Stronger collaboration needed to supercharge the ‘North’

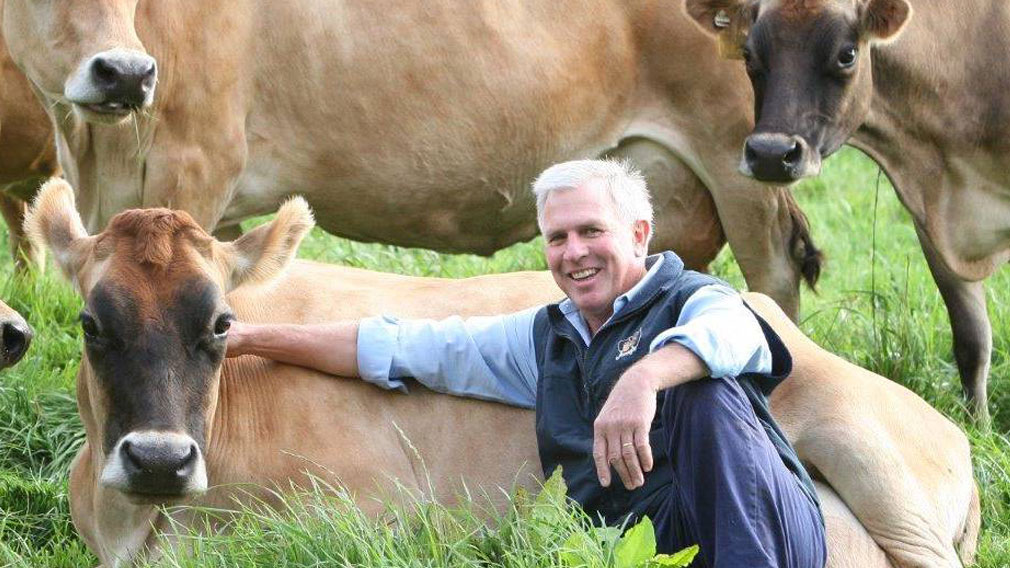

The latest vision to improve the pastoral industry in northern Australia may just be the rising tide that lifts all the north’s boats. (Supplied by Westpac Agribusiness)

The idea that the 40 per cent of Australia north of the Tropic of Capricorn is just sitting there, apparently doing little but growing cattle and crocs, has put a burr under the saddle of various governments and individuals for generations.

It’s a concept that’s demonstrably false – northern Australia currently produces about two-thirds of the nation’s export earnings, and may deliver more than 40 per cent of its GDP within a few decades. But the perception that the north is under-utilised is persistent.

Today, the north’s ability to prick southern Australia’s consciousness is more powerful than ever. Indonesia, on track to become one of the world’s top 10 economies, is closer to Darwin than Alice Springs is. The East Asian economic powerhouses, with China pre-eminent, are relative near-neighbours compared to the rest of the developed world. Technologies are available to overcome the tyrannies of distance and climate that have stymied the sort of explosive northern development that opportunity-minded Australians have dreamed of for decades.

These incentives have driven the latest vision for a developed north, the Northern Australia White Paper drafted under the Abbott government, and being realised under the Turnbull government.

The White Paper recognises that critical mass is essential to turning the north into an “economic powerhouse”.

“Transformation won’t happen if [northern Australia’s] population inches up by a few hundred thousand over the next 20 years,” the paper’s authors wrote.

“We need to lay the foundations for rapid population growth and put the north on a trajectory to reach a population of four to five million by 2060.” The north’s current population is just over one million.

The White Paper lays out a program in which the government sticks to its knitting. The government’s role is to lay down legislation that encourages private enterprise and investment, the authors wrote. It must ensure that enthusiasm for development doesn’t wreck the environment that pulls millions of tourist dollars, then get out of the way.

That vision has been notionally fulfilled in early 2017, with the Northern Territory Environment Protection Authority recommending approval of Seafarms’ Project Sea Dragon, a $2 billion proposal to build and operate a 10,000-hectare prawn farm at Legune Station, near the NT–WA border. If built, it will be one of the world’s largest aquaculture enterprises, drawing on world-leading Australian prawn breeding work to supercharge productivity.

