Ways to pay

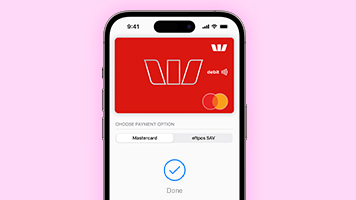

Pay with your phone

With your choice of wallets you can now carry your eligible Westpac cards with your smartphone. You can make purchases at millions of stores worldwide, at any terminal where contactless payments are accepted.

Wearables

Our range of payment wearables gives you the freedom to leave your wallet or card at home. Whether going for a run or grabbing a quick coffee, you can pay on the go.

Digital Card

Always have your money within reach with the Digital Card. Use it just like your physical card to shop online, pay bills, make in-app purchases and set up your recurring card payments, or even add it to your mobile or wearable wallet to shop in-store.

Make regular or recurring purchases and payments

Save your card with your regular providers for added convenience or connect to them using My Merchants for added security. Set up PayTo agreements with participating businesses to securely authorise and manage your payments online.

Pay friends

Paying friends money you owe them, splitting bills when out to dinner or even just paying a tradesman in real time, effortlessly and securely.

Things you should know

Internet connection may be needed to make purchases using Google Pay or Samsung Pay and normal mobile data charges apply.

A Visa or Mastercard debit card attached to an Australian bank account is required to use the Beem It app.