Our history

As Australia’s first bank and oldest company, the Westpac Group—which started life as the Bank of New South Wales in 1817—represents a central, unbroken thread that runs through Australian history. It has survived and thrived because it has been guided by the same purpose over the years: to provide stability, to support customers and communities, and to help grow the economy.

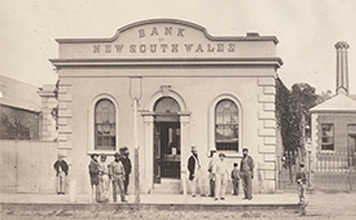

The Bank of New South Wales (Bank of NSW) was established in 1817 under a charter of incorporation signed by Governor Lachlan Macquarie. In October 1982, the Bank of NSW merged with the Commercial Bank of Australia, taking on the new name of Westpac Banking Corporation. Australia’s first company and oldest bank, Westpac has over 200 years of continuous service.

The Westpac Story

You can view our video covering our first 200 years, or read on for more.

Our timeline

1817

The foundations of Australia’s first bank - the Bank of New South Wales - were set by the merchants and business-people of colonial Sydney. At a public meeting in November 1816, a group of colonists came together to work out what could be done to strengthen and support the emerging economy. With Governor Macquarie’s backing, 39 citizens resolved to establish a bank with twin purposes - to provide banking services and to issue currency, thereby providing security and certainty on which to create a prosperous future for their families and the country.

Macquarie encouraged its growth: “Persevere Gentlemen, in time not too far distant the bank will gradually flourish, to the benefit of the country at large...”

From its opening day in 1817 until 1822 the Bank of New South Wales leased a house from Mary Reibey in Macquarie Place, which was the main town square and geographic centre of the colony. An emancipated convict and business-woman Reibey’s involvement marks the beginning of our long history working with women in finance and banking. She was one of our first female customers.

Founding proprietors included Margaret Campbell, who purchased shares in 1817, and Elizabeth Macquarie, who became a proprietor in 1819.

In July 1817 the first disaster relief fund was set up to help victims of natural disaster. Floods in the Hawkesbury River district had resulted in losses of stock and crops, impacting the livelihoods of local farmers. Supplemented by government assistance from the King’s stores, the Fund continued to support those affected until 1820, when a good harvest allowed recovery work to be completed. Helping in times of natural disaster remains part of who we are.

1851

Around the time of the Gold Rush we underwent a major expansion. Staff and gold-buying agents travelled to the gold fields in Victoria and New South Wales, living in tents alongside the miners to provide banking services (such as deposits, exchanges, and transfers) to them and local merchants. We also arranged regular transport of gold nuggets and dust back to Melbourne or Sydney, where it could be smelted into ingots on Bank premises. Within 10 years, we’d grown from a single office in Sydney to a network of 37 branches. The rapid growth of this network meant that many ‘branches’ were established in whatever premises could be found at the time. Tent branches were not uncommon, nor was the practice of renting a small space within an established building such as a shop, a hotel or post office, until a purpose-built branch could be established. The staff were as intrepid as the settlers: in our archives are letters of the time describing the difficulties of reaching remote locations on horseback (well before road and rail networks were developed), and dealing with extreme weather – rain, drought, heat or cold.

1861

Pastoralist, goldmine manager and banker Thomas Buckland joined the Bank as a member of the Board in 1861 and, for a time, also acted as General Manager. He was awarded £1000 as acknowledgement of his service as GM in 1879 and decided to use this to establish a fund – the Buckland Fund - to help employees and their families experiencing financial hardship. Buckland’s legacy continues to this day, with his fund forming part of the Westpac Foundation, which provides hundreds of grants to community organisations every year.

1879

Gold brought wealth to many, but also highlighted a growing inequality across society. Gold transports from the diggings to capital cities were often the targets of bushrangers. Our branches were not spared, with many bushrangers making raids. The most famous bushranger of all, Ned Kelly, held up the Bank’s branch in Jerilderie, in February 1879, robbing it of £2000. He also dictated a long letter outlining his grievances against the state – arguably a treatise on social justice – which is now held by the State Library of Victoria.

1883

Introducing new technology to the Bank in the effort to streamline and make banking more efficient and help customers is part of our history. In 1883 the then new technology of the telephone was introduced. The telephone revolutionised communications between branches and head office, which had previously relied upon letters travelling overland by horse or by sea.

1898

The Bank’s first female employees began work in October 1898, at Head Office in Sydney. Edith Lamb and Beatrice Tennyson Miller were required to operate another new piece of technology – the typewriter, to copy letters and memos, and to type up minutes of meetings. Known as ‘Lady Typewriters’, they were joined by Edith Mary Preshaw, in Brisbane in 1906.

More Westpac history

If you want to know more about Westpac's history, please email us or contact:

The Head of Historical Services

Westpac Group

Unit 2 Building A

16 Mars Road

Lane Cove NSW 2066

Ph: +61 9214 2230