Using money saving hacks helped Josh rebuild his finances

When times are tough, good money saving hacks can help you to stay on top of your finances and potentially continue to save. To compliment your good habits, you should find a good savings account that motivates you and provides a good interest rate. To illustrate this, we have provided the following story about Josh1.

December 2020 – 6 minute read

Key takeaways from this article:

- Know where you spend your money

- Form positive money management habits

- Set up your savings goals

- Find a good savings account

- Establish a foundation for financial security

.jpg)

Josh works in the hospitality industry on a casual basis. Before JobKeeper he was working three jobs and earning reasonable money. When COVID19 hit Josh was reduced to one job at the JobKeeper rate. With no savings or emergency fund, he had to reduce his expenses quickly. From smarter grocery shopping to buying second-hand, Josh was also relying on his friends and family just to survive.

Not wanting to have to rely on friends and family, Josh started to review his spending habits by utilising checklists like the Cost-cutting checklist (PDF 191KB). After reviewing his costs, Josh wanted to know more about managing his money and found some great articles and tools on our Master your Money hub.

By deciding where he wants to spend his money and instigating some simple money hacks, Josh has $50 left over each fortnight, even on JobKeeper payments. This means, for the first time, he can begin to form some great saving habits. Josh’s first savings goal is to put some money away for a rainy day. So, if another COVID occurs, or he loses his job, or the car breaks down he will have the money to get through it.

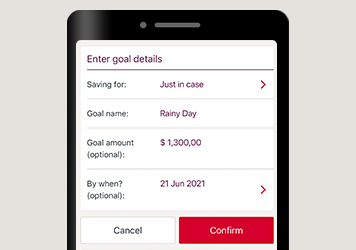

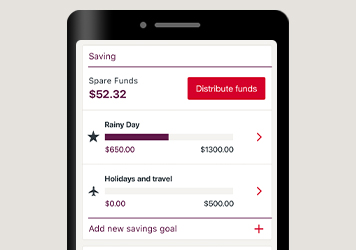

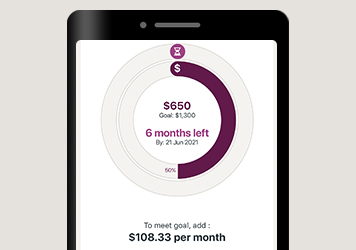

Josh has decided to use a Westpac Life account to help him achieve his savings habits as it had features that would help him. It allowed him to set up and name his goals like “Rainy day” and to play around with the amount he wanted to save and by when to give him an idea of what he needs to do to reach his goals. With his current $50 per fortnight, he will save $1,300 in the next twelve months, which is a good start. To make it even easier, Josh set up a regular deposit from his Westpac Choice account to his Westpac Life account to automate his savings and get on with life.

When his income goes up, Josh will be able to save more and add other savings goals to the account such as the “new car” he wants, on “overseas trip“ or maybe even a “deposit for a house”.

Josh also likes the graph that lets him see how close he is to reaching his goal and how much time he has left.

While it is easy to access his savings online, on the phone or at the branch, he really likes this extra feature, as it reminds him about his goals before using the money for something else.

All these features are great to help keep Josh focused and saving towards his goal, but he also wanted a good interest rate, to help with compound interest effect and kick start his savings. The Westpac Life account has up to a 5.2% p.a.* variable interest rate2 if you are between 18 and 29 years of age, which Josh qualifies for.

This is a great rate, at the moment, but Josh wanted to know more about the conditions to get the rate and what it would mean for him. He did a bit more digging and found out there are four different interest earning options to encourage him to save and spend with Westpac.

Option 1 - 2.00% p.a.

A base variable interest of 2.00% p.a. will be paid on the entire balance in his Westpac Life account even if he does not meet the other criteria.

Option 2 - 5.00% p.a.

