Partnerships with purpose

We’re your partner in building a sustainable future

Building Australian infrastructure, driving renewable energy development, financing sustainability goals, and empowering tomorrow’s business decisions with data insights.

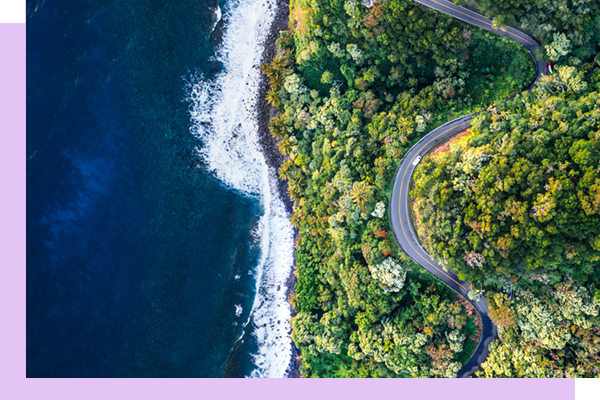

Reimagining infrastructure for a world in transition

Our industry experts are solving for today and building for tomorrow. We’re partnering with leading Australian organisations to finance infrastructure, from schools and hospitals, ports to airports, major toll roads and telecommunications networks.

Investing in a low emissions economy

We're powering opportunities to support the energy transition – lending to renewable energy solutions accounts for over 80% of our total electricity generation funding in Australia1.

Sustainable financing solutions

We’re providing finance to support a more sustainable future. Working with customers on innovative financing structures to help them to meet their sustainability goals, no matter where they are on their Environmental, Social and Governance (ESG) journey.

Defining future trends today

Westpac DataX business intelligence tools allow you to develop more targeted products and services using real-time smarter data. Our team of data specialists combines Westpac data (including over 6 million daily card transactions) with your own organisation’s data to provide deep insights on market conditions, economic conditions and market share.

Intelligent thinking and actionable ideas at Westpac IQ

Beating the scammers

Australian banks are collaborating to tackle the cyber crime challenge with a range of measures, including ‘confirmation of payee’ systems. Westpac experts outline what to expect.

ESG Impact: What you need to know - June 2024

There were several roadmaps to follow this month, with the Federal Government outlining its courses of action on sustainable finance and decarbonising the transport sector. We also report on the progress of zero-emissions haulage, a groundbreaking new electricity deal for a New Zealand aluminium smelter, how sustainable snake meat may boost food security, and more.

ESG Impact: What you need to know - May 2024

This edition explores the bumper investment in renewables in the Federal Budget 2024-5, how energy giants are breathing new life into ageing coal-fired assets, sustainability R&D in the red meat and livestock industry, new priorities announced at the First Nations Clean Energy Symposium, and more.

Things you should know

1. As at 30 September 2023. In addition to lending to renewable energy projects, Westpac also finances a mix of sustainable and non-sustainable lending generally.

Westpac Institutional Bank is a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714. This information is correct as at 1 December 2023. This product is available only to wholesale clients within the meaning of s761G of the Corporations Act 2001. You should consider whether or not these products and services are appropriate for you. Terms and conditions apply. Westpac Institutional Bank’s financing exposures are not limited to green and sustainable financing. For more details of Westpac Institutional Bank’s financing exposures, please see our latest presentation and results (PDF 5MB). Copyright 2023 Westpac Banking Corporation.