Westpac survey shows farmers see a fine future

A Westpac report shows 74 per cent of farmers see future opportunities for younger generations in their family business. (Getty)

Just a few years on from devastating droughts and bushfires that tested the mettle of many Australian farmers, the spring is well and truly back in the step of most in the agriculture sector.

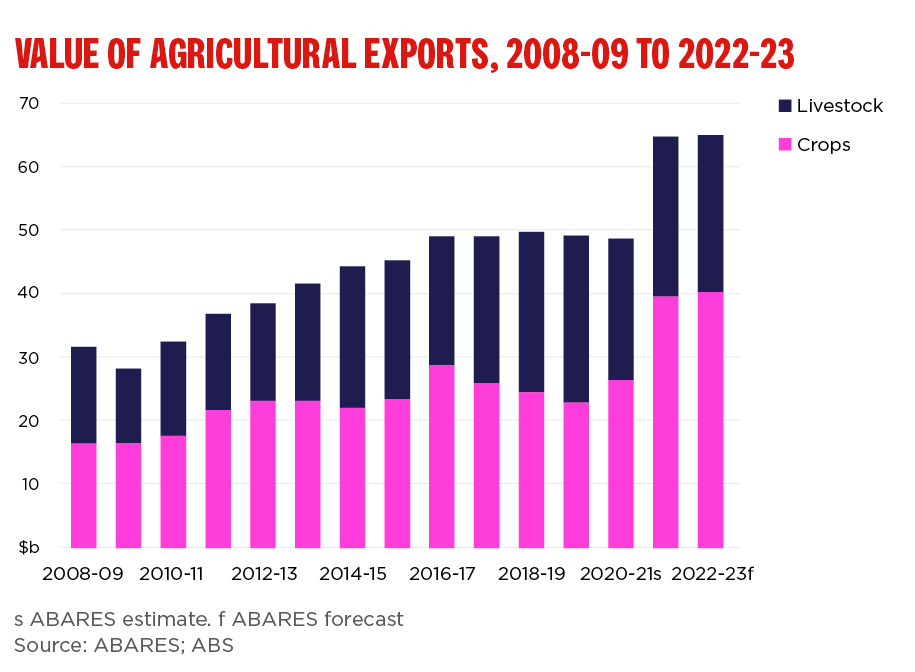

Near perfect growing conditions, booming food prices and strong demand for Australian produce is expected to see the value of national farm production top $80 billion for the second year in a row in 2022-23, according to recent forecasts from the Department of Agriculture’s research unit ABARES.

That’s a significant lift from the $63bn on average recorded annually over the previous four years to 2020-21.

It’s also a likely contributor to the prevailing positivity among Australian farmers found in a new survey by Westpac Agribusiness.

The report shows 77 per cent of the 405 farmers interviewed said they were optimistic about the future of their farming enterprises, and 74 per cent saw unlimited opportunities ahead for younger generations in their family businesses.

“While there are still supply chain issues and input costs have risen significantly, there’s a lot working in our farmers’ favour at the moment,” Peta Ward, Westpac’s acting national general manager for agribusiness, tells Westpac Wire.

Peta Ward, Westpac’s acting national general manager for agribusiness, based in Queensland. (Supplied)

“We’ve got, in most areas, favourable seasonal conditions – pretty much all of our water storages are full which, for most of our producers, means they're going to be able to grow crops for at least the next couple of years.

“We've also got strong commodity prices right across the board and there’s massive demand for Australian produce, both domestically – where Australian farmers provide 90 per cent of the food that's consumed – and on the export markets.”

Australia’s food exports are forecast by ABARES to reach a record of $65bn in 2022-23, driven by the strongest ever level of forecast crop exports.

“With what's going on around the world, particularly the war in Ukraine, there's a great opportunity for Australia to export our high-quality food to help feed countries around the world.”

Beyond the favourable market conditions, Ward says farmers’ optimism also stems from rising regional investment as more people move to the bush. For the first time since 1981, Australia's regional population grew more than the capital cities during 2020-21 – the regions up by 70,900 people, while capital cities lost 26,000, according to the Australian Bureau of Statistics.

“If you go back a decade or two, there was a massive drain of really smart people off the land, because parents were encouraging their kids to go off to the cities as that's where they saw their futures,” Ward says.

“That’s all changed now. We're seeing those kids come back, they’re bringing back skills and they’re bringing back partners, who, since COVID, can do their city-based jobs from a cattle station or wheat belt anywhere in Australia if they want to. That means we're seeing a lot of younger families back in the bush, which is reenergising small communities and really giving everyone a lot of optimism for the future.”

Westpac’s report says rapid adoption of new technologies, like precision crop spraying drones, is making farms more efficient. (Getty)

Despite the overwhelming positivity, Ward admits notable sector headwinds still exist.

“At the moment, it’s input costs which are surging; interest rates are up; and the ongoing supply chain disruptions since COVID are affecting the availability of machinery – it can be a wait of up to two years for a new sprayer or tractor,” she says.

National Farmers’ Federation President Fiona Simson also last month warned many farmers were “feeling the pain of eye-watering production costs”.

“Prices for fertiliser, fuel and power are on a rocket ride to the moon,” Simson said. “Producers are dealing with the highest fertiliser prices since 2008, as the global energy crisis takes its toll. Of course, all this is compounded by the ongoing worker shortage putting the handbrake on production, an issue that will only worsen later in the year during the crucial harvest period.”

These challenges, along with the short-term impacts of flooding, are flowing through to consumers at supermarket checkouts – food and beverages last month were named as the fourth highest inflation category over the previous 12 months, surging 5.9 per cent.

Another looming threat is the possible arrival of the highly contagious animal virus Foot & Mouth Disease on Australian shores, which could cost the economy up to $80 billion according to CSIRO modelling. To date, strengthened biosecurity measures have kept it at bay.

“Throughout the history of agriculture, there's always been pluses and minuses,” Ward says.

“But at the moment we’re seeing optimism every day, and its translating to strong demand for credit, not only for purchasing farms but for equipment and property improvements.

“Combined with high levels of savings during the pandemic, farmers and industry confidence is sky high.”