If he makes one deposit to his Westpac Life account and the balance of his account is higher at the end of a month, by at least one cent, compared to the start of that month, he will get an additional 3.00% p.a. variable interest rate. Adding this to the base rate of 2.00% p.a. brings his combined interest rate to 5.00% p.a. earnt on the entire balance. Yay.

Option 3 - 2.20% p.a.

As Josh has a Westpac Choice account and makes more than 5 debit card purchases from that account each month, Westpac will give him an extra 0.20% p.a. Spend & Save bonus variable interest rate on savings balance up to $30,000. Adding this to the base rate of 2.00% p.a. on the entire balance brings his combined interest rate to 2.20% p.a. Yay.

Option 4 - 5.20% p.a.*

If Josh grows his savings by 1c each month (option 2, an additional 3.00% p.a.) AND makes 5 debit card purchases on his Westpac Choice account in the same month (option 3, an extra 0.20% p.a.), adding these to the base rate of 2.00% p.a. brings his combined interest rate to 5.20% p.a.* Double yay!

So how much extra will Josh earn from interest over the next 12 months at the current variable interest rates on the four options.

| Option 1 | Option 2 | Option 3 | Option 4 |

|---|---|---|---|

| Base Rate | Bonus interest for growing your Westpac Life savings account balance by the end of each month. | Reward interest for making 5 eligible purchases a month with your debit card linked to your Choice account. | Qualify for all bonuses. |

| 2.00% p.a. | 5.00% p.a. | 2.20% p.a. on savings up to $30,000 | 5.20% p.a.* on savings up to $30,000 |

| $0 for 12 months. | $0 + $50 deposited each fortnight for 12 months. | $0 + $50 deposited each fortnight for 12 months. | $0 + $50 deposited each fortnight for 12 months. |

| Interest earned | Interest earned | Interest earned | Interest earned |

| $0 | $30.00 | $13.00 | $31.00 |

Josh thinks that earning another $31.00 for doing nothing more than sticking to good money management practices and using his Westpac Choice account for his transactions is easy money. While it does not appear to be a lot of money now, Josh knows that with continually saving and the impact of compound interest this could be very good for him in the future.

With some smart money hacks, Josh was able to stay on top of his living expenses and utility bills while utilising the benefits of a savings account like Westpac Life. Josh now believes when the next COVID or emergency comes along he will be in a good position to handle it and not have to call on his friends and family for help.

If you find yourself in a situation where your income is reduced or you can’t find a job, having a bit of money saved up will help you to pay your bills. Westpac Life makes it simple to save money in Australia.

1 This story and the names used in it are for illustrative purposes only and is not based on any one individual.

2 Westpac Life interest rates are current as at 17 November 2023 for customers between the ages of 18 and 29.

This article is from Westpac’s financial education specialists, continuing the legacy of Sir Alfred Davidson in helping you create a better financial future.

Things you should know

Fees and charges apply. Read the product Terms and Conditions and consider whether the product is right for you. This information is general in nature and does not take your personal objectives, circumstances or needs into account.

- You must be aged 18-29 with a Westpac Life and a Westpac Choice account – both in the same name. Joint accounts are not eligible.

- If you have multiple Westpac Life or Choice accounts, only the earliest opened account is eligible.

- You must make 5 eligible purchases with the debit card linked to your Westpac Choice account and have these settled (not pending) within a calendar month. The following transactions are ineligible: ATM transactions, PayID, BPAY, EFTPOS cash-out only transactions, direct debits and paying off a credit card account.

- For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. Bonus interest is calculated on the daily balance of your eligible Westpac Life account up to $30,000, and paid to your eligible Westpac Life account by the 20th day of the following month.

- If your eligible Westpac Life account is closed before 21st day of the following month, the bonus interest will not be paid.

- Only one Spend&Save bonus interest offer per customer.

- Offer may be varied or withdrawn at any time in accordance with the Deposit accounts for Personal customers Terms and Conditions. (PDF 620KB)