6 ways couples can achieve their goals

Minutes to read: 3 minutes

Minutes to read: 3 minutes

When you are in a relationship, whether it has just started or is a long-term relationship, you are likely to have several relationship goals. Perhaps that holiday away together, saving for a home deposit, planning a wedding, planning a family, providing a good education for your children and many more.

In this article we will explore six tips on achieving relationship goals.

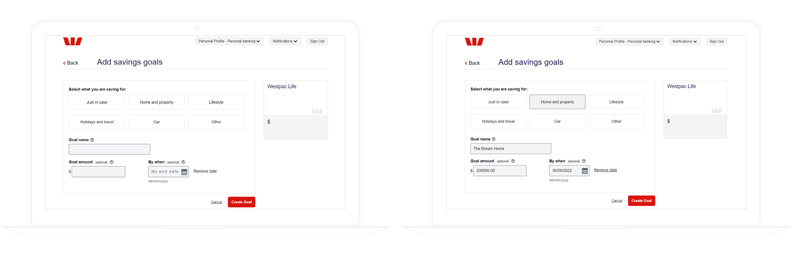

The first and most important step to achieving your goals is to set them. Discuss your couple goals with your significant other and give your goals names that are meaningful to both of you. It may be as simple as “Holiday”, “House deposit”, “Just in case”, “Emergency Fund”, “Road trip”, “Planning a Wedding” or more fun like “Our big fairytale wedding” or “For when I need retail therapy”.

At the end of the day the fewer goals the better. Too many goals can distract you, making it hard to achieve any one of them.

A bank account or savings account that allows you to name your goal will go a long way to helping you save.

Keep your plans simple and break them down into easy steps. For financial goals

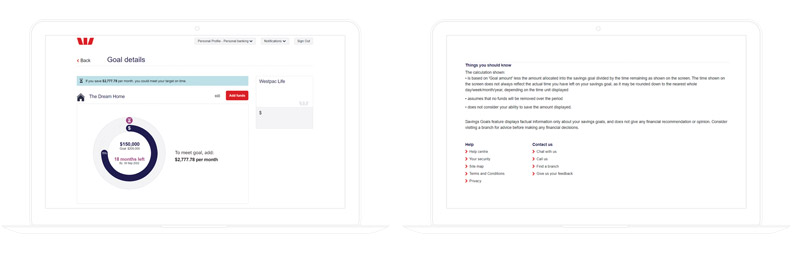

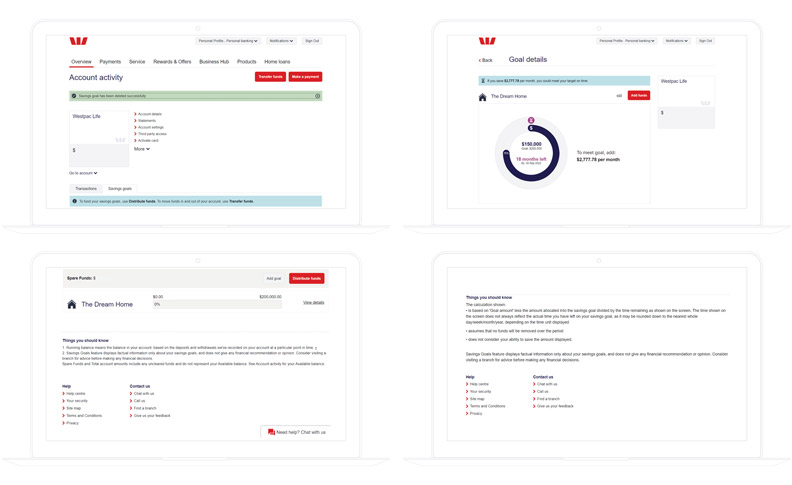

If you have your total cost and target date, a Westpac Life account will calculate how much you need to save each month to hit your target.

Can you afford to save more?

You could:

Target is too much?

Can you:

This is a great exercise to help with making financial decisions and budgeting. By understanding how much you need to save to achieve your goal, you can determine how much of your household income goes to household expenses, how much spending money to support your spending habits and how much to allocate to your savings goals.

Don’t get too stressed about your plans. While planning is important and really helps you to achieve goals, life is always changing. This is your plan, and it is OK to change it now or at any time along your journey. It is up to the both of you.

This seems obvious and you may think you have covered it in the first two steps. However, we can tend to lose sight of our relationship goals if we do not fully commit.

How you fully commit will depend on you. It may be writing them down, physically signing the couple goals, telling others (not just your significant other) that these are your couple goals, or maybe having a friend or relative keep you accountable by regularly asking how the goal is progressing.

Whichever method you use, make sure you are committed to your goals if you want them to happen.

As a couple you are already ideally placed to share your couple goals with each other. You are already ahead of the game.

Talk about your couple goals regularly and particularly if anything changes. Being honest about your goals and seeking help, when needed, is important to achieving your goals and can help in building a healthy relationship.

As a couple you may wish to share your couple goals with your friends, family or even on social media as well. They could also be a good source of information or help to keep you committed.

Feedback on how you are progressing to your goal, helps to keep you motivated and stay committed to your goals. Some people like to have a chart, a spreadsheet or banking app on which to mark off each stage of the plan and see how they are progressing towards their target.

With a clear idea of their progress, couples quite often have an at home date night ideas session where they check in and discuss their relationship goals, their personal finances and how they are going towards them.

The Westpac Life account can help you keep track of your financial goals by providing you with tools to show your progression.

Reaching your couple goals may have taken some time and effort it is now time to enjoy the goal you have been saving for.

Spend the money and celebrate your achievement.

By doing this you reinforce the habit of saving and know that other goals will be achievable in the future.

Being successful at saving is a journey that everyone is on. There will be setbacks and successes along the way. As a couple you already have an advantage in achieving goals. But you can increase your success by getting started and continuing to learn about saving at “Get serious about saving”.

This article is from Westpac’s financial education specialists, continuing the legacy of Sir Alfred Davidson in helping you create a better financial future.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness or the information to your own circumstances and, if necessary, seek appropriate professional advice.

The taxation position described is a general statement and should only be used as a guide. It does not constitute tax advice and is based on current tax laws and their interpretation.