Cashless payments: How OpenAir Cinema managed to go cash free

4-minute read

4-minute read

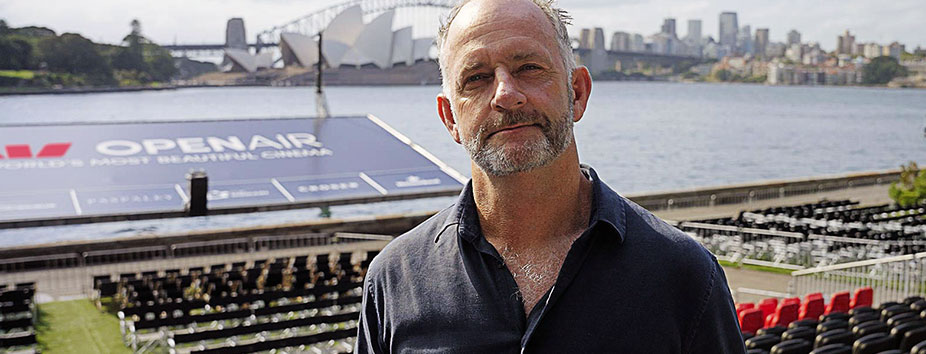

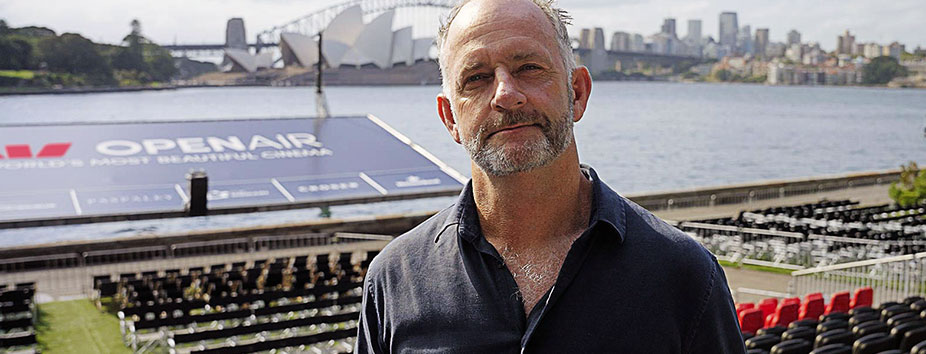

Westpac OpenAir Cinema started making the switch in late 2019 and now, in 2021, it’s totally cashless. Managing Director Rob Bryant explains how he phased out cash transactions and shares advice for small businesses looking to do the same.

Every summer for the past 24 years, Mrs Macquaries Point in Sydney’s Royal Botanic Gardens has played host to screenings of classic and new release films. As the sun goes down, the massive screen comes up, framed by the incredible view of the Sydney Harbour Bridge and Opera House. It’s safe to say that a night out at the Westpac OpenAir Cinema is a pretty special experience.

Managing Director Rob Bryant has been there since the beginning, helping thousands of people make the most of their night out. Varying with the weather, the OpenAir Cinema season usually runs for around two months each summer. But it was something worse than rain that affected this latest season. “This summer was a little bit different because of COVID-19,” says Bryant.

“The capacity of the event has actually been cut in half, so we have a much longer season to make up for it.” Capacity wasn’t the only thing that COVID-19 affected. Bryant had planned to start the transition to cash-free payments in 2019, but the projected roll-out time was two to three years. “COVID certainly sped up the process,” says Bryant.

Tickets to the screenings themselves are sold online via Ticketmaster. But, until 2019, onsite food and drinks could be bought using either cash or card. Noticing that cash purchases had dwindled steadily in recent years, Bryant started planning to slowly phase out cash.

“We felt it was the right time to go cashless,” he says. “We weren’t expecting 100 per cent of people to make the switch immediately so we adopted it as a policy in 2019, but with some back-ups. We kept a small reserve of cash onsite so we could continue to serve the minority of people who insisted on paying with cash, but we didn’t advertise the fact.”

But COVID’s arrival, though disastrous in so many ways for the team at OpenAir Cinema, facilitated a faster transition to cashless payments. “Contactless payment was part of our COVID-safe plan so, in the summer of 2020, we were able to tell customers that we’d made the move fully,” Bryant explains. “COVID-19 changed the world and we’ve had only the rare instance of someone wanting to use cash since COVID.”

After researching the market, the team at OpenAir Cinema opted to use a Kounta point-of-sale (POS) system. A cloud-based platform designed for hospitality and events businesses, Kounta runs on both iPad and Android tablets. “It effectively turns the tablet into an order pad and cash register,” Bryant explains. “Our whole menu is available on screen, so staff can put the transaction together then have the customer tap their card or mobile device to pay.”

Kounta1 connects directly to the Westpac Presto Smart EFTPOS machine2, which means payments can be processed instantly. The system can also be linked to a barcode scanner and receipt printer. “Getting everything up and running was simple,” says Bryant. “We replaced our old tills with a fleet of 12 iPads at a cost of $700 apiece. Westpac organised the terminals and gave us some helpful advice about vendors whose systems they could be integrated with, and then Kounta took care of putting it all together. All we needed to do was supply the internet connection.”

Cashless payments mean swifter service. When customers are queued up and keen to get back to the show, every second counts. “We do thousands of transactions per screening and, though it might only feel like a few seconds for a cash transaction, it’s closer to 10 or 15 seconds. Switching to cashless and saving that time really adds up over the course of the evening,” says Bryant. “The OpenAir Cinema is a special event for most of our patrons and making the payment process more seamless and efficient helps us to give them a more enjoyable experience on the night.”

Not having to count a stack of notes and coins each evening, and take them to the bank the next morning, is also a serious time saver. “You lose the sheer burden of having to bank the money and having to count it every night,” says Bryant. “The POS system tells you what your settlement should be, then you look at your bank account and there it is.”

But, beyond the day to day, there’s the benefit of streamlining the whole operation. Bank feeds from Westpac business transaction accounts can be linked to popular cloud accounting solutions, including Xero, MYOB and QuickBooks3. This saves time on reconciliations and provides business owners with better visibility and control of their finances. “When you consider the labour savings on the administration front, we certainly come out way ahead.”

Transporting the night’s takings to the bank is a risk in itself but going cashless also reduces the risk of skimming. Having no cash onsite means one less security concern and reduced opportunities for POS fraud – a perennial risk when employees handle cash in a fast-paced environment.

Cashless payments can be simple and cost effective and could save you significant time and money by reducing admin costs. And your bank can help you make the switch. With contact-free digital and EFTPOS payments now the norm for Australian customers and businesses, it’s a great time to consider going cashless.

Westpac is a key partner of Westpac OpenAir Cinema. The advice within this article is general in nature and may not be appropriate for you. We recommend you seek professional financial advice before proceeding.

Applications for merchant terminals are subject to approval. Terms and Conditions, fees and charges (PDF 334KB) apply.