Time to put super ideologies aside

Competition among super funds to secure a "best in show" listing would benefit consumers, says Melinda Howes. (Getty)

The superannuation industry is at a crossroads.

The two-year examination of our national superannuation system by the Productivity Commission (PC) is arguably the most independent and evidence-based assessment since its inception.

For too long the industry has been distracted, fighting among each other rather than focussing on ensuring the best possible retirement outcome for millions of Australians.

It’s time for all industry participants and politicians to put ideology aside and galvanise around the PC’s conclusions on the scale of consumer disadvantage caused by the current superannuation system.

It is a powerful argument for change.

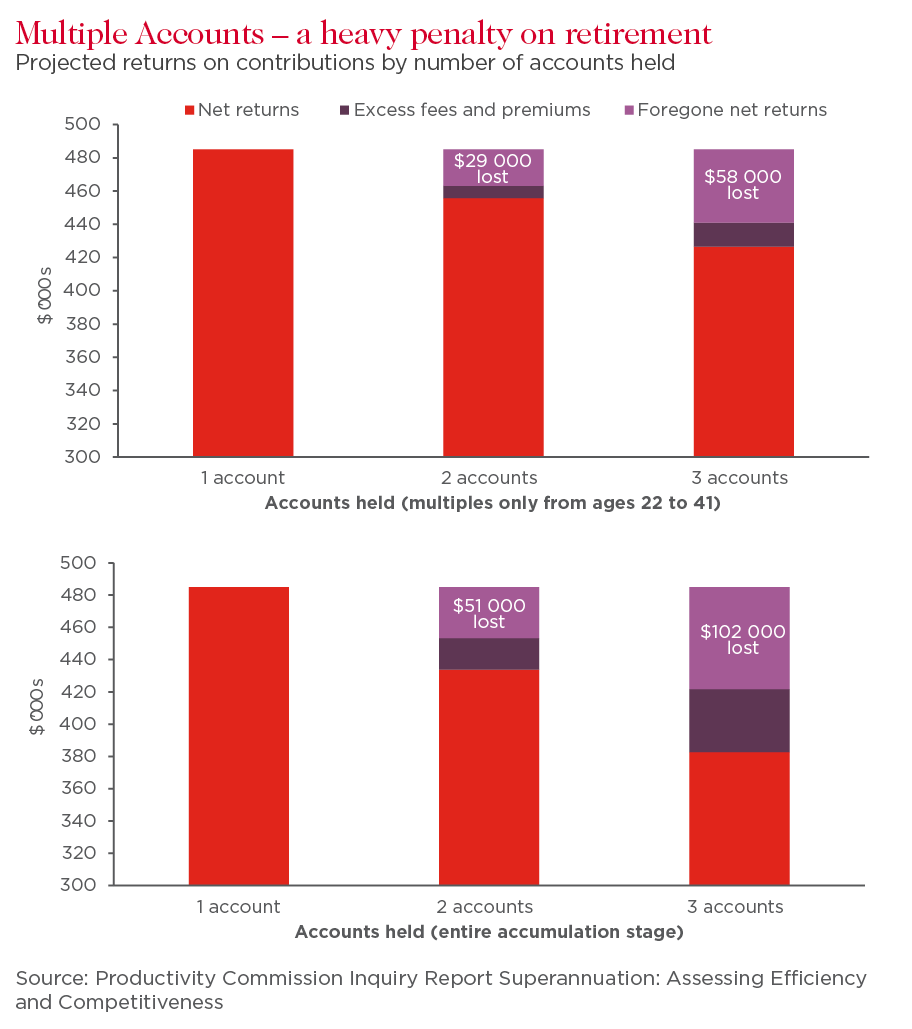

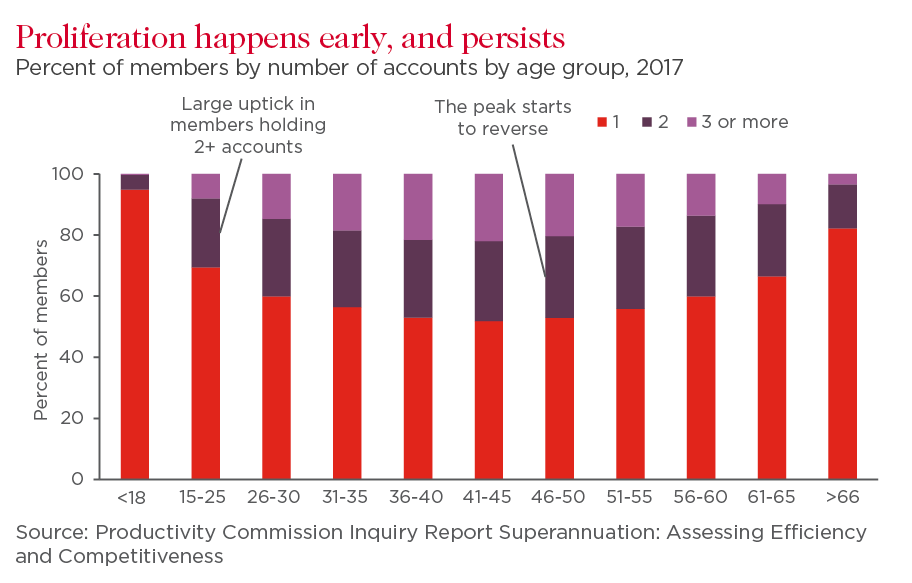

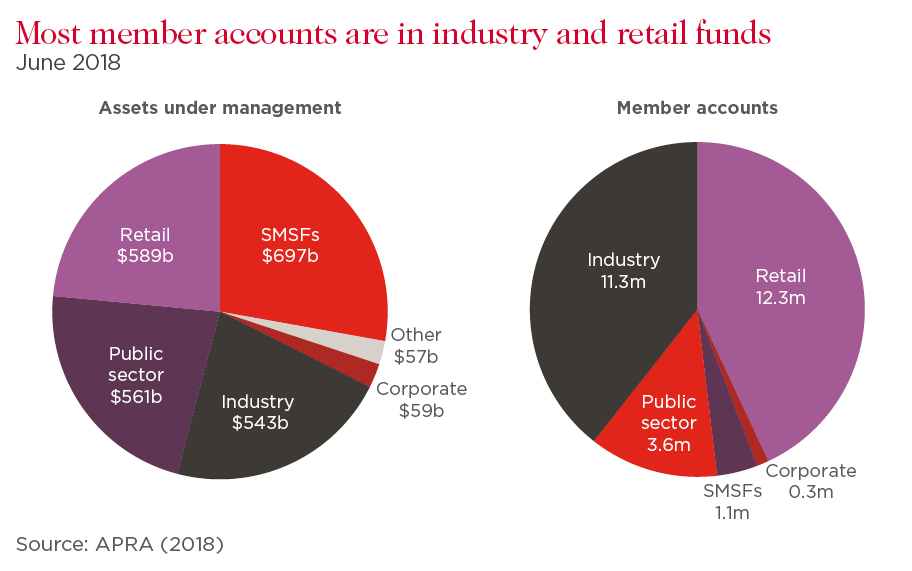

Australians are losing $2.6 billion each year due to unnecessary multiple accounts. One third of the 30 million customer accounts in the system could be consolidated, saving consumers $690 million in unwarranted fees and $1.9 billion in unnecessary insurance.

Further, the broad-based erosion of retirement savings, by all types of superannuation funds, is regressive, hitting lower income Australians the hardest.

BT supports the PC’s key recommendations to address the shortcomings in the current system. We agree that consumers should only ‘default once’ and should carry that account with them for life, unless they choose to switch. We also agree that the risk of consumers being defaulted to a poorly performing fund can be removed by introducing a ‘best in show’ selection process.

The ‘best in show’ model would, for the first time since the establishment of our default superannuation system, see default selection based on merit alone.

The PC has recommended a selection panel that is above politics. If well designed, the ‘best in show’ model would therefore be free of political ideology, and agnostic to corporate structure, profit or not-for-profit status and different governance models.

