, ‘trade wars’ define us

Australia’s economy grew 3.4 per cent in the year to June 30. (Getty)

Much has been written in recent weeks about the 10-year anniversary of the GFC – for good reason. It was the biggest financial shock most people had lived through and the after effects still linger across many economies.

Through the GFC we learnt just how interconnected the world’s economies were, particularly the interconnectivity of capital markets.

I saw at the time the importance of the ‘Australian story’ – to be able to say to international investors that we were unified, strong, well-regulated and had good consistent policy.

Travelling through Asia in recent weeks, I was reminded – perhaps helped by that curiously powerful reflection that comes when abroad – of the many positives that still hold true for Australia.

Firstly, corporate Australia is generally growing at a solid pace.

While corporate leaders have concerns about political uncertainty and the rising cost of capital – despite still being close to multi-decade lows – business conditions remain excellent. The largest 200 ASX listed companies are again expected to report reasonable earnings growth this financial year.

In the buoyant mining sector, majors Rio, BHP and Fortescue have unveiled more than $6.5 billion in capital expenditure in WA’s Pilbara and we’re also seeing increasing activity in gold, lithium and other battery minerals.

Several companies across the data technology, agriculture, health, education, tourism and infrastructure sectors are prospering domestically while also tapping Asia’s – in particular China’s – rising demand for our quality services and goods, whether Lendlease signing a deal to develop and operate a senior living village in Shanghai or Blackmores’ Asia business recording record sales in June.

Domestically, the recent national accounts showed the economy expanded a better than expected 3.4 per cent, the final budget outcome for 2017-18 improved materially to a deficit of $10.1 billion and there is greater “synchronised growth” across the state economies for the first time since 2010.

Fortescue's Solomon Hub mining operations in WA’s Pilbara region. (Getty)

So I’m not surprised that at Westpac, we are starting to see increasing M&A activity across several key sectors, reflecting growing confidence in future investment and growth expectations.

Of course, it’s not all blue sky: some sectors remain under pressure. Many are grappling with the global ‘loss of trust’ phenomenon sweeping big business and intense transformation pressures amid technological disruption and greater competition.

Consumers continue to see little wage growth, and household wealth is reducing as the Sydney and Melbourne housing markets continue to ease.

Unsurprisingly, the major global risk occupying business leaders’ minds is the possibility of an escalation and spreading of the trade war between China and the US after last month’s latest measures.

To date, around 85 per cent of US imports to China have been affected. If the US follows through with threats to impost another $267bn of tariffs on Chinese goods, the bulk of trade between the world’s two biggest economies will have been officially drawn into the trade war, whether that’s wheat, or steel, or cars, or electronics goods.

As a mid-sized, open and free-trading economy, there’s no doubt the risks to Australia are high: the tariffs already announced will reduce GDP for the US and China, which in turn will flow through to the global economy given they account for nearly 40 per cent of world GDP.

At the most negative end of the spectrum, some observers fear global recession – and possibly even military conflict. But the more positive see little impact on the world economy, a deal to resolve the disputes and perhaps even some relative upside for Australia.

Interestingly, in Singapore last week, several of the large commodity trading companies I spoke with said that – so far – overall activity remained fine, noting that the sources of flow to China for some goods, like soybeans and almonds have changed, and no longer come from the US.

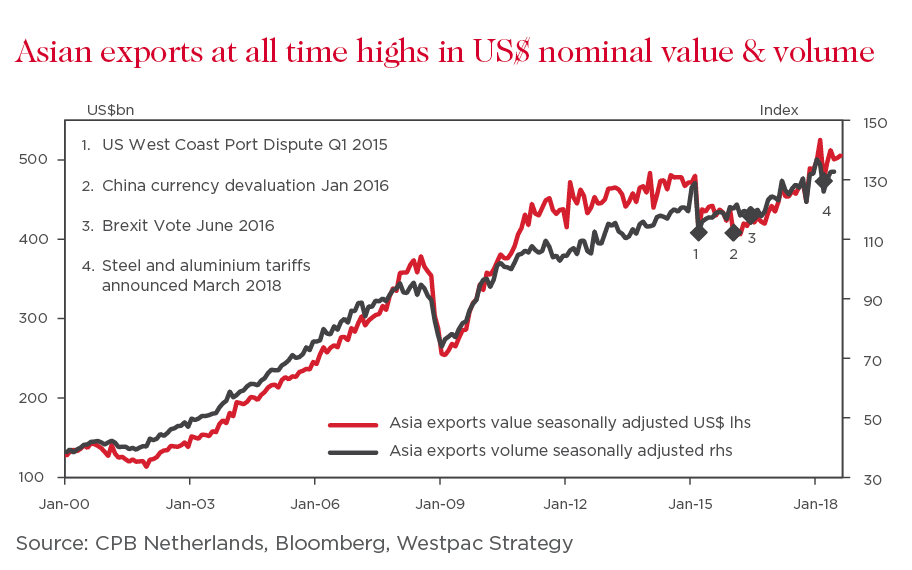

Westpac research shows that trade between Asia and the US remains strong, despite fears of an impact in recent months with Asian exports in both volume and US dollar terms still at record highs.

While uncertainty is negative for businesses’ willingness to invest in the short term, the mid-longer term story which centres on China’s domestic capacity, demand for Australia’s goods and services, and the opportunities through the “belt and road” infrastructure project remain intact.

Also, a substantial shock to Australian growth would require a further escalation and spreading of the trade war to more of our trading partners, which is unlikely.

Ultimately, I believe China and the US will come to an agreement that assuages both concerns, probably one that – like all good negotiations – includes compromises.

Threats and headwinds are nothing new, and it’s easy to be overly negative: I remember Glenn Stevens dryly observing back in 2012 during the European sovereign crisis that Australians worry more about the Greek economy than the Greeks do.

While continued success is not guaranteed and we mustn’t shy away from Australia’s vulnerabilities, 10 years on from the GFC Australia still has so much opportunity and potential. Making the most of it requires ongoing vigilance, plus being able to adapt and transform.

It also requires an optimistic spirit. As we’ve shown for the last 27 years of consecutive economic growth, we’re not all bad at it – trade wars, political uncertainty, funding costs or otherwise.

That strong “Australian story” that helped carry us through the GFC is far from redundant.