But a few days before the EPA approval was posted on March 23, Seafarms told shareholders that it was delaying making a final decision on investing in the project by three months, and initial development would be delayed a year.

The reasons for delay, as reported by The West Australian, are a laundry list of why “developing the north” is hard, which included “a change in the Northern Territory Government, a big wet season hampering access on Legune Station, an unexpected requirement for one of its environmental impact statements lodged with the NT Government and an unfinalised Indigenous Land Use Agreement.”

This challenging mix of volatile state and Indigenous politics, bureaucracy and a temperamental natural environment are ever-present hazards to progress, with isolation and Canberra making their own contributions. A similar brew of reasons was cited in the NT Government’s decision earlier this year to back away from the third stage of the Ord irrigation development.

For Luke Bowen, general manager of the Northern Australia Development Office, these are old challenges, and negotiable. Sitting above them all, though, is the larger and more intractable danger of fragmented effort. That starts in Canberra.

“We’ve got the Northern Australia White Paper, the Agricultural Competitiveness White Paper, the Defence White Paper, and they all have strong relevance to the north,” Bowen says. “But so far, the federal government hasn’t been coordinating these strategies very well. It’s not thinking across the northern Australia portfolio.

“We’re trying to lift government’s sights a bit higher. It’s not just a few roads and bridges, a bit of water policy here and a bit of trade there. We have to address the question of why we’re talking about northern Australia in the first place.”

Bowen has his own answers. The north, “slap-bang in the middle of a region that’s changing rapidly”, represents an intersection of Australia’s economic, strategic and diplomatic interests.

“As the world’s 12th-largest economy, are we doing enough to position ourselves as a regional power, with influence? We need to start viewing northern Australia as more than just an opportunity to sell a few more mangoes and cattle to someone overseas.”

Bowen believes the key lies in building permanent interconnected capacity. The Seafarms project, for instance, might not just be about prawn farming. It could be an opportunity to produce feedstuffs rich in omega-3 from algae, which could feed prawns and cattle depending on processing.

“If we can get some of these sectors to feed off each other, then you start to build capacity around people, machinery, infrastructure, innovation. With enough critical mass in some sectors we could start thinking about automation, so we’re not relying on backpackers to harvest fruit in 40-degree heat,” he says. “You start to build economies of scale that lessen the costs of moving containers in and out of Darwin. When you join things up, a regional economy starts to take shape.”

Across the border, in Western Australia, the Ord River Irrigation Area project is 57 years into bootstrapping itself into self-sustainability.

The end is not yet in sight, but massive investment in Ord Stage 2 by Chinese company Shanghai Zhongfu, via its Australian vehicle Kimberley Agricultural Investments (KAI), is the biggest bet yet on the Ord by a private investor.

Jill Williams, who heads the Kununurra Chamber of Commerce and Industry, says that KAI’s stake in Stage 2 – the company leased almost all the land released in the development – is of a scale that finally gives a private Ord investor the critical mass to invest in their own infrastructure and research.

KAI is considering building its own small-seed processing plant, to back its belief that chia and other small-seed crops have potential in the Kimberley, and Williams observes that this immediately gives new scope for other operators to work with alternative crops.

Williams’ concern is that private investment in the region needs to grow faster than shrinking state government investment, which has kept the Ord on life support through various times of crisis.

That relationship has been fraught. Currently, Ord agribusiness is fuming at Perth because unresolved mishmashes of policy are causing investor uncertainty.

“The government gives us 50-year land leases, but only two-year water licences,” reports Matthew Dear, General Manager for Ord Irrigation. “And we’ve seen government release land for development, but then two years after the release it’s still sitting there because there are no clearing or development guidelines.”

Water security, in particular, remains out of synch with the south. Dear and Bowen report that the absence of mechanisms like water trading in WA and the NT, despite the policy long being in place for southern irrigators, is stalling investment in concepts like mosaic irrigation, which would see graziers run a centre-pivot irrigator to grow fodder crops to supplement their pastoral enterprises.

But if there are challenges launching new industries in the north, the oldest agribusiness, pastoralism, is finding new strength. Northern Australia ran just under half of Australia’s 27 million cattle in early 2017, and beef provides an enormous percentage of the north’s income. In the NT, pastoralism generates 90 per cent of the Territory’s primary production value.