It would also drive all superannuation funds – industry and retail – to perform better. You can only imagine how fierce the competition would be to secure a ‘best in show’ listing and the extent to which consumers would benefit.

The recommendation for an enhanced Member Outcomes test, which would allow the Australian Prudential Regulation Authority (APRA), to weed out underperforming funds, is also sound. BT supports similar measures currently being implemented by the regulator, the legal framework for which still needs to be passed by the Senate.

The industry would fall short of consumers’ expectations, however, if we were to only weed out the tail of underperforming funds. Consumers in mid-tier funds should also enjoy the benefits of competition between the best performing funds.

Put simply, the PC has recognised that the current Fair Work Commission (FWC) administered default model has not served consumers well. It concluded the current process “is not putting members first”.

Proponents of the status quo argue that the benefits of the FWC model were never considered by the PC Review. This is simply not true. The PC stated very clearly that structural flaws in the current default system cause the proliferation of accounts, erosion of balances and allocation of consumers to underperforming funds.

Critically, the PC found that within the FWC administered model there was no competition for the right to provide default products and no rivalry between funds to attract members. In effect, the FWC process for listing default funds in modern awards stifles competition and “constitute an effective barrier to entry.”

It also warned that the FWC process gave rise to an increased risk of inducements being offered by default providers to employers to retain default business.

In total, 31 recommendations have been made by the PC, all of which are worth careful and detailed consideration with the interests of consumers being the starting point.

Any superannuation fund that believes it performs strongly, is well governed and delivers good member outcomes should publicly embrace the PC’s proposals.