Ready-made investment portfolios

BT Invest is not available to new investors from 11 February 2022. Existing customers in BT Invest are not impacted by the closure to new investors and will continue to have access to all features and functionality of the product.

Why BT Invest?

Westpac's wealth expert, BT, is now offering a new way to invest that's easy. If you are new to investing or want an expertly managed portfolio, you may like to consider one of five ready-made managed portfolio options. Each is professionally managed to save you time researching, purchasing and monitoring your investments.

Your investments are monitored and rebalanced for you by investment experts.

View your investment portfolio side by side with your online banking and receive tax reporting to make tax time simple.

A ready-made portfolio gives you a diversified investment portfolio in one investment.

Open an account in minutes and start investing from as little as $1,000.

How can I invest?

Choose one of five ready-made BT Invest managed portfolios. These five diversified portfolios are aligned to acknowledged wealth industry profiles covering most stages of your wealth journey (i.e. Conservative, Moderate, Balanced, Growth and High Growth). You choose the portfolio and we’ll do the rest.

Diversified portfolios

Want more control to build your portfolio?

Create your own portfolio from a wide a range of investment options using the build your own option.

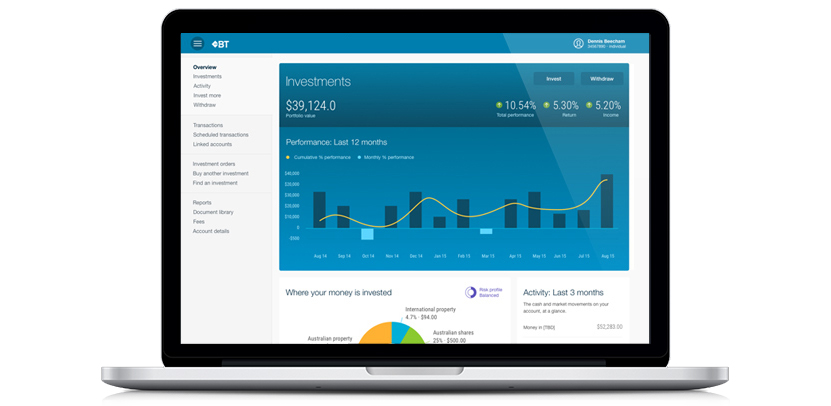

See what it's like to use the BT Invest platform

Fees

The total fees and charges payable by you will include the fees for the BT Invest service as well as any fees and costs of the available investments chosen by you. It is important to understand the fee of any available investment you choose, and that those fees will be in addition to the fees charged for BT Invest.

The amount you pay for specific investments, is generally shown in the relevant product disclosure statement or other disclosure documents for each available investment.

| Fee | Amount |

|---|---|

| Account based administration fee | $60 p.a. per account Charged once you have made your first deposit |

This is a summary only. For full information on fees and costs refer to the ‘Fees & Costs’ section of the BT Invest Investor Guide.

Next steps

- All people in Australia that are 18 years or older.

- Those who can maintain a minimum balance of $100 in the transaction account.

- Open a BT Invest account in about 10 minutes.

- Make an initial deposit and choose between Ready-made or Build your own portfolios.

- Start investing.

Important things to consider before you invest

Before you consider investing through BT Invest, it is important you understand the risks that can affect your investment. Generally, these are:

- Risks associated with using BT Invest.

- Investment risks associated with the investments you access through BT Invest.

- Investment risk: The value of your investments held through BT Invest may be influenced by movements in global and domestic market exchanges, international currencies and interest rates. Adverse movements could result in possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

- Investment specific risks: An investment in a managed portfolio option or managed fund which has exposure to an entity that is listed on a stock exchange may be affected by unexpected changes in that entity’s operations (due to quality of management, use of technology, etc.) or its business environment. Similarly, an investment in a managed portfolio managed fund option may be affected by unexpected changes in the fund’s operations or by changes in investment management personnel. (For more information see the 'Performance' section in 'Investing with BT Managed Portfolios')

- Managed portfolio risks: The likely rate of return and the risk of losing money are different in respect of each managed portfolio option, as different strategies carry different levels of risk depending on the mix of assets. Each managed portfolio option therefore may or may not be appropriate for your individual circumstances. There is also risk associated with transaction timing. Generally the managed portfolio option you choose will not be rebalanced more frequently than once per business day. There is a risk that the responsible entity managing your portfolio may not be able to process rebalancing instructions from the investment manager immediately on receiving the instructions, leading to a potential divergence from the return on the investment manager's notional portfolio. This can occur for a variety of reasons, including illiquidity.

