SAVINGS GOALS

How can Savings Goals help?

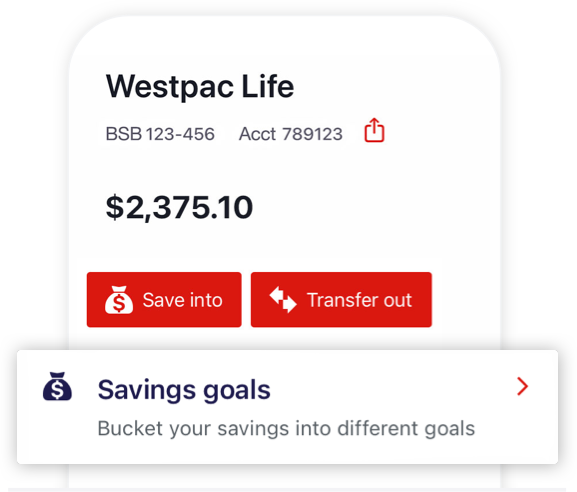

Savings Goals is a feature of Westpac Life designed to help make your dreams a reality.

- Bucket your savings into different goals within the one account

- Know how much you need to put away regularly to reach your goals

- Put your savings on autopilot by setting up recurring transfers to your individual savings goals

- Work towards shared savings goals with your joint account partner

- Keep tabs and organise your savings in an easy visual way.

Set it and forget it

The results are in. Customers who set up an auto deposit from their transaction account to their Life account are on average 2 times more likely to reach their goals*. It only takes a few minutes to set up an auto deposit and it’s a great way to help keep your savings on track.

Set up a regular transfer

How to set up Savings Goals

Open the Westpac App and select your Life account. You’ll see a Savings Goals dropdown menu beneath your account balance – tap on this to open it up.

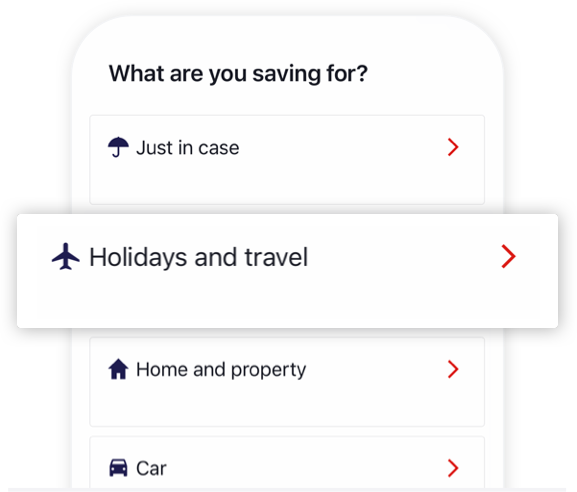

Select ‘Add new savings goal’ to create your new goal. You can then personalise your goal by giving it a name, set the goal amount and when you want to reach your goal by.

Once you’ve tapped ‘Confirm’ you’ll be able to set up a regular transfer to put your savings on autopilot.

Keep track of your Savings Goals

- Track your progress against the timings you set, by simply logging in to the Westpac App.

- Setting up regular transfers and checking in on your progress can help make your savings goals real as well as make them easier to achieve.

- Even if you start out small, you are in control. Adjust your regular payments as you progress, or top up your goal when it suits you to help you reach it sooner.

Want to give savings goals a go but don’t have a Life account?

Opening a new Westpac Life savings account is easy and only takes a few minutes. And once your account is open, you can dive straight into setting up and reaching your savings goals.

Open a Westpac Life account

Aged 18-29?

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a Life Savings and Choice bank account.

You may find these useful

Things you should know

- Savings Goals: Both an account holder and an authorised user can use the Savings Goals feature, including to view, add, edit and delete the savings goals on a Westpac Life or Bump account.

Westpac Life account: to open a Westpac Life account you need to be aged 18+ (if you’re under 18, check out our Bump savings account)

*Results based on 6month period (Jul21-Dec21) of behaviour for customers with a Westpac Life and eligible transaction account between the age of 18 to 54 (excludes customers who have a credit card or mortgage)