Everyday banking + up to 5.2% P.A. on savings

Aged 18-29? Earn bonus interest when you Spend&Save with this handy combinations of bank accounts.

Simplify your banking with linked accounts

Combine your Westpac Choice account with a Westpac Life savings account and meet the eligibility criteria each month to earn up to 5.2% p.a. variable interest.

Westpac Choice

An account + debit card for your day-to-day spending

plus

Westpac Life

An account that helps you save and rewards you for it

Earn up to 5.2% p.a. on your savings

How your interest adds up

| Earn interest on your savings: | 2.00% p.a. |

| Get a bonus each month you grow your savings: | 3.00% p.a. |

| Get a bonus for 5+ debit card uses a month: |

0.20% p.a. |

| Total interest including bonuses: | 5.20% p.a.* |

All interest rates are variable and subject to change. Spend&Save applies to eligible card purchases only and to balances held in Life accounts up to $30,000. The 0.20% bonus does not apply to amounts above that balance.

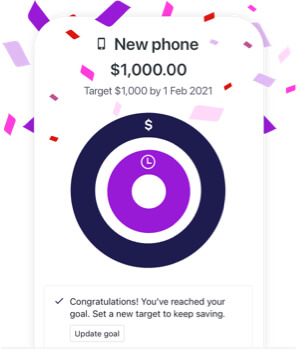

Get help hitting your savings goals

Use the Savings Goals feature of the Westpac App to manage all your goals through your Life account.

- Use the Savings Goal feature of the Westpac App to manage all your goals through your life account

- Set up to six savings goals

Great if you’re saving for a few different things. - Put your savings on autopilot

Make saving easier by setting up recurring transfers from your Choice account after every payday. - Keep track of your progress

Check how your goals are going whenever you need to, all in one place in the Westpac App.

Fees & Rates

| Fees | ||

|---|---|---|

| Westpac Life savings account | $0 | |

| Westpac Choice bank account | $5 (criteria for fee waiver below) | |

This fee is waived for:

|

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 620KB)

You may find these useful

Things you should know

Google Pay Terms and Conditions (PDF 125KB)

Apple Pay Terms and Conditions (PDF 42KB)

Samsung Pay Terms and Conditions (PDF 63KB)

Apple Pay Terms and Conditions (PDF 42KB)

Samsung Pay Terms and Conditions (PDF 63KB)

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

*

Total variable interest: total variable interest consists of two parts: Westpac Life variable interest and Spend&Save bonus variable interest. To earn the total variable interest, you must meet the criteria for both parts.

1.

Westpac Life variable interest: includes a standard variable base rate plus a variable bonus rate. To earn the variable bonus interest you must make a deposit to your Westpac Life account, ensure the account balance is higher at the end than the beginning of the month and keep the account balance above $0. Interest is calculated on the daily balance of your Westpac Life account and paid on the last business day of the month.

2.

Spend&Save bonus variable interest:

- You must be aged 18-29 with a Westpac Life and a Westpac Choice account – both in the same name. Joint accounts are not eligible.

- If you have multiple Westpac Life or Choice accounts, only the earliest opened account is eligible.

- You must make 5 eligible purchases with the debit card linked to your Westpac Choice account and have these settled (not pending) within a calendar month. The following transactions are ineligible: ATM transactions, PayID, BPAY, EFTPOS cash-out only transactions, direct debits and paying off a credit card account.

- For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. Bonus interest is calculated on the daily balance of your eligible Westpac Life account up to $30,000, and paid to your eligible Westpac Life account by the 20th day of the following month.

- If your eligible Westpac Life account is closed before 21st day of the following month, the bonus interest will not be paid.

- Only one Spend&Save bonus interest offer per customer.

- Offer may be varied or withdrawn at any time in accordance with the Deposit accounts for Personal customers Terms and Conditions. (PDF 620KB)

3. Westpac everyday account: To open a Westpac Life or Bump account, customers must hold a Westpac everyday account in the same name and be registered for Online and Phone Banking. Fees and charges may apply on the everyday account.

4.

Safe Online Banking guarantee: ensures that customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac

Online Banking Terms and Conditions (PDF 555KB) for full details, including when a customer will be liable.

5.

Savings Goals: Both an account holder and an authorised user can use the Savings Goals feature, including to view, add, edit and delete the savings goals on a Westpac Life or Bump account.

6. Partner offers are subject to Terms and Conditions and may be varied or change at any time. Images are shown for illustrative purposes only.

7. Apple, the Apple logo, iPhone and Apple watch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service of Apple Inc.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co.

Google Pay and Google Play are trademarks of Google Inc.

Global ATM: A 3% Westpac Foreign Transaction Fee applies to overseas debit card withdrawals. A list of

Global Alliance members is available. To ensure access to savings and/or cheque account funds when overseas obtain a Debit Mastercard®.

The “RFI Group Australian Banking Innovation Awards – Most Innovative Savings Product” was awarded in November 2020 for the Spend&Save bonus interest available for customers aged 18-29, with Westpac Life and Choice accounts.

The “RFI Group Australian Banking Innovation Awards – Most Innovative Savings Product” was awarded in November 2020 for the Spend&Save bonus interest available for customers aged 18-29, with Westpac Life and Choice accounts.