Home Loan Portability

What is Portability?

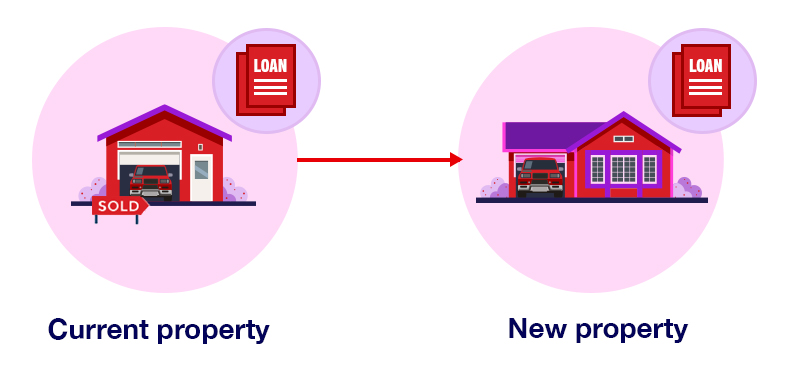

Portability is a home loan feature that allows you to keep your home loan when selling by changing the property securing the mortgage from your current property to a new one. Sometimes called a substitution of security, it means you can avoid all the hassles and costs involved with refinancing and opening a new home loan. It also gives you the flexibility to fix your interest rate when you want. If you require an increase to the loan, this must be done either before, or after the application has been finalised - remember if you have a fixed rate loan, break costs may apply.

Why portability could be your home loan’s superpower

No hassles

Keep your current home loan to keep your interest rate, repayments, features and set-ups, like direct debit and offset.

No break costs

You can avoid break costs on a fixed rate home loan if you keep your existing limit and balance when substituting security.

Avoid upfront costs

By porting your home loan you could save both time and money, avoiding the potential upfront costs of a new loan.

Faster turnaround

Porting your loan reduces both prep and paperwork, meaning it’s generally faster than applying for a new loan.

How do I get started?

Westpac home loan portability application

How to complete the online form

Once you’ve spoken to a home loan expert, you can port your Westpac home loan by applying online for a change of security. Provide details of:

1. The representative or home loan expert that you’ve spoken to

2. Your current property and new property (if available), including settlement dates

3. Ensure you request to keep your loan open

4. Under Additional information please type Application for portability.

We’ll then get back in touch with you.

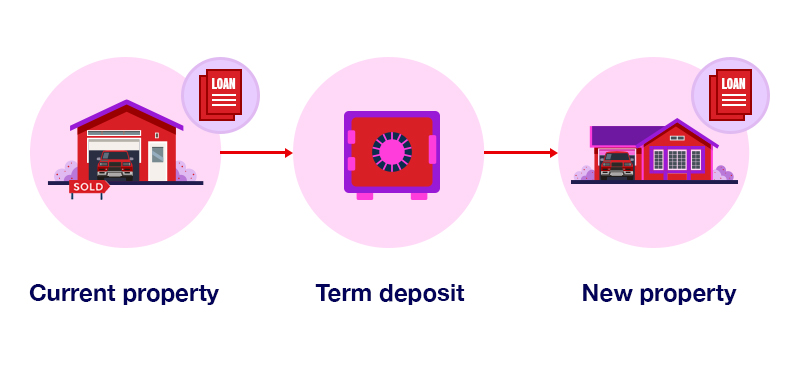

Two ways to use portability on your home loan

How same time settlement works

Use this option when you’re buying and selling at the same time, for an easy transfer of your home loan security.

Your current property is held as security on your existing mortgage. When you sell and buy a new property, the settlement dates are aligned, meaning the loan security is simply transferred from your current property to the new property. All you need to do is keep paying your home loan repayments as normal.

To apply for same time settlement

After contacting your local home loan expert, you’ll need to complete the Property and Security Request Form before you sell your current property or buy your new one. Provide details of:

1. The representative or home loan expert that you’ve spoken to

2. Your current and new properties including settlement date

3. Ensure you request to keep your loan open

4. Under Additional information please type Application for portability.

We’ll then be in touch with next steps.

Frequently asked questions

The general rule for portability is like-for-like substitution, which basically means switching the property being held as the mortgage security on the home loan with a property of equal or greater value. A valuation may be required for the new property.

To find out if you can port your loan, contact your local home loan expert before completing the Property and Security Request Form. If ineligible, you’ll have the option to start a new home loan application.

Things you should know

Conditions, credit criteria, fees and charges apply. Residential lending is not available for Non-Australian Resident borrowers.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information and if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent, professional tax advice on any taxation matters before making a decision based on this information.

Credit provided by Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.