Personal Banking

Value starts with a sweet rate

Our Flexi First variable rate home loan saves you around $600 of interest a month for the first 2 years^^

Feature rate

For a property to live in, with LVR up to 70%

6.44% p.a. 2-yr intro discount on variable rate^^^ |

| |

6.76% p.a. Comparison rate* |

Variable rate includes 2-year 1.64% p.a. discount from loan settlement, reverting to 1.24% p.a. life-of-loan discount thereafter^^^ (excludes refinances within Westpac Group), and a 0.10% p.a. discount for LVR+ up to 70%. For new Owner Occupier loans and P&I repayments. Credit criteria, T&Cs apply.

^^Example Only: Our Flexi First Option Variable Home Loan Introductory offer estimate savings of around $600 of interest a month over the first two years compared to our Flexi First Option Standard Variable Home Loan. Example based on a new loan size of $400,000 with an LVR less than 70% over a 30 year period.

A range of tools and calculators

Explore these tools to estimate your home loan repayments, borrowing power and upfront costs, plus get property reports and more.

Sweet discounts and rewards

On top of all-round value, eligible Westpac debit and credit cards come with built-in sweet discounts, cashbacks and special deals from everyday brands, stores and utility partners.

Advanced Security features to help keep you safe

Our Westpac Protect™ service works to help keep you safe from fraudsters, protecting you, your finances and your family**

Consolidate your debts and save

Save on interest and fees by consolidating debts into one easy-to-manage personal loan.

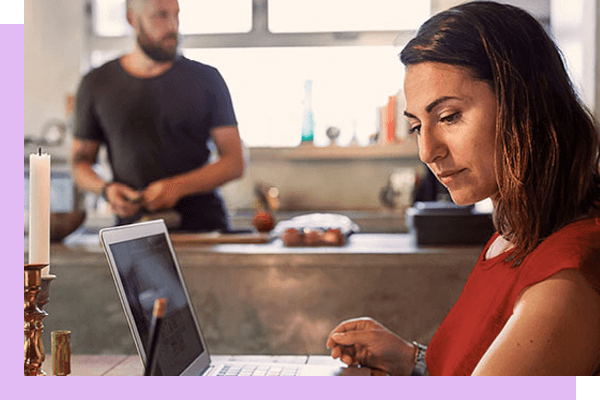

See what your money’s doing

The Westpac App lets you track your spending, so you can see exactly where to save money and better manage your budget.

Australia’s largest ATM network

With Australia’s largest ATM network, a fee free ATM is never far away. You can search for an ATM using the Westpac App, or our Branch and ATM locator.

Support if you need it

If you find that your finances are starting to get on top of you, you’re not alone. We can offer assistance with financial hardship support.

Eligibility criteria applies.

Money Matters

A selection from our library of articles to help you get more value from your finances.

Things you should know

Conditions, credit criteria, fees and charges apply. Residential lending is not available for Non-Australian Resident borrowers.

This information has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information and, if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent advice on any taxation matters.

^^^Flexi First Option special offer rates with Principal & Interest repayments

Special offers are only available on new Flexi First Option Home and Investment Loans with Principal & Interest repayments. Discounts do not apply to internal refinances or switches within the Westpac Group, which includes refinances from Westpac, St.George, Bank of Melbourne, BankSA and RAMS. Not available to company and trust account holders. Offer may be varied or withdrawn at any time. Interest rates are subject to change:

- For a property to live in (Owner occupier): Offer commences 24/11/2023. Includes a 1.64% p.a. discount for two years from the loan settlement date, at the end of the period it will revert to a 1.24% p.a. discount for the life of the loan.

*Comparison rate: The comparison rate is based on a loan of $150,000 over the term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

+LVR stands for the loan-to-value ratio. LVR is the amount of your loan compared to the Bank’s valuation of your property offered to secure your loan expressed as a percentage. Home loan rates for new loans are set based on the initial LVR and won’t change during the life of the loan as the LVR changes.

** If your Westpac account is compromised due to Online Banking fraud, we guarantee to repay any missing funds, provided you complied with our Online Banking Terms and Conditions. This includes keeping your sign-in details (including passwords), Westpac Protect Security Codes) private, not participating in the unauthorised transaction, and immediately notifying us when you suspect and unauthorised transaction or potential fraud on your accounts.