From 2009–10 to 2013–14, northern pastoralism was in a trough. Acute drought in Queensland, the enormous cost of the 2011 Indonesian live export ban, and the low cattle prices that these events contributed to, pushed down pastoral incomes for several seasons in a row. Pastoral property sales came to a standstill, and northern beef enterprise debt seemed immovable, at best.

That began to turn around in 2014–15, as the live export trade freed up and cattle prices rose. In 2017, aided by a generally outstanding wet season, the Northern Territory Cattlemen’s Association (NTCA) membership is in better financial shape than it has been for years, says its Chief Executive Tracey Hayes.

“We’re seeing the industry with a positive cash flow, and it’s consolidating, paying down debt, investing in capital works, making succession arrangements and diversifying,” Hayes says. “It has come through one of the toughest cycles it has experienced, and is positioning itself for prosperity.”

That feeling isn’t just the perennial optimism of the cattle producer, Hayes adds. Foreign investors are recovering their taste for Australian pastoralism, bringing the promise of new supply chains.

Among them is the Chinese-owned Landbridge Group, which was controversially awarded a 99-year lease over Darwin Port in 2015.

“Landbridge is serious about its relationship with the Northern Territory, and we’re serious about our relationship with the group,” Hayes says. “If we get it right, Landbridge’s involvement would give the local AACo abattoir direct access to China. That would be an important step in diversification for northern beef.”

AACo’s Livingstone abattoir, opened in February 2015, is capable of processing 1000 head of cattle a day. Before the facility opened, any cattle not capable of being exported live to Asia had to be trucked hundreds or thousands of kilometres east or south for slaughter. AACo’s investment meant that producers had an accessible (by northern standards) abattoir to turn excess stock into boxed beef.

With its own herd of half-a-million cattle, AACo is its own best customer for the abattoir. A new beef pipeline into China would open the gates for more cattle from other enterprises, another step in lessening the northern beef industry’s reliance on live trade.

Building diversification – of markets and enterprises – is an important objective for the NTCA. It has recently put on a Business Development Officer charged with helping its membership find new ways of earning an income from their vast lease holdings. For most of those leases, cattle will be the primary venture for the foreseeable future.

But after the vulnerability of the one-species, one-market model was exposed during the 2011 live export shutdown, pastoralists have become more open to wearing hats other than a broad-brimmed akubra. Among the options, Hayes says, are tourism, date palms and irrigated vegetables grown on bore water. There is also a focus on improving productivity of Aboriginal-held lands, which account for 45 per cent of the NT.

But pastoral diversification faces the same challenges as any undertaking in the north: limited infrastructure, distance to markets, labour and a challenging climate.

For that reason, Hayes is enthusiastic about a memorandum of understanding signed in April 2017 by the beef industry representatives of WA, Qld and the NT, supporting the development of a northern Australia strategic plan for the sector.

An important aspect of the plan will be recognition that northern pastoralism can’t prosper in isolation: in a region without a critical mass of people and money, every sector has to play a role in supporting other sectors. “It’s a fantastic opportunity for all of us in the beef industry across the north to come together and identify challenges and opportunities,” Hayes says. “If we can all agree on a collaborative approach, it gives us that much more power when we go to Canberra.”

For instance, the Beef Roads Programme, announced by the federal government in 2015 – along with a useful allocation of $100 million towards road development – came after a lengthy analysis process in which the three northern jurisdictions jointly identified $3 billion in transport projects that could potentially be funded.

“That analysis represents a strategic document that is going to sit on a shelf unless we do something about it,” Hayes says. “If we just go to Canberra as the NTCA, we can easily be dismissed. But if the entire north is saying, ‘these projects are a critical need’, then we stand a much better chance of being heard.”

The pastoral industry can be the rising tide that lifts all the north’s boats, Hayes believes. “Our industry underpins prosperity in rural and regional areas, and if we can grow in ways that align with other businesses, the whole region becomes more attractive as a place to make nation-building investments.”

First published in Westpac Agribusiness' Produce Magazine.