Construction Option Loans

Download this helpful infographic on Construction Loan applications.

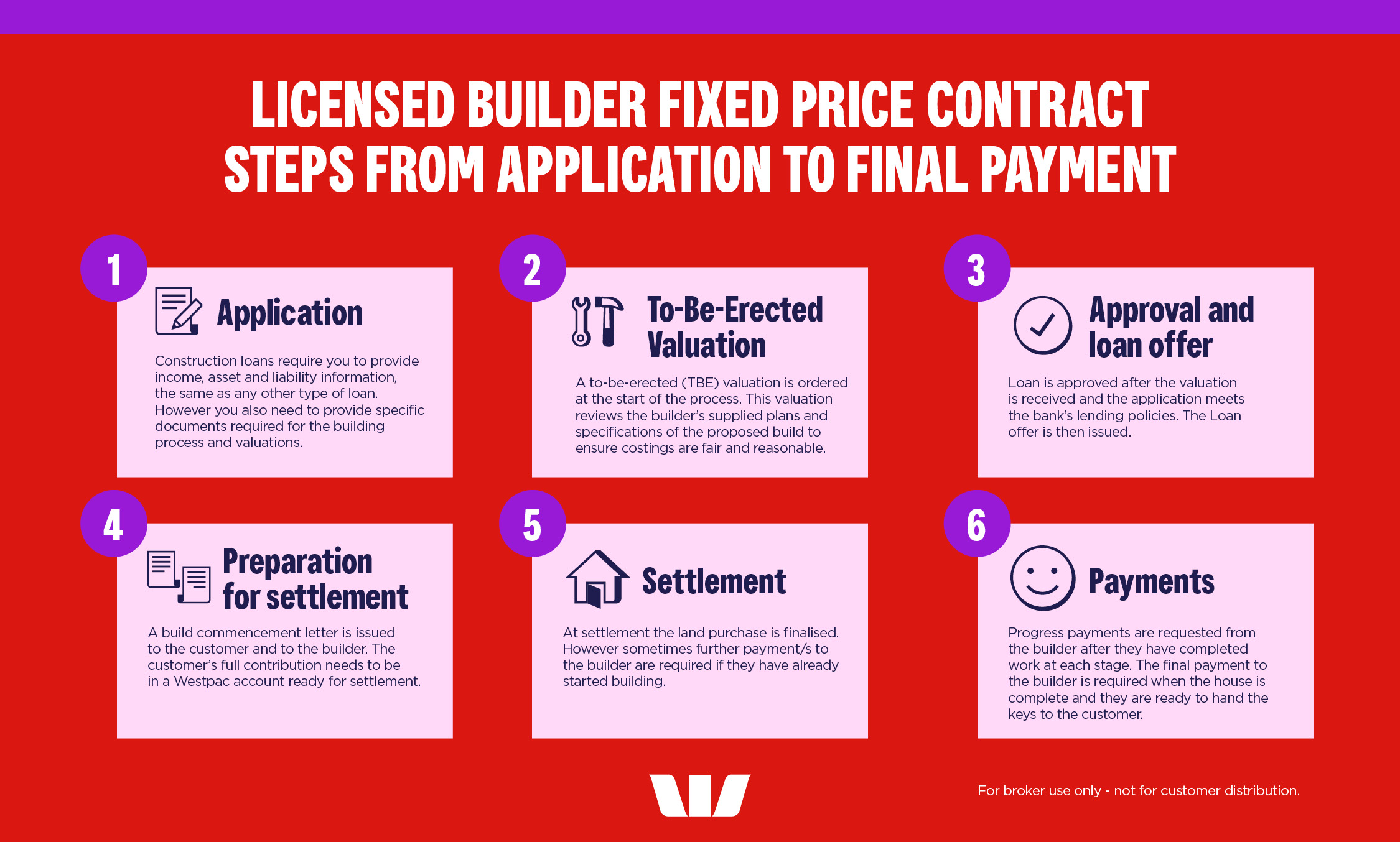

Licensed Builder Fixed Price Contract: Steps from Application to Final Payment

1. Application

- Existing lending standards apply

- For single land and build applications, your client’s full contribution is required at settlement

- For separate land and build applications with lengthy delays to build, an Approval in Principle (AIP) for the build should be completed

- Where First Home Owner Grant (FHOG) is being used, arrange for documents to be sent in with the application

2. To-Be-Erected Valuation

- Correct entry into ApplyOnline will ensure a To-Be-Erected valuation is ordered

- Ensure the valuer has all the information required for the valuation by uploading to Valex

3. Approval and Loan Offer

- Review valuation to ensure payment schedule is to industry standard

- Review whether the valuation requires a Quantity Surveyor Report. Please note that a QSR may be required at each progress inspection

- Review risk ratings which require referral to PACE

- Loan Offer is sent once the loan is approved

4. Preparation for Settlement

- Ensure your client has deposited their FULL contribution into a Westpac account ready for settlement

- Return your client’s signed verbal payment authority to allow for phone requests of payments

5. Settlement

- Operations Team manages the land settlement, and the loan then migrates to the payments team post settlement

- If a payment is required to the builder as part of settlement, it will be made to the builder at settlement

6. Payments

- Payments are paid to the builder or reimbursed to your client for amount already paid

- Progress Inspections are required at certain stages and are completed by the valuer

Resources and tips for your client.

Building or renovating can be an overwhelming experience for your clients. Here are some helpful articles and resources you could share with them to help answer some commonly asked questions.

Guides and Resources

Things you should know

Credit Criteria, fees and charges apply. Terms and conditions available on request. Based on Westpac's credit criteria, residential lending is not available for Non-Australian Resident borrowers.

This information's been prepared without taking your clients objectives, needs and overall financial situation into account. For this reason, your client consider the appropriateness of the information and, if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent advice on any taxation matters.

If any of the information related to (or provided by) Westpac Group that you rely on is printed, downloaded or stored in any manner on your systems, files or otherwise, please ensure that you update your systems and files with the most up-to-date information provided by us and rely only on such updated information.

*Comparison rate: The comparison rate is based on a loan of $150,000 over the term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Also see Construction Option Guide FAQs (PDF 158KB) (PDF 158KB)

Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.