Businesses are facing into challenging conditions with resilience

Consumer demand has been slowing under pressure from higher inflation and interest rates. (Getty)

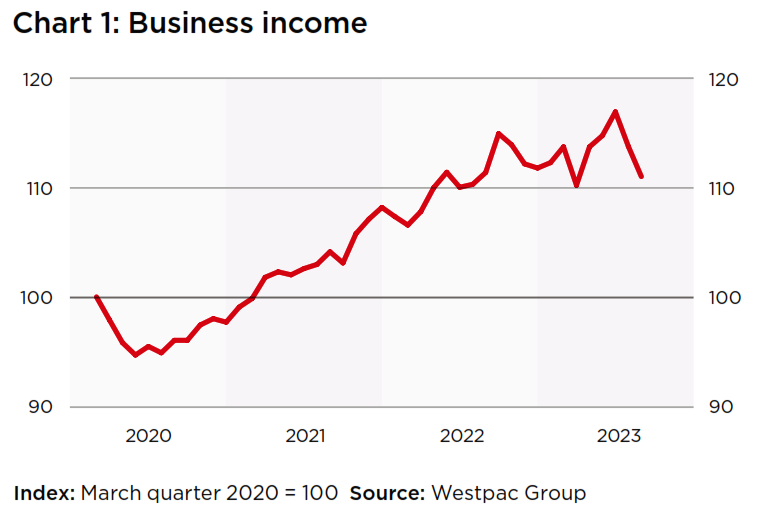

Australian businesses remain resilient as they face into challenging economic conditions. Turnover is slowing, but easing cost pressures are offering relief.

They also have the backstop of strong financial buffers built up during the pandemic and have looked to boost sales and deliver cost efficiencies through innovative means.

Those are some of the key findings from Westpac Business Bank’s quarterly snapshot, which uses internal bank data from millions of daily transactions to show how evolving economic conditions are influencing business cash flows and conditions.

Business revenue fell in annual terms over the September quarter, with the decline most noticeable in the wholesale trade sector, which saw turnover fall 7.3 per cent. Communication services, retail trade and property services were not far behind.

Industries that provide services for Australia’s fast-growing population were more resilient. Education-related businesses saw an 8.5 per cent gain in income over the same period, with construction and healthcare also recording gains.

Internal liaison suggests SMEs have responded to more difficult conditions by finding new ways to move stock and boost sales, including discounting, packaging up or bundling goods and services, and offering special deals. It’s a trend that looks set to continue.

Meanwhile, businesses have seen some welcome relief on the cost front, with most industries experiencing a decline in cost pressures over the September quarter. The exceptions were education, property services, and finance & insurance.

Rising input costs – including for fuel, power, machinery, electronics, and a host of other goods – have been hard to escape and universal across industries since 2020. But it looks like we have now turned the corner, with the cost base for businesses first moderating and now easing over the course of 2023.

As global supply chains continue to improve, we expect further cost relief in the months ahead.

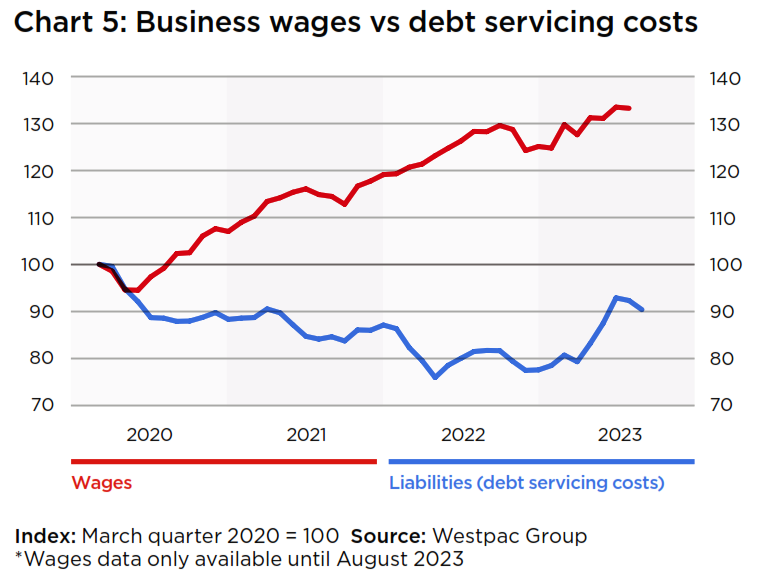

However, the snapshot also shows that domestic sources of cost pressure are becoming more important. The cost of labour continues to rise, overheads such as rents and energy prices are higher, and the cost of debt servicing has also gone up.

A big increase in award and minimum wages, which took effect from 1 July, looks to have led to a one-off jump in the level of expenses for businesses. Higher award wages along with the broader labour market tightness has seen the SME wage bill rise by almost 35 per cent relative to pre-pandemic levels. There are some early signs that wage pressures are now easing at the margins, even as employment continued to grow at a solid pace in the September quarter.

The Business Bank’s snapshot in July noted that businesses have built up strong buffers to withstand choppy economic conditions ahead. They’ve been paying down debt where possible, increasing their liquid assets, maintaining credit lines and investing in their productive capacity.

The benefits of that forward-thinking strategy are now becoming evident. The cost of servicing debt has risen following the Reserve Banks’s series of interest rate hikes over the past 18 months, but due to the sector’s stronger financial position, total debt servicing costs remain below pre-pandemic levels in aggregate.

The divergence in cost pressures and turnover between industries is relatively small, but there is significant variability when it comes to business size.

Conditions have weakened materially for small and micro businesses with annual turnover of less than $3 million a year. For these businesses, their income to expense ratio is almost 14 per cent below pre-pandemic levels, compared to just under 7 per cent for businesses with annual turnover above $3 million.

Larger businesses have been able to capture much more of the increase in demand for goods and services over recent years. As a result, they have been more easily able to pass on cost increases without losing demand.

Fortunately, many small businesses have paid down their debt and, despite interest rate hikes, are using less resources than before the pandemic to service debt. For operations with turnover below $3 million, debt-servicing outlays are down by 20 per cent compared with pre-pandemic. For big business, debt servicing costs are generally back to pre-pandemic levels.

The array of challenges facing businesses is evolving. As inflation moderates further businesses will likely see further cost relief, while household spending power will improve. This will help support businesses over time.

There remains a rocky path ahead, but in aggregate, the SME sector is well prepared to take the challenge on.

Full report: Westpac Quarterly Business Snapshot (PDF 607KB)

Besa would like to acknowledge the work of Business Bank economists Pat Bustamante, Jameson Coombs and Jarek Kowcza in helping to compile the quarterly snapshot