Westpac Notice Saver

Essentials

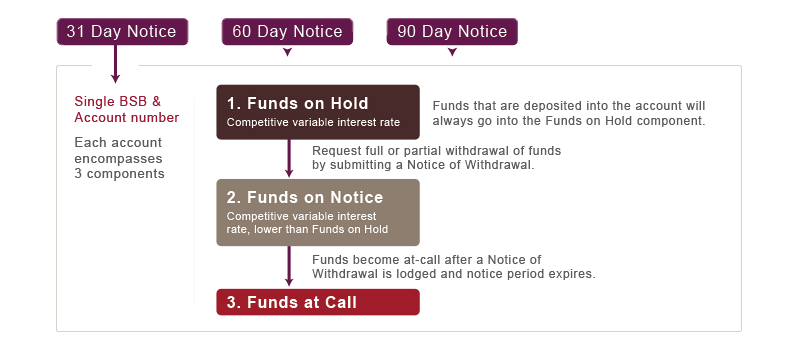

The Westpac Notice Saver account is a surplus cash flow solution for wholesale customers designed to bring together a variable rate of interest with your choice of notice period. You can add funds to your account at any time to increase your rate of return, whilst having the option to withdraw some or all of your funds after waiting a predetermined notice period.

How it works

The Westpac Notice Saver account requires a minimum opening balance of $500,000 to be deposited within the first 30 days and is opened with either a 31, 60 or 90 day notice period. At the end of your notice period, you have the option of withdrawing some or all of your funds. Interest is calculated daily and paid monthly. You can deposit funds to your account at any time to ensure you earn a variable rate of return.

3 account types, based on different cash flows needs

Convenience

- Choose the notice period account that best meets your surplus cash flow

- Top up Funds on Hold balances at any time, potentially increasing returns

- Submit up to 10 notices at once - instead of managing multiple term deposits.

Rewarding

The Westpac Notice Saver includes the following features that work to increase your returns:

- Competitive variable interest rates with no minimum or maximum investment amount after the initial $500,000 deposit, so every dollar is working for you

- Interest is calculated daily and paid monthly

- May be suitable for cash investments within a Self Managed Super Fund (SMSF) depending on the structure of the SMSF.

Fees and charges

| Account-keeping fee (formerly known as monthly service fee) |

$0 |

| Number of free electronic transactions per month (not including Corporate Online channel) | Unlimited |

| Self service electronic deposits through Corporate Online | Free |

| Automated telephone banking transactions (from the Funds at Call portion of the account) | Free |

| Staff assisted withdrawals (from the Funds at Call portion of the account) | $5.00 |

| Staff assisted deposit | $2.50 |

| Other bank charges may apply - see the Terms and Conditions booklet for full details | |

| Corporate Online fees & charges apply if Corporate Online channel is being used |

Be aware

You cannot withdraw funds when they are Funds on Hold or Funds on Notice. To access your funds or close your account, you must issue a Notice of Withdrawal and wait the relevant notice period (unless we determine you are in financial hardship). You must submit a Notice of Withdrawal and wait the applicable notice period to close the account.

Rates

Variable interest rates (p.a.)

| Notice Saver account | Funds on Hold | Funds on Notice | Funds at Call |

|---|---|---|---|

| 31 days | 4.60% | 2.35% | 0% |

| 60 days | 4.75% | 2.75% | 0% |

| 90 days | 5.10% | 3.00% | 0% |

The above rates are not applicable for Financial Institution customers. If you are a Financial Institution please contact your Relationship Manager or Private Banker (as applicable) for details of the interest rates that may apply to your Notice Saver account.

Things you should know

To hold a Westpac Notice Saver account, you must be a wholesale customer making a minimum initial investment of $500,000 within the first 30 days of account opening. You must be a resident of Australia aged 18 years or over, or a domestically registered business entity, and be a Westpac Commercial Bank or Private Bank customer with a relationship manager or private banker. You must also hold an eligible Westpac transaction account in the same name from which fees for the Notice Saver may be debited.

Funds deposited into this account will automatically be placed in Funds on Hold and can only be accessed once a Notice of Withdrawal has been issued and the relevant notice period has been served. You cannot withdraw funds early or break a notice period, unless we determine you are in financial hardship.

You should read the Westpac Notice Saver Terms and Conditions booklet (PDF 230KB) available through your Relationship Manager or Private Banker before making a decision and consider whether this product is appropriate for you. The 180 day account is no longer available for sale.

This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. If you are a Westpac Commercial Bank customer, you will need to use Westpac Corporate Online to service this product online. If you do not already have Westpac Corporate Online, you should read the terms and conditions which apply to Westpac Corporate Online available at westpac.com.au and consider whether the product is appropriate for you before you decide to register for this product.