- Term deposit risk: There are some specific risks to investing in term deposits: Term deposit interest rates are fixed for the term of the investment (until maturity), and as a result you are protected from any fall in interest rates for that term. However, you will also not benefit from interest rate rises that occur during the term. Early withdrawal of term deposits will generally result in a waiting period before the term deposit proceeds are paid to you. An interest rate adjustment may apply if you or we terminate the term deposit before maturity (including if you close your account).

- Tax risk: The tax impact of your investments will depend on your personal circumstances. You should seek your own professional taxation advice in relation to your investment.

- Changes in tax and other regulations: BT Invest has been designed based on the current regulatory environment. If those regulations change, the value of your investments may be adversely affected.

- BT Invest operational risk: The risk that administration, computer and supporting systems may not always work as they should. The effective operation of BT Invest (that is powered by Panorama) depends on the integrity of our systems. However, there is a risk that these systems may not be available or operate effectively in certain circumstances. We take risk management seriously, and have procedures in place that are designed to reduce the risk of systems not working effectively and to respond promptly should problems arise. However, you should be aware that not all of these risks can be foreseen.

This summary sets out the general risks associated with BT Invest and investments accessed through BT Invest. It is not an exhaustive list of all the risks of investing. You should refer to the BT Invest Investor Guide and the disclosure documents for the specific investments available through BT Invest (including the PDS for BT Cash Management Account and BT Managed Portfolios) to better understand the risks of investing. These disclosure documents, can be found below.

Westpac and BT – we’re here to help

As part of our Group and one of Australia’s leading wealth experts, BT has been helping Australians build and protect their wealth since 1969.

Through BT, you can access a range of solutions across super and investments, to help you plan for today and tomorrow.

Things you should know

BT Invest pack (PDF 1.65 MB)

Contains your Investor Guide, Additional Information and Terms Booklet

BT Invest Cash Management Account Pack (PDF 312 KB)

Contains BT Invest Cash Management Account and related Payments Services Terms and Conditions and the Fee and Charges Brochure and Interest Rate Schedule

BT Panorama Financial Services Guide (PDF 259 KB)

BT Invest Managed Portfolios PDS Part 1 (PDF 409 KB)

Contains General Information

BT Invest Managed Portfolios PDS Part 2 (PDF 390 KB)

Contains Investment Options Booklet

Mercer Passive Conservative Portfolio Fact Sheet (PDF 122 KB)

Mercer Passive Moderate Portfolio Fact Sheet (PDF 121 KB)

Mercer Passive Balanced Portfolio Fact Sheet (PDF 121 KB)

Mercer Passive Growth Portfolio Fact Sheet (PDF 122 KB)

Mercer Passive High Growth Portfolio Fact Sheet (PDF 119 KB)

DNR Capital Australian Equities High Conviction Portfolio (PDF 143 KB)

Pendal Australian Shares Portfolio (PDF 141 KB)

BT S&P/ASX 20 Shares Portfolio (PDF 125 KB)

Antares Dividend Builder Portfolio (PDF 135 KB)

BT Managed Portfolio Proxy Voting Record (PDF 97 KB)

Pendal Sustainable Future Australian Shares Portfolio Fact Sheet (PDF 73 KB)

BT Invest Target Market Determination (PDF 530 KB)

BT Invest Cash Management Account Target Market Determination (PDF 911 KB)

BT Managed Portfolios Target Market Determination (PDF 913 KB)

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) operates BT Invest. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Invest Cash Management Account (BT Invest CMA). Together, these products are referred to as the BT Invest products.

A Product Disclosure Statement or other disclosure document (PDS) for the BT Invest products can be obtained by contacting BT on 1300 881 716 or by clicking here. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of interests in the BT Invest products.

BTPS and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities or the BT Invest CMA acquired through the BT Invest products, an investment in, or acquired using, the BT Invest products is not an investment in, deposit with or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of any investments in, or acquired through, the BT Invest products.

Unless otherwise stated, capitalised terms used in this website have the meaning given in the BT Invest Investor Guide. Any tax position described in this website is a general statement and for guidance only; it does not constitute tax advice and is based on current tax laws and our interpretation. You should seek independent professional tax advice.