BILL’S BITES: Budget won’t force RBA’s hand on rates

The federal budget indicates that the economy is in a lot better shape than we were expecting.

The government has received an economic windfall from stronger income, driven by higher inflation and commodity prices and ongoing strength in the labour market. The current financial year will now see a modest surplus of $4.2 billion, before deficits return from 2023/24.

That has enabled Treasurer Jim Chalmers to announce a relatively large spending package, to provide cost of living relief to the most vulnerable households, but we don’t think it will have any near-term implications for the Reserve Bank’s interest rate policy.

Australia’s debt levels are now projected to peak at about 36 per cent of GDP, and come down to 32 per cent of GDP in later years. That compares with October’s projected peak of 47 per cent of GDP.

We expected that the starting point for the budget would have improved by about $136 billion, in fact it was better than that at $146 billion. The government, after all its spending, has still improved the budget position by $126 billion. So they’ve gone backwards by about $20 billion from that base.

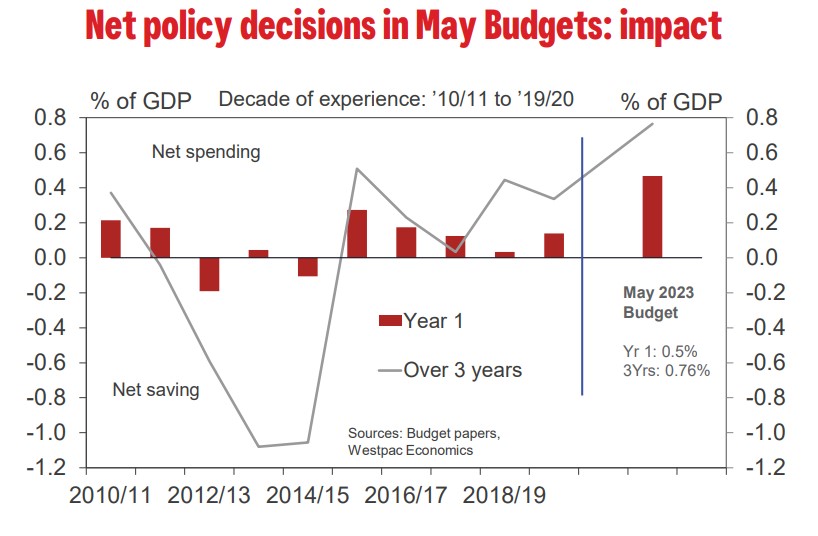

The problem is that $20 billion in spending is quite a large number. It will be distributed roughly $13 billion in 2023/24, $5 billion in 2024/25 and $3 billion thereafter. The extra spending in the first year amounts to 0.5 per cent of GDP and compares with the average from the last 10 years of about 0.25 per cent of GDP.

There will be some in the market who say that this is a big spending budget. But really, the key initiatives that we saw in the budget were sorely needed.

We saw $5.6 billion for Medicare, $4.6 billion for an increase in Jobseeker, $2.7 billion for rental relief and $1.9 billion to assist single mothers. These were all things that needed attention at this stage in the economic cycle.

The outlook remains challenging, with output growth set to slow as higher interest rates bite. We’re only expecting growth in the economy of 0.9 per cent in 2023/24, and that’s mainly due to the pressure that the household sector will be under.

I think those policies were necessary, and I don’t expect them to put upward pressure on interest rates in the near term. We’re not changing our view that the RBA will not increase the cash rate further in August. The pressure will come later on in the year, and into 2024. That’s when we’re expecting interest rate cuts.

Those big spending initiatives may affect the timing of those rate cuts, but I don’t think they’re going to force the RBA’s hand in the near term.

For more budget analysis from the Westpac Economics team, visit WestpacIQ.