Cut-through, relevance key in digital age

Social media platforms, such as Twitter, are attracting a higher proportion of attention than ever before. (Getty)

Clearly, in the digital age, financial services companies struggle to win through being “top of mind”.

This realisation was brought to the fore recently after spending a few days with colleagues in New York and experiencing some platforms that had truly mastered bringing together not only “desirability”, but also “relevance” and “cut-through”.

Using artificial intelligence, geo-location and big data, platforms now dynamically serve up personalised baskets of goods, learn, and instantaneously adjust based on users’ behaviour, feedback and location. This results in a rich, gamified and engaging user experience.

Dating apps are a great example, from Tinder to Coffee Meets Bagel to Tin Dog. It’s all about convenience and personalisation. But the reality facing the financial services industry is that people are also consumed by social media sites Facebook, Twitter and LinkedIn, or Uber, online shopping and coffee ordering sites, or checking emails and WhatsApp.

For most individuals, only after all of this do financial services get considered. Apologies – plus after the dentist, going by some surveys of the choice of getting your teeth checked or going to a bank branch.

So as financial services struggle to compete in desirability, cut-through and relevance are becoming so much more important.

Digital transactions have soared in the past decade amid increased mobile phone ownership. (Getty)

In my view, the battleground for the customer today and in the future is at the service and experience layer. Sure, major technological advances like in big data, and infrastructural elements, such as cloud, are incredibly significant. But winning on the 5.5 inch playing field is more a function of seamlessly translating data to information, information to insight, insight to action and action to benefit.

It all points to a longer and purer focus on service value, which is a challenging reality for incumbents. It requires faith. And faith must be underpinned by belief that service will lead to deeper, richer customer relationships which, combined with frictionless processes, will result in superior businesses outcomes.

That doesn’t always mean triggering a response or call to action on a product. But rather outcomes based on there simply being no reason for a customer to do anything other than use your products because they are so seamlessly woven into the service layer (the relevance), and transparently and obviously in the customer’s best interests (the cut-through). Relationships then deepen.

It’s one of the core principles of Westpac’s Service Revolution strategy, which I’ll unashamedly admit is one of the most exciting yet challenging transformations I have seen in my 17 years in financial services.

Looking ahead, the space continues to rapidly change and challenges emerge.

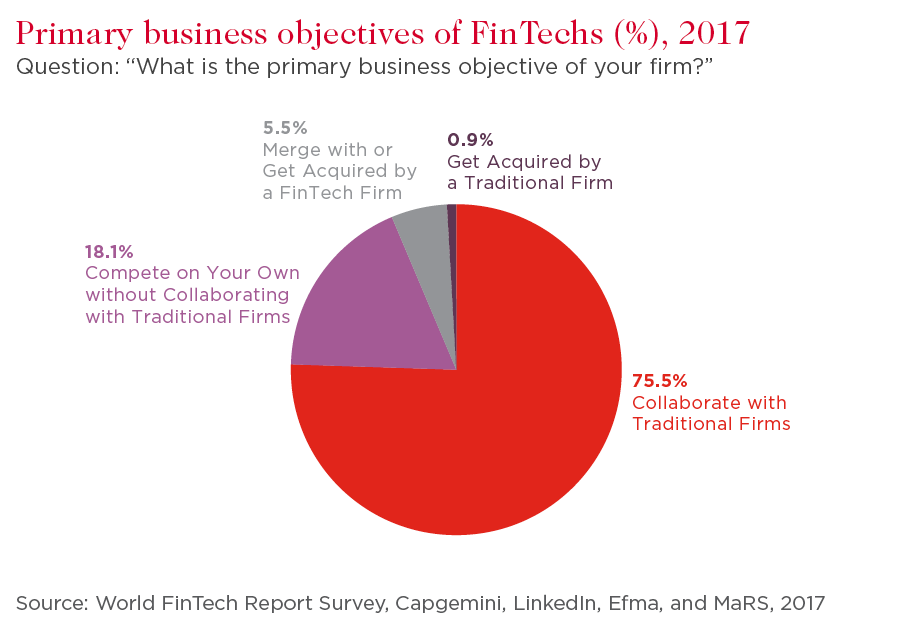

While it’s clear there’ll be more collaboration with fintechs/start-ups and incumbents, an interesting new trend is emerging where traditional players are moving toward a fully outsourced model of digital innovation. Full teams, IP and investments are bundled together offsite in a trend I think is only just beginning as collaboration evolves.

Sometimes separation from “business as usual” can be a good thing, particularly when you are trying to drive different cultural norms and levels of innovation. Notably, it actually often includes the dumping of words like “innovation” and “transformation”, replaced with adjectival nouns for these centres incorporating the likes of “delivery” or “execution”.

A case in point is Baltimore-based T Rowe Price, which has established its Tech Delivery Centre in New York in the Facebook building. In visiting this operation I was amazed at the choices made. The location, name, fit out, IT stack (which actually didn’t really exist as everything was hosted on Amazon Web Services). In a chat with Jordan, who runs the centre, he noted that driving the “new normal” requires being very deliberate and disciplined. Everything matters, execution is key and symbols are important.

I agree.

An issue is that the skill sets required in the digital era are becoming increasingly scarce and therefore expensive. For traditional companies, finding a good Java or Python programmer, or adept data scientist, requires competing with companies offering flexible environments, higher pay, equity and the ability to work on exciting problems and new technology unencumbered by legacy.

Employment propositions need to adapt if we are to be successful amid a war for talent.

But given the uphill battle for desirability, if we have no relevance and cut through there’s not much point in even playing.

For a bank, establishing a beachhead on something we can deliver is critical. I believe the answer lies in the big life moments for our customers and being truly excellent and cutting through in these moments that matter.

My hypothesis is we will see a two-step approach.

Firstly, the utility backbone – transactional banking, payments, apps, tools – must be seamless to the point of ambivalence. Then it will involve an engaging, rich, relevant focus on the moments that matter in order to shoot near the top of consumers’ consideration stack. Some engagements, like for a mortgage, will be customer-driven, but others may need prompting, such as life insurance after having a child.

But the right to win in these moments of truth will come from the other dimension – the underlying service backbone and experience that is so frictionless it is hardly noticed, used at the customer’s election.

In financial services, where we will have to fight harder than most to compete in the digital age, only the service leaders will thrive.